A) Current ratio

B) Working capital

C) Quick assets

D) Quick ratio

E) Record an accrual and disclose in the notes to the financial statements

F) Disclose only in notes to financial statements

G) No disclosure needed in notes to financial statements

![]()

I) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On June 1,Davis Inc.issued an $84,000,5%,120-day note payable to Garcia Company.Assume that the fiscal year of Garcia ends June 30.Using a 360-day year,what is the amount of interest revenue recognized by Garcia in the following year? When required,round your answer to the nearest dollar.

A) $700

B) $1,600

C) $1,062

D) $4,200

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1,Gemstone Company obtained a $165,000,10-year,7% installment note from Guarantee Bank.The note requires annual payments of $23,492,with the first payment occurring on the last day of the fiscal year.The first payment consists of interest of $11,550 and principal repayment of $11,942.The journal entry to record the issuance of the installment note for cash on January 1 would include a

A) debit to interest expense for $11,550

B) credit to interest payable for $11,550

C) credit to notes payable for $165,000

D) debit to notes payable for $165,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The cost of a product warranty should be included as an expense in the

A) period the cash is collected for a product sold on account

B) future period when the cost of repairing the product is paid

C) period of the sale of the product

D) future period when the product is repaired or replaced

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Payroll taxes levied against employees become liabilities

A) the first of the following month

B) when the payroll is paid to employees

C) when data are entered in a payroll register

D) at the end of an accounting period

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 5,Thomas Company,a calendar-year company,issued $1,000,000 of notes payable,of which $250,000 is due on January 1 each of the next four years.The proper balance sheet presentation on December 31 is

A) Current Liabilities,$1,000,000

B) Current Liabilities,$250,000; Long-Term Debt,$750,000

C) Long-Term Debt,$1,000,000

D) Current Liabilities,$750,000; Long-Term Debt,$250,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be used to compute the federal income taxes to be withheld from an employee's earnings?

A) FICA tax rate

B) wage and tax statement

C) FUTA tax rate

D) withholding table

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Notes may be issued

A) when assets are purchased

B) to creditors to temporarily satisfy an account payable created earlier

C) when borrowing money

D) for all of these

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which is not a determinate in calculating federal income taxes withheld from an individual's pay?

A) marital status

B) types of earnings

C) gross pay

D) number of withholding allowances

F) None of the above

Correct Answer

verified

Correct Answer

verified

Essay

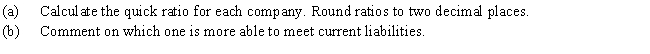

Use the following information and calculate the quick ratio for Davis Company and for Bender Inc.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following will have no effect on an employee's take-home pay?

A) social security tax

B) unemployment tax

C) marital status

D) number of exemptions claimed

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Essay

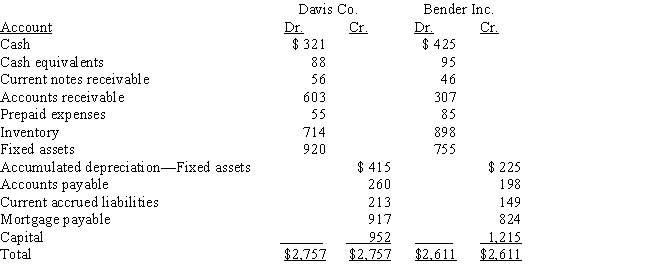

Roseland Design borrowed $700,000 on a 90-day note from CorpOne Funding Company.CorpOne discounts the note at 8%.(Assume a 360-day year is used for interest calculations.)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A pension plan that promises employees a fixed annual pension benefit,based on years of service and compensation,is called a(n)

A) defined contribution plan

B) defined benefit plan

C) unfunded plan

D) compensation plan

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

During the first year of operations,a company granted warranties on its products at an estimated cost of $8,500.The product warranty expense should be recorded in the years of the expenditures to repair the products covered by the warranty payments.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

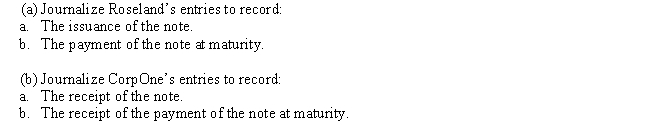

On October 1,Ramos Co.signed a $90,000,60-day discounted note at the bank.The discount rate was 6%,and the note was paid on November 30.(Assume a 360-day year is used for interest calculations.)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Zennia Company provides its employees with varying amounts of vacation per year,depending on the length of employment.The estimated amount of the current year's vacation cost is $135,000.On December 31,the end of the current year,the current month's accrued vacation pay is

A) $135,000

B) $67,500

C) $0

D) $11,250

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The journal entry used to record the issuance of an interest-bearing note for the purpose of borrowing funds for the business is

A) debit Accounts Payable; credit Notes Payable

B) debit Cash; credit Notes Payable

C) debit Notes Payable; credit Cash

D) debit Cash and Interest Expense; credit Notes Payable

F) All of the above

Correct Answer

verified

Correct Answer

verified

Essay

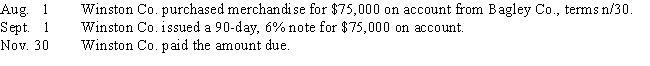

Journalize the following entries on the books of Winston Co.for August 1,September 1,and November 30.(Assume a 360-day year is used for interest calculations.)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Martin Jackson receives an hourly wage rate of $30,with time and a half for all hours worked in excess of 40 hours during a week.Payroll data for the current week are as follows: hours worked,46; federal income tax withheld,$350; social security tax rate,6.0%; and Medicare tax rate,1.5%.What is the net amount to be paid to Jackson?

A) $1,470.00

B) $1,009.75

C) $1,097.95

D) $460.25

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The journal entry to record the payment of an interest-bearing note is

A) debit Cash; credit Notes Payable

B) debit Accounts Payable; credit Cash

C) debit Notes Payable and Interest Expense; credit Cash

D) debit Notes Payable and Interest Receivable; credit Cash

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 188

Related Exams