B) False

Correct Answer

verified

Correct Answer

verified

Essay

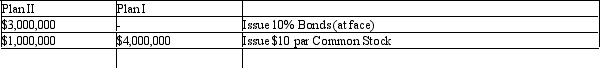

Sorenson Co., is considering the following alternative plans for financing their company:

Income tax is estimated at 40% of income.

Determine the earnings per share of common stock under the two alternative financing plans, assuming income before bond interest and income tax is $1,000,000.

Income tax is estimated at 40% of income.

Determine the earnings per share of common stock under the two alternative financing plans, assuming income before bond interest and income tax is $1,000,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A corporation issues for cash $8,000,000 of 8%, 25-year bonds, interest payable semiannually. The amount received for the bonds will be

A) present value of 50 semiannual interest payments of $320,000, plus present value of $8,000,000 to be repaid in 25 years

B) present value of 25 annual interest payments of $640,000

C) present value of 25 annual interest payments of $640,000, plus present value of $8,000,000 to be repaid in 25 years

D) present value of $8,000,000 to be repaid in 25 years, less present value of 50 semiannual interest payments of $320,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An installment note payable for a principal amount of $48,000 at 6% interest requires Lawson Company to repay the principal and interest in equal annual payments of $11,395 beginning December 31, 2011, for each of the next five years. After the final payment, the carrying amount on the note will be

A) $5,425

B) $8,975

C) $11,395

D) $0

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The amount of interest expense reported on the income statement will be more than the interest paid to bondholders if the bonds were originally sold at a discount.

B) False

Correct Answer

verified

True

Correct Answer

verified

Multiple Choice

The market interest rate related to a bond is also called the

A) stated interest rate

B) effective interest rate

C) contract interest rate

D) straight-line rate

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The journal entry a company records for the payment of interest, interest expense, and amortization of bond discount is

A) debit Interest Expense, credit Cash and Discount on Bonds Payable

B) debit Interest Expense, credit Cash

C) debit Interest Expense and Discount on Bonds Payable, credit Cash

D) debit Interest Expense, credit Interest Payable and Discount on Bonds Payable

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Both callable and non-callable bonds can be purchased by the issuing corporation in the open market.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The cash and securities comprising a sinking fund established to redeem bonds at maturity in 2015 should be classified on the balance sheet as

A) fixed assets

B) current assets

C) intangible assets

D) investments

F) All of the above

Correct Answer

verified

Correct Answer

verified

Essay

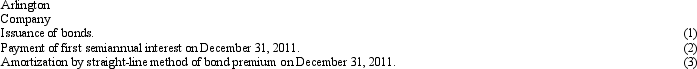

On June 30, 2011, Arlington Company issued $1,500,000 of 10-year, 8% bonds, dated June 30, for $1,540,000. Present entries to record the following transactions:

Correct Answer

verified

Correct Answer

verified

True/False

If the market rate of interest is 8% and a corporation's bonds bear interest at 7%, the bonds will sell at a premium.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If the amount of a bond premium on an issued 11%, 4-year, $100,000 bond is $12,928, the annual interest expense is $5,500.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The buyer determines how much to pay for bonds by computing the present value of future cash receipts using the contract rate of interest.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Miracle Corporation issues 1,000, 10-year, 8%, $1,000 bonds dated January 1, 2011, at 96. The journal entry to record the issuance will show a

A) debit to Discount on Bonds Payable for $40,000.

B) debit to Cash of $1,000,000.

C) credit to Bonds Payable for $960,000.

D) credit to Cash for $960,000.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1, 2010, the Horton Corporation issued 10% bonds with a face value of $200,000. The bonds are sold for $196,000. The bonds pay interest semiannually on June 30 and December 31 and the maturity date is December 31, 2014. Horton records straight-line amortization of the bond discount. The bond interest expense for the year ended December 31, 2010, is

A) $19,800

B) $19,200

C) $20,800

D) $24,000

F) B) and D)

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

When the corporation issuing the bonds has the right to repurchase the bonds prior to the maturity date for a specific price, the bonds are

A) convertible bonds

B) unsecured bonds

C) debenture bonds

D) callable bonds

F) None of the above

Correct Answer

verified

Correct Answer

verified

Essay

Given the following data, prepare an amortization table (use the effective method) 1/1/10 - issue $800,000, 9%, 3 year bonds, interest paid annually on 12/31, to yield 8% Use the following format (round to nearest dollar - may have a slight rounding difference); Date Cash Paid Interest Exp. Amortization Bond Carrying Value

Correct Answer

verified

Date Cash Paid Interest Exp. Amortization Bond Carrying Value

1/1/10 820,615

12/31/10 72,000 65,649 6,351 814,264

12/31/11 72,000 65,141 6,859 807,405

12/31/12 72,000 64,592 7,408 800,000 (rounded)

Correct Answer

verified

Multiple Choice

The bond indenture may provide that funds for the payment of bonds at maturity be accumulated over the life of the issue. The amounts set aside are kept separate from other assets in a special fund called a(n)

A) enterprise fund

B) sinking fund

C) special assessments fund

D) general fund

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Any unamortized premium should be reported on the balance sheet of the issuing corporation as

A) a direct deduction from the face amount of the bonds in the liability section

B) as paid-in capital

C) a direct deduction from retained earnings

D) an addition to the face amount of the bonds in the liability section

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the market rate of interest on bonds is higher than the contract rate, the bonds will sell at

A) a premium

B) their face value

C) their maturity value

D) a discount

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 181

Related Exams