A) Increase income

B) Decrease net income

C) Decrease expenses

D) Increase assets

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Depreciation Expense and Accumulated Depreciation are classified, respectively, as

A) expense, contra asset

B) asset, contra liability

C) revenue, asset

D) contra asset, expense

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Essay

On March 1, a business paid $3,600 for a twelve month liability insurance policy. On April 1 the same business entered into a two-year rental contract for equipment at a total cost of $18,000. Determine the following amounts: (a) insurance expense for the month of March (b) prepaid insurance as of March 31 (c) equipment rent expense for the month of April (d) prepaid equipment rental as of April 30

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A business pays weekly salaries of $25,000 on Friday for a five-day week ending on that day. The adjusting entry necessary at the end of the fiscal period ending on Tuesday is

A) debit Salaries Payable, $10,000; credit Cash, $10,000

B) debit Salary Expense, $10,000; credit Drawing, $10,000

C) debit Salary Expense, $10,000; credit Salaries Payable, $10,000

D) debit Drawing, $10,000; credit Cash, $10,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the accounts below would most likely appear on an adjusted trial balance but probably would not appear on the trial balance?

A) Fees Earned

B) Accounts Receivable

C) Unearned Fees

D) Depreciation Expense

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A business pays bi-weekly salaries of $20,000 every other Friday for a ten-day period ending on that day. The last pay day of December is Friday, December 27. Assuming the next pay period begins on Monday, December 30 and the proper adjusting entry is journalized at the end of the fiscal period (December 31) . The entry for the payment of the payroll on Friday, January 10 includes a:

A) debit to Salary Expense of $16,000

B) debit to Salary Expense of $4,000

C) credit to Salary Payable of $16,000

D) credit to Salary Payable of $4,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Deferred revenue is revenue that is

A) earned and the cash has been received

B) earned but the cash has not been received

C) not earned and the cash has not been received

D) not earned but the cash has been received

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Prepaid expenses are eventually expected to

A) become expenses when their future economic value expires.

B) become revenues when services are performed.

C) become expenses in the period when they are paid.

D) become revenues when the liability is no longer owed.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Accruals are needed when an unrecorded expense has been incurred or an unrecorded revenue has been earned.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The entry to adjust for the cost of supplies used during the accounting period is

A) debit Supplies Expense; credit Supplies

B) debit Owner Capital; credit Supplies

C) debit Accounts Payable; credit Supplies

D) debit Supplies; credit Owner Capital

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Essay

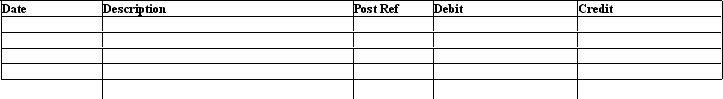

The company determines that the interest expense on a note payable for period ending December 31st is $775. This amount is payable on January 1st. Prepare the journal entries required on December 31st and January 1st.

Correct Answer

verified

Correct Answer

verified

Essay

A one-year insurance policy was purchased on October 1, 2011 for $4,200. The adjusting entry on December 31, 2010 would be:

Correct Answer

verified

$4,200/12 = $350 x 3 = $1,050

11ea9439_7036_60ac_8ff9_272f602433ad_TB2013_00_TB2013_00

Correct Answer

verified

Multiple Choice

If there is a balance in the unearned subscriptions account after adjusting entries are made, it represents a(n)

A) deferral

B) accrual

C) drawing

D) revenue

F) None of the above

Correct Answer

verified

A

Correct Answer

verified

True/False

By ignoring and not posting the adjusting journal entries to the appropriate accounts, net income will always be overstated.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the effect of the debit portion of an adjusting entry is to increase the balance of an expense account, which of the following describes the effect of the credit portion of the entry?

A) decreases the balance of an owner's equity account

B) increases the balance of a liability account

C) increases the balance of an asset account

D) decreases the balance of an expense account

F) A) and C)

Correct Answer

verified

B

Correct Answer

verified

Essay

Salaries of $6,400 are paid for a five-day week on Friday. Prepare the adjusting journal entry that is required if the month ends on Thursday.

Correct Answer

verified

Correct Answer

verified

Essay

At the end of the current year, $3,700 fees have been earned but have not been billed to clients. Journalize the adjusting entry to record the accrued fees.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At the end of the fiscal year, the usual adjusting entry for accrued salaries owed to employees was omitted. Which of the following statements is true?

A) Salary Expense for the year was understated.

B) The total of the liabilities at the end of the year was overstated.

C) Net income for the year was understated.

D) Owner's equity at the end of the year was understated.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Austin, Inc. made a Prepaid Rent payment of $3,500 on January 1st. The company's monthly rent is $700. The amount of Prepaid Rent that would appear on the January 31 balance sheet after adjustment is:

A) $2,800

B) $700

C) $3,500

D) $1,750

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Adjusting entries always include

A) only income statement accounts.

B) only balance sheet accounts.

C) the cash account.

D) at least one income statement account and one balance sheet account.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 179

Related Exams