A) can eliminate market risk, but it cannot eliminate firm-specific risk.

B) can eliminate firm-specific risk, but it cannot eliminate market risk.

C) increases the portfolio's standard deviation.

D) is not necessary for a person who is risk averse.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If a person had increasing marginal utility, then the decline in utility from losing $1,000 would be greater than the increase in utility from gaining $1,000.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sari puts $100 into an account with an interest rate of 10 percent. According to the rule of 70, about how much does she have at the end of 21 years?

A) $210

B) $300

C) $800

D) $1,010

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For a risk averse person,

A) the pleasure of winning $1,000 on a bet exceeds the pain of losing $1,000 on a bet.

B) the pain of losing $1,000 on a bet exceeds the pleasure of winning $1,000 on a bet.

C) the utility function exhibits the property of increasing marginal utility.

D) the utility function gets steeper as wealth increases.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the efficient market hypothesis, which of the following statements is not correct?

A) Stock market prices tend to rise today if they rose yesterday.

B) As judged by the typical person in the market, all stocks are fairly valued all the time.

C) At the market price, the number of shares being offered for sale matches the number of shares people want to buy.

D) All of the above statements are incorrect.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

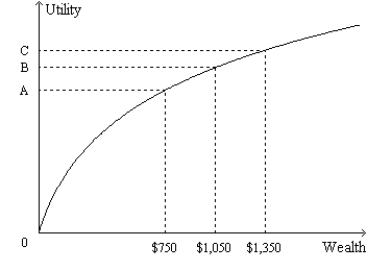

Figure 27-2. The figure shows a utility function for Britney.  -Refer to Figure 27-2. Suppose the vertical distance between the points (0, A) and (0, B) is 5. If her wealth increased from $1,050 to $1,350, then

-Refer to Figure 27-2. Suppose the vertical distance between the points (0, A) and (0, B) is 5. If her wealth increased from $1,050 to $1,350, then

A) Britney's subjective measure of her wellbeing would increase by less than 5 units.

B) Britney's subjective measure of her wellbeing would increase by more than 5 units.

C) Britney would change from being a risk-averse person into a person who is not risk averse.

D) Britney would change from being a person who is not risk averse into a risk-averse person.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Rita puts $10,000 into each of two different assets. The first asset pays 10 percent interest and the second pays 5 percent. According to the rule of 70, what is the approximate difference in the value of the two assets after 14 years?

A) $12,000

B) $14,000

C) $15,500

D) $20,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the rule of 70, if the interest rate is 10 percent, about how long will it take for the value of a savings account to double?

A) about 6.3 years

B) about 7 years

C) about 7.7 years

D) about 10 years

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At which interest rate is the present value of $95.40 one year from today equal to $90 today?

A) 4 percent

B) 5 percent

C) 6 percent

D) 7 percent

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Toni deposited $250 into an account and one year later she had $272.50 in the account. What interest rate was paid on Toni's deposit?

A) 8 percent

B) 9 percent

C) 10 percent

D) None of the above is correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose you win a small lottery and you are given the following choice: You can (1) receive an immediate payment of $10,000 or (2) three annual payments, each in the amount of $3,600, with the first payment coming one year from now, the second two years from now, and the third three years from now. You would choose to take the three annual payments if the interest rate is

A) 2 percent, but not if the interest rate is 3 percent.

B) 3 percent, but not if the interest rate is 4 percent.

C) 4 percent, but not if the interest rate is 5 percent.

D) 5 percent, but not if the interest rate is 6 percent.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The concept of present value helps explain why the quantity of loanable funds demanded decreases when the interest rate increases.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Hector puts $150 into an account when the interest rate is 4 percent. Later he checks his balance and finds he has about $168.73. How long did Hector wait to check his balance?

A) 3 years

B) 3.5 years

C) 4 years

D) 4.5 years

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the interest rate is 7.5 percent, then what is the present value of $4,000 to be received in 6 years?

A) $2,420.68

B) $2,591.85

C) $2,996.33

D) $3,040.63

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You have been promised a payment of $100,000 in the future. In which case is the present value of this future payment highest?

A) You receive the payment 2 years from now and the interest rate is 6 percent.

B) You receive the payment 2 years from now and the interest rate is 4 percent.

C) You receive the payment 3 years from now and the interest rate is 6 percent.

D) You receive the payment 3 years from now and the interest rate is 4 percent.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not correct?

A) There is a greater reduction in risk by increasing the number of stocks in a portfolio from 1 to 10, than by increasing it from 100 to 120 stocks.

B) The historical rate of return on stocks has been about 5 percentage points higher than the historical rate of return on bonds.

C) Stock in an industry that is very sensitive to economic conditions is likely to have a higher average return than stock in an industry that is not so sensitive to economic conditions.

D) If you had information about a corporation that no one else had, you could earn a very high rate of return. This contradicts the efficient market hypothesis.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is correct?

A) Risk-averse people will not hold stock.

B) Diversification cannot reduce firm-specific risk.

C) The larger the percentage of stock in a portfolio, the greater the risk, but the greater the average return.

D) Stock prices are determined by fundamental analysis rather than by supply and demand.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You deposit X dollars into a 3-year certificate of deposit that pays 4.75 percent annual interest. At the end of the 3 years you have $4,229.70. What number of dollars, X, did you deposit?

A) $3,680.00

B) $3,712.77

C) $3,750.00

D) $3,772.57

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

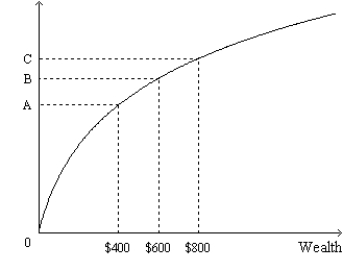

Figure 27-1. The figure shows a utility function.  -Refer to Figure 27-1. What is measured along the vertical axis?

-Refer to Figure 27-1. What is measured along the vertical axis?

A) risk aversion

B) marginal utility

C) utility

D) the number of units of a good that can be purchased

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You have been promised a payment of $400 in the future. In which of the following cases is the present value of this payment the lowest?

A) You receive the payment 4 years from now and the interest rate is 4 percent.

B) You receive the payment 4 years from now and the interest rate is 5 percent.

C) You receive the payment 5 years from now and the interest rate is 4 percent.

D) You receive the payment 5 years from now and the interest rate is 5 percent.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 261 - 280 of 500

Related Exams