A) $5,000.

B) $10,000.

C) $18,000.

D) $30,000.

E) None of the above.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 2,2011,Orange Corporation purchased equipment for $300,000 with an ADS recovery period of 10 years and a MACRS useful life of 7 years.Section 179 was not elected.MACRS depreciation properly claimed on the asset,including depreciation in the year of sale,totaled $79,605.The equipment was sold on July 1,2012,for $290,000.As a result of the sale,the adjustment to taxable income needed to arrive at current E & P is:

A) No adjustment is required.

B) Decrease $49,605.

C) Increase $49,605.

D) Decrease $79,605.

E) None of the above.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

True/False

When current E & P is positive and accumulated E & P has a deficit balance,the two accounts are netted for dividend determination purposes.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Pheasant Corporation ended its first year of operations with taxable income of $225,000.At the time of Pheasant's formation,it incurred $50,000 of organizational expenses.In calculating its taxable income for the year,Pheasant claimed an $8,000 deduction for the organizational expenses.What is Pheasant's current E & P?

A) $175,000.

B) $183,000.

C) $225,000.

D) $233,000.

E) None of the above.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

In the current year,Pink Corporation has a § 179 expense of $80,000.As a result,next year,taxable income must be decreased by $16,000 to determine current E & P.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Blue Corporation distributes property to its sole shareholder,Zeke.The property has a fair market value of $450,000,an adjusted basis of $305,000,and is subject to a liability of $250,000.Current E & P is $550,000.With respect to the distribution,Blue has a gain of:

A) $200,000 and Zeke has dividend income of $450,000.

B) $145,000 and Zeke's basis is the distributed property is $305,000.

C) $200,000 and Zeke's basis in the distributed property is $450,000.

D) $145,000 and Zeke has dividend income of $200,000.

E) None of the above.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Pursuant to a qualifying stock redemption,Redbird Corporation (E & P of $400,000) transfers land held for investment purposes to Bob,a 10% shareholder.On the date of the distribution,Redbird has a basis of $200,000 in the land and its fair market value is $150,000.Bob has a basis of $40,000 in the shares redeemed.With respect to the redemption:

A) Bob will recognize a gain of $110,000.

B) Bob will have $150,000 of dividend income.

C) Bob will have a $200,000 basis in the land.

D) Redbird Corporation will recognize a capital loss of $50,000.

E) None of the above.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During the current year,Goose Corporation sold equipment for $500,000 (adjusted basis of $260,000) .The equipment was purchased a few years ago for $560,000 and $300,000 in MACRS deductions have been claimed.ADS depreciation would have been $200,000.As a result of the sale,the adjustment to taxable income needed to determine current E & P is:

A) No adjustment is required.

B) Subtract $100,000.

C) Add $100,000.

D) Add $80,000.

E) None of the above.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Use of MACRS cost recovery when computing taxable income does not require an E & P adjustment.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

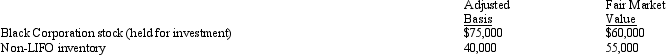

In the current year,Verdigris Corporation (with E & P of $250,000) made the following property distributions to its shareholders (all corporations) :  Verdigris Corporation is not a member of a controlled group.As a result of the distribution:

Verdigris Corporation is not a member of a controlled group.As a result of the distribution:

A) The shareholders have dividend income of $100,000.

B) The shareholders have dividend income of $130,000.

C) Verdigris has a gain of $15,000 and a loss of $15,000, both of which it must recognize.

D) Verdigris has no recognized gain or loss.

E) None of the above.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

When computing E & P,an adjustment to taxable income is necessary for any domestic production activities deduction.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

When current E & P has a deficit and accumulated E & P is positive,the two accounts are netted at the date of the distribution.If a positive balance results,the distribution is a dividend to the extent of the balance.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Sally and her mother are the sole shareholders of Owl Corporation.During the current year,Owl distributes cash in redemption of all of Sally's stock.Sally continues to be employed as controller for Owl after the redemption.The distribution is a complete termination redemption resulting in sale or exchange treatment for Sally.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Maria and Christopher each own 50% of Cockatoo Corporation,a calendar year taxpayer.Distributions from Cockatoo are: $750,000 to Maria on April 1 and $250,000 to Christopher on May 1.Cockatoo's current E & P is $300,000 and its accumulated E & P is $600,000.How much of the accumulated E & P is allocated to Christopher's distribution?

A) $0.

B) $75,000.

C) $150,000.

D) $300,000.

E) None of the above.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

When computing E & P,taxable income is not adjusted for additional first-year depreciation.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

For tax purposes,all stock redemptions are treated as dividend distributions.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The rules used to determine the taxability of stock dividends also apply to distributions of stock rights.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In June of the current year,Marigold Corporation declares a $4 dividend out of E & P on each share of common stock to shareholders of record on August 1.Ellen and Tim each purchase 100 shares of Marigold stock on July 1.On July 15,Ellen also purchases a short position in Marigold.Tim sells 50 of his shares on August 10 and continues to hold the remaining 50 shares through the end of the year.Ellen closes her short position in Marigold on October 15.With respect to the dividends,which of the following is correct?

A) Ellen will have $400 of qualifying dividends subject to reduced tax rates and $400 of ordinary income (from dividends paid on the short position of Marigold stock) .

B) Tim will have $200 of qualifying dividends subject to reduced tax rates and $200 of ordinary income.

C) All $800 of Ellen's dividends will qualify for reduced tax rates.

D) All $400 of Tim's dividends will qualify for reduced tax rates.

E) None of the above.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Distributions that are not dividends are a return of capital and decrease the shareholder's basis.Once basis is reduced to zero,any excess is taxed as a capital gain.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Nondeductible meal and entertainment expenses must be subtracted from taxable income to determine current E & P.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 137

Related Exams