A) $500 loss

B) $15,500 loss

C) $15,500 gain

D) $500 gain

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The balance in Discount on Bonds Payable

A) should be reported on the balance sheet as an asset because it has a debit balance

B) should be allocated to the remaining periods for the life of the bonds by the straight-line method, if the results obtained by that method materially differ from the results that would be obtained by the interest method

C) would be added to the related bonds payable to determine the carrying amount of the bonds

D) would be subtracted from the related bonds payable on the balance sheet

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If bonds are issued at a discount, it means that the

A) bondholder will receive effectively less interest than the contractual rate of interest.

B) market interest rate is lower than the contractual interest rate.

C) market interest rate is higher than the contractual interest rate.

D) financial strength of the issuer is suspect.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The amount of interest expense reported on the income statement will be more than the interest paid to bondholders if the bonds were originally sold at a discount.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Debenture bonds are

A) bonds secured by specific assets of the issuing corporation

B) bonds that have a single maturity date

C) issued only by the federal government

D) issued on the general credit of the corporation and do not pledge specific assets as collateral.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A corporation issues for cash $1,000,000 of 10%, 20-year bonds, interest payable annually, at a time when the market rate of interest is 12%. The straight-line method is adopted for the amortization of bond discount or premium. Which of the following statements is true?

A) The amount of the annual interest expense is computed at 10% of the bond carrying amount at the beginning of the year.

B) The amount of the annual interest expense gradually decreases over the life of the bonds.

C) The amount of unamortized discount decreases from its balance at issuance date to a zero balance at maturity.

D) The bonds will be issued at a premium.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

There is a loss on redemption of bonds when bonds are redeemed above carrying value.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The present value of the periodic bond interest payments is the value today of the amount of interest to be received at the end of each interest period.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

An equal stream of periodic payments is called an annuity.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A $300,000 bond was redeemed at 98 when the carrying value of the bond was $296,000. The entry to record the redemption would include a

A) loss on bond redemption of $4,000.

B) gain on bond redemption of $4,000.

C) gain on bond redemption of $2,000.

D) loss on bond redemption of $2,000.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The interest expense recorded on an interest payment date is increased

A) only if the market rate of interest is less than the stated rate of interest on that date.

B) by the amortization of premium on bonds payable.

C) by the amortization of discount on bonds payable.

D) only if the bonds were sold at face value.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the market rate of interest was 11%, Valley Corporation issued $100,000, 8%, 10-year bonds that pay interest semiannually. Using the straight-line method, the amount of discount or premium to be amortized each interest period would be

A) $4,000

B) $896

C) $17,926

D) $1,793

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not an advantage of issuing bonds instead of common stock?

A) Tax savings result

B) Income to common shareholders may increase.

C) Earnings per share on common stock may be lower.

D) Stockholder control is not affected.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the market rate of interest is greater than the contractual rate of interest, bonds will sell

A) at a premium.

B) at face value.

C) at a discount.

D) only after the stated rate of interest is increased.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One potential advantage of financing corporations through the use of bonds rather than common stock is

A) the interest on bonds must be paid when due

B) the corporation must pay the bonds at maturity

C) the interest expense is deductible for tax purposes by the corporation

D) a higher earnings per share is guaranteed for existing common shareholders

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

The total interest expense over the entire life of a bond is equal to the sum of the interest payments plus the total discount or minus the total premium related to the bond.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If bonds payable are not callable, the issuing corporation

A) can exchange it for common stock

B) can repurchase them in the open market

C) must get special permission from the SEC to repurchase them

D) is more likely to repurchase them if the interest rates increase

F) A) and C)

Correct Answer

verified

Correct Answer

verified

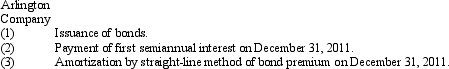

Essay

On June 30, 2011, Arlington Company issued $1,500,000 of 10-year, 8% bonds, dated June 30, for $1,540,000. Present entries to record the following transactions:

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A corporation issues for cash $10,000,000 of 8%, 30-year bonds, interest payable annually, at a time when the market rate of interest is 9%. The straight-line method is adopted for the amortization of bond discount or premium. Which of the following statements is true?

A) The amount of annual interest paid to bondholders remains the same over the life of the bonds.

B) The amount of annual interest expense decreases as the bonds approach maturity.

C) The amount of annual interest paid to bondholders increases over the 30-year life of the bonds.

D) The carrying amount decreases from its amount at issuance date to $10,000,000 at maturity.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The balance in Premium on Bonds Payable should be reported as a deduction from Bonds Payable on the balance sheet.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 186

Related Exams