A) increase government spending.

B) increase the money supply.

C) decrease government spending.

D) decrease the money supply.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If people decide to hold less money, then

A) money demand decreases, there is an excess supply of money, and interest rates rise.

B) money demand decreases, there is an excess supply of money, and interest rates fall.

C) money demand increases, there is an excess demand for money, and interest rates fall.

D) money demand increases, there is an excess demand for money, and interest rates rise.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is correct?

A) A higher price level shifts money demand rightward.

B) When money demand shifts rightward, the interest rate rises.

C) A higher interest rate reduces the quantity of goods and services demanded.

D) All of the above are correct.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that there is no accelerator affect. The MPC = 3/4. The government increases both expenditures and taxes by $600. The effect of taxes on aggregate demand is 3/4 the size of that created by government expenditures alone. The crowding out effect is 1/5 as strong as the combined effect of government expenditures and taxes on aggregate demand. How much does aggregate demand shift by?

A) $1480

B) $480

C) $160

D) None of the above is correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Short Answer

An increase in taxes shifts the aggregate curve to the .

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If taxes

A) increase, then consumption increases, and aggregate demand shifts leftward.

B) increase, then consumption decreases, and aggregate demand shifts rightward.

C) decrease, then consumption increases, and aggregate demand shifts rightward.

D) decrease, then consumption decreases, and aggregate demand shifts leftward.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Paul Samuelson, a famous economist, said that

A) "the bond market has predicted zero out of the past nine recessions."

B) "the stock market has predicted zero out of the past nine recessions."

C) "the bond market has predicted nine out of the past five recessions."

D) "the stock market has predicted nine out of the past five recessions."

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Other things the same, an increase in taxes shifts aggregate demand to the left. In the short run this makes output fall which makes the interest rate rise.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Permanent tax cuts shift the AD curve

A) farther to the right than do temporary tax cuts.

B) not as far to the right as do temporary tax cuts.

C) farther to the left than do temporary tax cuts.

D) not as far to the left as do temporary tax cuts.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The lag problem associated with fiscal policy is due mostly to

A) the fact that business firms make investment plans far in advance.

B) the political system of checks and balances that slows down the process of implementing fiscal policy.

C) the time it takes for changes in government spending or taxes to affect the interest rate.

D) All of the above are correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The interest rate falls if

A) the price level falls or the money supply falls.

B) the price level falls or the money supply rises.

C) the price level rises or the money supply falls.

D) the price level rises or the money supply rises.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Changes in monetary policy aimed at reducing aggregate demand involve decreasing the money supply or increasing the interest rate.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose households attempt to decrease their money holdings. To counter this decrease in money demand and stabilize output, the Federal Reserve will

A) increase government spending.

B) increase the money supply.

C) decrease government spending.

D) decrease the money supply.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements generates the greatest amount of disagreement among economists?

A) Increases in the money supply shift aggregate demand to the right.

B) In the long run, increases in the money supply increase prices, but not output.

C) Recessions are associated with decreases in consumption, investment, and employment.

D) Government should use fiscal policy to try to stabilize the economy.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

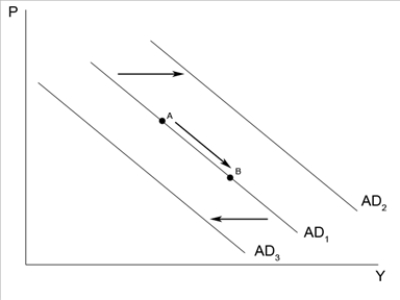

Figure 34-8  -Refer to Figure 34-8. An increase in taxes will

-Refer to Figure 34-8. An increase in taxes will

A) shift aggregate demand from AD1 to AD2.

B) shift aggregate demand from AD1 to AD3.

C) cause movement from point A to point B along AD1.

D) have no effect on aggregate demand.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose foreigners find U.S. goods and services more desirable for some reason other than a change in the exchange rate. Which policies could be used to offset the resulting change in output?

A) an increase in the money supply and an increase in government purchases.

B) an increase in the money supply and a decrease in government purchases.

C) a decrease in the money supply and an increase in government purchases.

D) a decrease in the money supply and a decrease in government purchases.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The theory of liquidity preference is most helpful in understanding

A) the wealth effect.

B) the exchange-rate effect.

C) the interest-rate effect.

D) misperceptions theory.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the long run, fiscal policy influences

A) saving, investment, and growth; in the short run, fiscal policy primarily influences technology and the production function.

B) saving, investment, and growth; in the short run, fiscal policy primarily influences the aggregate demand for goods and services.

C) technology and the production function; in the short run, fiscal policy primarily influences saving, investment, and growth.

D) the aggregate demand for goods and services; in the short run, fiscal policy primarily influences technology and the production function.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the interest-rate effect, an increase in the price level will

A) increase money demand and interest rates. Investment declines.

B) increase money demand and interest rates. Investment increases.

C) increase money demand, reduce interest rates, and investment increases.

D) decrease money demand and interest rates. Investment declines.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the MPC = 0.75, then the government purchases multiplier is about

A) 1.33.

B) 7.

C) 4.

D) 3.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 261 - 280 of 512

Related Exams