B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kristen's employer owns its building and provides parking space for its employees.The value of the free parking is $150 per month.Karen's employer does not have parking facilities,but reimburses its employee for the cost of parking in a nearby garage,up to $150 per month.

A) Kristen and Karen must recognize gross income from the parking services.

B) Kristen can exclude the employer provided parking from gross income, but Karen must include her reimbursement in gross income.

C) Kristen must include the value of the employer provided parking from her gross income, but Karen can exclude her reimbursement from gross income.

D) Neither Kristen nor Karen is required to include the cost of parking in gross income.

E) None of the above.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Ed died while employed by Violet Company.His wife collected $40,000 on a group term life insurance policy that Violet provided its employees,and $6,000 of accrued salary Ed had earned prior to his death.All of the premiums on the group term life insurance policy were excluded from the Ed's gross income.Ed's wife is required to recognize as gross income the $46,000 she received.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Christie sued her former employer for a back injury she suffered on the job in 2011.As a result of the injury,she was partially disabled.In 2012,she received $240,000 for her loss of future income,$160,000 in punitive damages because of the employer's flagrant disregard for the employee's safety,and $15,000 for medical expenses.The medical expenses were deducted on her 2011 return,reducing her taxable income by $12,000.Christie's 2012 gross income from the above is:

A) $415,000.

B) $412,000.

C) $255,000.

D) $175,000.

E) $172,000.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Section 119 excludes the value of meals from the employee's gross income:

A) Whenever the employee is working during the normal mealtimes.

B) When the employer pays for the meals, if the employee makes an accounting to the employer.

C) When the meals are provided for the employee, on the employer's business premises, and as a convenience to the employer.

D) When the meals are provided for the employee on the employer's business premises as a convenience to the employee.

E) None of the above.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

In December 2012,Emily,a cash basis taxpayer,received a $2,500 cash scholarship for the Spring semester of 2013.However,she did not use the funds to pay the tuition until January 2013.Emily can exclude the $2,500 from her gross income in 2012.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Benny loaned $100,000 to his controlled corporation.When it became apparent the corporation would not be able to repay the loan in the near future,Benny canceled the debt.The corporation should treat the cancellation as a nontaxable contribution to capital.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2012,Khalid was in an automobile accident and suffered physical injuries.The accident was caused by Rashad's negligence.Khalid threatened to file a lawsuit against Amber Trucking Company,Rashad's employer,claiming $50,000 for pain and suffering,$25,000 for loss of income,and $100,000 in punitive damages.Amber's insurance company will not pay punitive damages; therefore,Amber has offered to settle the case for $120,000 for pain and suffering,$25,000 for loss of income,and nothing for punitive damages.Khalid is in the 35% marginal tax bracket.What is the after-tax difference to Khalid between Khalid's original claim and Amber's offer?

A) Amber's offer is $30,000 less. (- $100,000 punitive damages + $70,000 increased pain and suffering.)

B) Amber's offer is $10,500 less. [($30,000 ´ .35) = $10,500].

C) Amber's offer is $19,500 less. [$30,000(1 - .35) = $19,500].

D) Amber's offer is $5,000 more. [$70,000 - (1 - .35) ($100,000) = $65,000].

E) None of the above.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

For a person who is in the 35% marginal tax bracket,$1,000 of tax-exempt income is equivalent to $1,350 of income that is subject to tax.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jena is a full-time undergraduate student at State University and is claimed by her parents as a dependent.Her only source of income is a $10,000 athletic scholarship ($1,000 for books,$5,500 tuition,$500 student activity fee,and $3,000 room and board) .Jena's gross income for the year is:

A) $10,000.

B) $4,000.

C) $3,000.

D) $500.

E) None of the above.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ridge is the manager of a motel.As a condition of his employment,Ridge is required to live in a room on the premises so that he would be there in case of emergencies.Ridge considered this a fringe benefit,since he would otherwise be required to pay $800 per month rent.The room that Ridge occupied normally rented for $70 per night,or $2,100 per month.On the average,90% of the motel rooms were occupied.As a result of this rent-free use of a room,Ridge is required to include in gross income.

A) $0.

B) $800 per month.

C) $2,100 per month.

D) $1,890 ($2,100 ´ .90) .

E) None of the above.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Perfection Tax Service gives employees $12.50 as "supper money" when they are required to work overtime,approximately 25 days each year.The supper money received:

A) Must be included in the employee's gross income.

B) Must be included in the employee's gross income if the employee does not spend it for supper.

C) May be excluded from the employee's gross income as a "no-additional cost" fringe benefit.

D) May be excluded from the employee's gross income as a de minimis fringe benefit.

E) None of the above.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

A cash basis taxpayer took an itemized deduction of $5,500 for state income tax paid in 2012.His total itemized deductions in 2012 were $18,000.In 2013,he received a $900 refund of his 2012 state income tax.The taxpayer must include the $900 refund in his 2013 Federal gross income in accordance with the tax benefit rule.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Melody works for a company with only 22 employees.Her employer contributed $2,000 to her health savings account (HSA),and the account earned $100 in interest during the year.Melody withdrew only $1,200 to pay medical expenses during the year.Melody is not required to recognize any gross income from the HSA for the year.

B) False

Correct Answer

verified

Correct Answer

verified

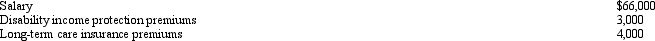

Multiple Choice

James,a cash basis taxpayer,received the following compensation and fringe benefits in 2012:  His actual salary was $72,000.He received only $66,000 because his salary was garnished and the employer paid $6,000 on James's credit card debt he owed.The wage continuation insurance is available to all employees and pays the employee three-fourths of the regular salary if the employee is sick or disabled.The long-term care insurance is available to all employees and pays $150 per day towards a nursing home or similar facility.What is James's gross income from the above?

His actual salary was $72,000.He received only $66,000 because his salary was garnished and the employer paid $6,000 on James's credit card debt he owed.The wage continuation insurance is available to all employees and pays the employee three-fourths of the regular salary if the employee is sick or disabled.The long-term care insurance is available to all employees and pays $150 per day towards a nursing home or similar facility.What is James's gross income from the above?

A) $66,000.

B) $72,000.

C) $73,000.

D) $75,000.

E) None of the above.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 101 - 115 of 115

Related Exams