A) decreased by $70 billion.

B) increased by $250 billion.

C) increased by $70 billion.

D) decreased by $62.5 billion.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is the best measure of the total amount that the federal government owes to private owners of U.S. Treasury securities?

A) government interagency borrowing

B) the government budget deficit

C) the gross public debt

D) the net public debt

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

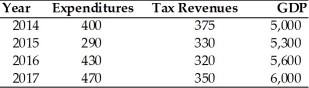

-Suppose that initially there is no public debt. Using the above table, the public debt over this four-year period would have

-Suppose that initially there is no public debt. Using the above table, the public debt over this four-year period would have

A) increased by $215.

B) decreased by $100.

C) increased by $1,375.

D) decreased by $1,590.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the long run, a higher government budget deficit causes

A) a decrease in both private spending and equilibrium real GDP.

B) an increase in both private spending and equilibrium real GDP.

C) a decrease in private spending while equilibrium real GDP remains unchanged.

D) no change in private spending but a decrease in equilibrium real GDP.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Noncontrollable expenditures are called "noncontrollable" because

A) they increase at the same rate as the public debt.

B) they change without congressional action.

C) only the president can approve these entitlement payments.

D) the political process determines the size of the payments.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A government budget surplus is

A) a situation in which the supply of goods in the economy is greater than the demand for goods.

B) a situation in which the amount spent by the government is greater than the amount collected in taxes.

C) the public debt.

D) an excess of revenues over government spending.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is TRUE about how trade deficits and government budget deficits are related?

A) The trade deficit leads to a reduction in investment that leads to a government budget deficit.

B) The trade deficit leads to a decline in imports relative to exports that leads to a government budget deficit.

C) The government budget deficit leads to higher interest rates that will lead to a trade deficit.

D) The government budget deficit leads to lower interest rates that will lead to a lower trade deficit.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the difference between the short run and the long run when there is full employment and the government engages in deficit spending?

A) Real GDP will increase in both the short run and the long run.

B) Real GDP will increase in the long run but not the short run.

C) Real GDP will increase in the short run but not the long run.

D) Real GDP will not increase in either the long run or the short run.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

To evaluate relative changes in the net public debt, we must

A) look at the absolute amount owed by the government.

B) compare it to the nation's real GDP.

C) look at the annual percentage change in the public debt.

D) compare it to the debts of all developed countries.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Net public debt is equal to

A) the gross public debt minus current year tax revenue collection.

B) the gross public debt minus taxes paid by foreign corporations on their profits made in the United States.

C) the gross public debt plus all governmental interagency borrowing.

D) the gross public debt minus all governmental interagency borrowing.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The difference between gross public debt and net public debt is that

A) net public debt includes interagency borrowing while the gross domestic product debt does not.

B) net public debt is expressed in real terms while gross public debt is expressed in nominal terms.

C) gross public debt includes interagency borrowing while net public debt does not.

D) gross public debt is held by individuals while net public debt is held by the government.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the current year, a nation's government spending equals $100 trillion and its revenues are $130 trillion. Which of the following is TRUE?

A) The nation's national debt equals $30 trillion.

B) This nation has a current year budget surplus of $30 trillion.

C) This nation is currently running a budget deficit of $30 trillion.

D) This nation has a current year budget surplus of $230 trillion.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Since 1940, the U.S. government has experienced

A) about the same number of years with budget deficits as with budget surpluses.

B) twice as many annual budget surpluses as annual budget deficits.

C) only one year with a budget surplus.

D) many more budget deficits than budget surpluses.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the net public debt declined last year, then which of the following most likely occurred during that year?

A) The government's budget was balanced.

B) The government experienced a budget surplus.

C) The government experienced a budget deficit.

D) The share of foreign holdings of the government's debt increased.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is TRUE about the difference between the public debt and the government budget deficit?

A) The public debt always increases while the government budget deficit may increase or decrease.

B) The public debt for this year will increase or decrease depending upon whether there is a government budget deficit or a government budget surplus.

C) The public debt is a flow measure and the government budget deficit is not a flow measure.

D) There is no relationship between the public debt and the government budget deficit since one is a stock measure and the other is a flow measure.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

To compare the net public debt of various countries, the debt has to be compared to

A) the country's trade deficit.

B) the country's current budget deficit or surplus.

C) the country's real GDP.

D) the country's national defense expenditure.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the long run, what effect does a government's deficit spending have on equilibrium real Gross Domestic Product (GDP) ?

A) Government deficit spending will increase equilibrium real Gross Domestic Product (GDP) .

B) Deficit spending will decrease the nation's equilibrium real Gross Domestic Product (GDP) .

C) Higher government deficits will not raise equilibrium Gross Domestic Product (GDP) above the full-employment level.

D) Higher government deficits will raise equilibrium Gross Domestic Product (GDP) above the full-employment level and also have an inflationary effect.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the public debt increased by the same amount each year during the past three years, then

A) the U.S. government must have operated with the same budget surpluses during the past three years.

B) the U.S. government must have experienced budget surpluses that increased by the same amount each of the past three years.

C) the U.S. Treasury must have issued securities to fund a flow of government spending that exceeded a flow of tax revenues by the same amount during each of the past three years.

D) during each of the past three years, the U.S. Treasury must have bought back the same amount of securities that had previously been issued to cover deficits experienced more than three years ago.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stocks change ________ whereas flows relate to ________.

A) within a given period of time; changes between points in time

B) only at the end of each year; amounts at a given point in time

C) between points in time; changes within a given time period

D) and that causes flows to change; changes that have no impact on stocks

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is NOT an example of a flow variable?

A) planned investment

B) capital stock

C) The federal deficit

D) inventory investment

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 146

Related Exams