B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If net exports are positive, then

A) exports are greater than imports.

B) net capital outflow is negative.

C) Both of the above are correct.

D) Neither of the above is correct.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

An increase in the government budget deficit shifts the supply of loanable funds to the left.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A tax credit for purchases of capital goods causes the interest rate to increase and the exchange rate to appreciate.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In which cases) doesdo) a country's demand for loanable funds shift left?

A) both an increase in the budget deficit and capital flight

B) an increase in the budget deficit, but not capital flight

C) capital flight, but not an increase in the budget deficit

D) neither an increase in the budget deficit nor capital flight

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 1995 House Speaker Newt Gingrich threatened to send the United States into default on its debt. During the day of this announcement, U.S. interest rates rose and the real exchange rate of the U.S. dollar depreciated. Which of these changes is consistent with the results of the open-economy macroeconomic model?

A) the increase in U.S. interest rates

B) the depreciation of the real exchange rate of the U.S. dollar

C) Both a and b are consistent.

D) Neither a nor b are consistent.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The variable that links the market for loanable funds and the market for foreign-currency exchange is

A) net capital outflow.

B) national saving.

C) exports.

D) domestic investment.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Capital flight raises a country's interest rate.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

As the interest rate rises, it is possible that net capital outflow could move from a positive to a negative value.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

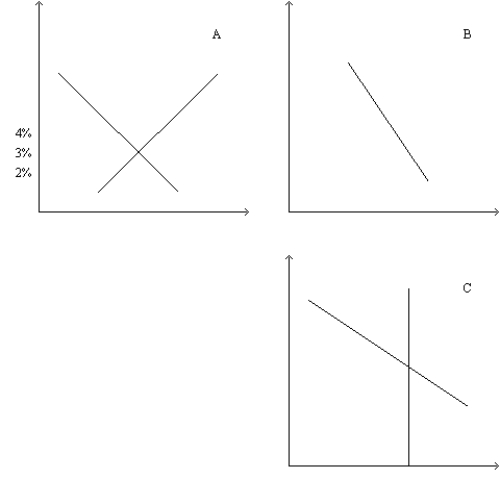

Figure 32-4

Refer to this diagram of the open-economy macroeconomic model to answer the questions below.

-Refer to Figure 32-5. In the market for foreign-currency exchange, the effects of an increase in the budget surplus can be illustrated as a move from j to

-Refer to Figure 32-5. In the market for foreign-currency exchange, the effects of an increase in the budget surplus can be illustrated as a move from j to

A) g.

B) h.

C) i.

D) k.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Other things the same an increase in the interest rate

A) increases national saving, this is shown by moving along the demand for loanable funds curve.

B) increases national saving, this is shown by moving along the supply of loanable funds curve.

C) decreases national saving, this is shown by moving along the demand for loanable funds curve.

D) decreases national saving, this is shown by moving along the supply of loanable funds curve.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is correct concerning the open-economy macroeconomic model?

A) The net-capital-outflow curve slopes upward.

B) The key determinant of net capital outflow is the real exchange rate.

C) The supply of dollars in the market for foreign-currency exchange is vertical.

D) None of the above is correct.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the open-economy macroeconomic model, the amount of net capital outflow represents the quantity of dollars

A) supplied for the purpose of selling assets domestically.

B) supplied for the purpose of buying foreign assets.

C) demanded for the purpose of buying U.S. net exports of goods and services.

D) demanded for the purpose of importing foreign goods and services.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The explanation for the slope of

A) the supply of loanable funds curve is based on the logic that a higher real interest rate leads to higher saving.

B) the demand for loanable funds curve is based on the logic that a higher interest rate leads to higher saving.

C) the supply of loanable funds curve is based on the logic that a higher real interest rate leads to lower saving.

D) the demand for loanable funds curve is based on the logic that a higher interest rate leads to lower saving.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If at a given real interest rate desired national saving is $140 billion, domestic investment is $90 billion, and net capital outflow is $60 billion, then at that real interest rate in the loanable funds market there is a

A) surplus. The real interest rate will rise.

B) surplus. The real interest rate will fall.

C) shortage. The real interest rate will rise.

D) shortage. The real interest rate will fall.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a country has a negative net capital outflow, then

A) on net it is purchasing assets from abroad. This adds to its demand for domestically generated loanable funds.

B) on net it is purchasing assets from abroad. This subtracts from its demand for domestically generated loanable funds.

C) on net other countries are purchasing assets from it. This adds to its demand for domestically generated loanable funds.

D) on net other countries are purchasing assets from it. This subtracts from its demand for domestically generated loanable funds.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

From 1980 to 1987, U.S. net capital outflows decreased. According to the open-economy macroeconomic model, which of the following could have caused this?

A) an increase in the demand for U.S. currency in the market for foreign-currency exchange

B) a decrease in the demand for U.S. currency in the market for foreign-currency exchange

C) an increase in the supply of loanable funds

D) a decrease in the supply of loanable funds

F) All of the above

Correct Answer

verified

Correct Answer

verified

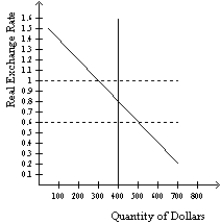

Multiple Choice

Figure 32-2  -Refer to Figure 32-2. If the real exchange rate is 1, then there is a

-Refer to Figure 32-2. If the real exchange rate is 1, then there is a

A) surplus of 100 so the real exchange rate will fall.

B) surplus of 100 so the real exchange rate will rise.

C) shortage of 100 so the real exchange rate will fall.

D) shortage of 100 so the real exchange rate will rise.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the government of India implemented a policy that decreased national saving, its real exchange rate would

A) depreciate and Indian net exports would rise.

B) depreciate and Indian net exports would fall.

C) appreciate and Indian net exports would rise.

D) appreciate and Indian net exports would fall.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Capital flight shifts the NCO curve to the left.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 441 - 460 of 484

Related Exams