B) False

Correct Answer

verified

Correct Answer

verified

True/False

Bondholders claims on the assets of the corporation rank ahead of stockholders.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bonds Payable has a balance of $1,000,000 and Premium on Bonds Payable has a balance of $7,000.If the issuing corporation redeems the bonds at 101,what is the amount of gain or loss on redemption?

A) $3,000 loss

B) $3,000 gain

C) $7,000 loss

D) $7,000 gain

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Essay

On the first day of the fiscal year,a company issues a $1,000,000,7%,5 year bond that pays semi-annual interest of $35,000 ($1,000,000 ´ 7% ´ 1/2),receiving cash of $884,171.Journalize the first interest payment and the amortization of the related bond discount using the straight-line method.Round answer to the nearest dollar.

Correct Answer

verified

Correct Answer

verified

True/False

The effective-interest method of amortizing a bond discount or premium is the preferred method.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the market rate of interest is 10%,a $10,000,12%,10-year bond that pays interest semiannually would sell at an amount

A) less than face value.

B) equal to the face value.

C) greater than face value.

D) that cannot be determined.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The journal entry a company records for the issuance of bonds when the contract rate is greater than the market rate would be

A) debit Bonds Payable,credit Cash

B) debit Cash and Discount on Bonds Payable,credit Bonds Payable

C) debit Cash,credit Premium on Bonds Payable and Bonds Payable

D) debit Cash,credit Bonds Payable

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Essay

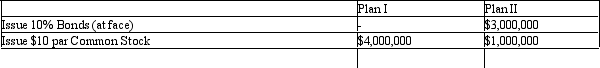

Sorenson Co. ,is considering the following alternative plans for financing their company:

Income tax is estimated at 40% of income.

Determine the earnings per share of common stock under the two alternative financing plans,assuming income before bond interest and income tax is $1,000,000.

Income tax is estimated at 40% of income.

Determine the earnings per share of common stock under the two alternative financing plans,assuming income before bond interest and income tax is $1,000,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bonds Payable has a balance of $900,000 and Premium on Bonds Payable has a balance of $10,000.If the issuing corporation redeems the bonds at 103,what is the amount of gain or loss on redemption?

A) $1,200 loss

B) $1,200 gain

C) $17,000 loss

D) $17,000 gain

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the effective-interest method is used,the amortization of the bond premium

A) increases interest expense each period

B) decreases interest expense each period

C) increases interest expense in some periods and decreases interest expense in other periods

D) has no effect on the interest expense in any period

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Merchant Company issued 10-year bonds on January 1,2011.The 15% bonds have a face value of $100,000 and pay interest every January 1 and July 1.The bonds were sold for $117,205 based on the market interest rate of 12%.Merchant uses the effective-interest method to amortize bond discounts and premiums.On July 1,2011,Merchant should record interest expense (round to the nearest dollar) of

A) $7,032

B) $7,500

C) $8,790

D) $14,065

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A bond indenture is

A) a contract between the corporation issuing the bonds and the underwriters selling the bonds

B) the amount due at the maturity date of the bonds

C) a contract between the corporation issuing the bonds and the bond trustee,who is acting on behalf of the bondholders.

D) the amount for which the corporation can buy back the bonds prior to the maturity date

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The journal entry a company records for the payment of interest,interest expense,and amortization of bond discount is

A) debit Interest Expense,credit Cash and Discount on Bonds Payable

B) debit Interest Expense,credit Cash

C) debit Interest Expense and Discount on Bonds Payable,credit Cash

D) debit Interest Expense,credit Interest Payable and Discount on Bonds Payable

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

The face value of bonds is quoted as a percentage of the bonds' market value.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

When the effective interest method of amortization is used,the amount of interest expense for a given period is calculated by multiplying the face rate of interest by the bond's carrying value at the beginning of the given period.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sinking Fund Income is reported in the income statement as

A) income from operations

B) extraordinary

C) gain on sinking fund transactions

D) other income

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Debenture bonds are

A) bonds secured by specific assets of the issuing corporation

B) bonds that have a single maturity date

C) issued only by the federal government

D) issued on the general credit of the corporation and do not pledge specific assets as collateral.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bonds with a face amount $1,000,000,are sold at 96.The entry to record the issuance is

A) Cash 1,000,000 Premium on Bonds Payable 40,000

Bonds Payable 960,000

B) Cash 960,000 Premium on Bonds Payable 40,000

Bonds Payable 1,000,000

C) Cash 960,000 Discount on Bonds Payable 40,000

Bonds Payable 1,000,000

D) Cash 960,000 Bonds Payable 960,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

If bonds of $1,000,000 with unamortized discount of $10,000 are redeemed at 98,the gain on redemption of bonds is $10,000.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1,2014,the Horton Corporation issued 10% bonds with a face value of $200,000.The bonds are sold for $192,000.The bonds pay interest semiannually on June 30 and December 31 and the maturity date is December 31,2018.Horton records straight-line amortization of the bond discount.The bond interest expense for the year ended December 31,2014,is

A) $10,800

B) $18,400

C) $21,600

D) $28,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 161 - 180 of 183

Related Exams