Filters

Question type

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 112

Multiple Choice

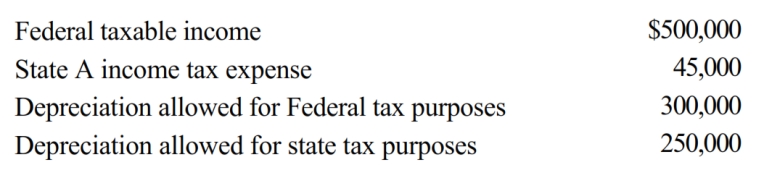

Ramirez Corporation is subject to income tax only in State a. Ramirez generated the following income and deductions.  Federal taxable income is the starting point in computing A taxable income. State income taxes are not deductible for A tax purposes. Ramirez's A taxable income is:

Federal taxable income is the starting point in computing A taxable income. State income taxes are not deductible for A tax purposes. Ramirez's A taxable income is:

A) $495,000.

B) $500,000.

C) $545,000.

D) $595,000.

E) B) and D)

F) C) and D)

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Question 113

Multiple Choice

Parent and Minor form a non-unitary group of corporations. Parent is located in a state with an effective tax rate of 3%, while Minor's effective tax rate is 9%. Acting in concert to reduce overall tax liabilities, the group should:

A) Have Parent charge Minor an annual management fee.

B) Shift Parent's high-cost assembly and distribution operations to Minor.

C) Execute an intercompany loan, such that Minor pays deductible interest to Parent.

D) All of the above are effective income-shifting techniques for a non-unitary group.

E) None of the above is an effective income-shifting technique for a non-unitary group.

F) B) and E)

G) A) and E)

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Question 114

Short Answer

Match each of the following events, considered independently, to its likely effect on WillCo's various apportionment factors. WillCo is based in Q and has customers in Q, R, and S. To this point, WillCo has not established nexus with S. More than one choice may be correct. a. No change in apportionment factors b. Q apportionment factor increases c. Q apportionment factor decreases d. R apportionment factor increases e. R apportionment factor decreases f. S apportionment factor increases g. S apportionment factor decreases -WillCo completes the construction of production facilities in S.

Correct Answer

verified

Correct Answer

verified

Showing 201 - 204 of 204

Related Exams