A) $61,800

B) $68,100

C) $99,100

D) $100,100

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

An S shareholder's basis is increased by stock purchases and capital contributions.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which transaction affects the Other Adjustments Account on an S corporation's Schedule M-2?

A) Payroll penalty.

B) Unreasonable compensation.

C) Life insurance proceeds (nontaxable to the recipient S corporation) .

D) Taxable interest.

F) A) and B)

Correct Answer

verified

C

Correct Answer

verified

Essay

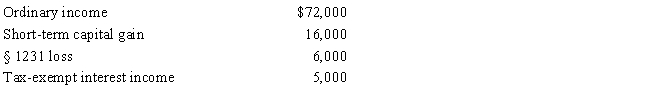

Gene Grams is a 45% owner of a calendar year S corporation during the tax year.His beginning stock basis is $230,000,and the S corporation reports the following items.

Calculate Grams's stock basis at year-end.

Calculate Grams's stock basis at year-end.

Correct Answer

verified

Correct Answer

verified

True/False

An S corporation can claim a deduction for its NOL amounts.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a resident alien shareholder moves outside the U.S.,the S election is terminated.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Liabilities affect the owner's basis differently in an S corporation than they do in a partnership.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Any distribution of cash or property by a corporation that does not exceed the balance of AAA with respect to S stock during a post-termination transition period of approximately one year is applied against and reduces the basis of the S stock.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

An item that appears in the "Other Adjustments Account" affects stock basis,but not AAA,such as tax-exempt interest.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

Realized gain is recognized by an S corporation on its distribution of ____________________ property.

Correct Answer

verified

Correct Answer

verified

Short Answer

Non-separately computed loss ____________________ a S shareholder's stock basis.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following reduces a shareholder's S corporation stock basis?

A) Depletion deductions in excess of the basis of property.

B) Illegal kickbacks paid.

C) Nontaxable income.

D) Sales income.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Short Answer

Stock basis first is increased by income items,then ____________________ by distributions,and finally decreased by ____________________.

Correct Answer

verified

Correct Answer

verified

True/False

AAA can have a negative balance.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

An S corporation that has total assets of at least $50 million on Schedule L at the end of the tax year must file a Schedule M-3.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

An S election is made on the shareholder's Form 2553.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

When loss assets are distributed by an S corporation,a shareholder's basis is equal to the asset's fair market value.

B) False

Correct Answer

verified

True

Correct Answer

verified

Essay

On December 31,Erica Sumners owns one share of an S corporation's 10 outstanding shares of stock.The basis of Erica's share is $300.The next year the S corporation incurs a loss of $3,650.Determine the amount of the loss allocated to Erica,and calculate her stock basis at the end of the second year.

Correct Answer

verified

The loss assigned to each day of the S corporation's tax year is $10 ($3,650/365 days).For each day,$1 is allocated to each outstanding share ($10/10 shares).Erica is allocated $365 of loss for her one share owned during the tax year.However,she is limited to a loss deduction of $300,i.e.,such that her stock basis reaches zero.Her stock basis is zero at the end of the year.She has a $65 loss carryforward available for deduction in subsequent years.

Correct Answer

verified

Essay

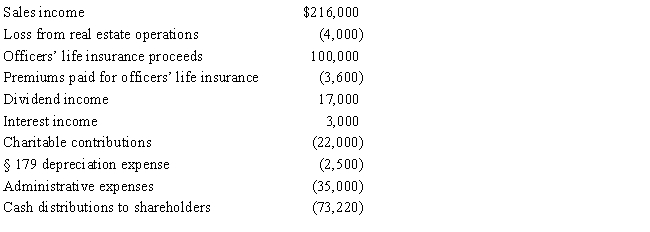

Towne,Inc.,a calendar year S corporation,holds AAA of $627,050 at the beginning of the tax year.During the year,the following items occur.

Calculate Towne's ending AAA balance.

Calculate Towne's ending AAA balance.

Correct Answer

verified

Correct Answer

verified

True/False

S corporation status allows shareholders to realize tax benefits from corporate losses immediately (assuming sufficient stock basis).

B) False

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 145

Related Exams