A) 38.9%

B) 0%

C) 19.4%

D) 27.5%

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is NOT a diversifiable risk?

A) The risk that oil prices rise,increasing production costs

B) The risk of a product liability lawsuit

C) The risk that the CEO is killed in a plane crash

D) The risk of a key employee being hired away by a competitor

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is FALSE?

A) The standard deviation is the square root of the variance.

B) Because investors dislike only negative resolutions of uncertainty,alternative measures that focus solely on downside risk have been developed,such as the semi-variance and the expected tail loss.

C) While the variance and the standard deviation are the most common measures of risk,they do not differentiate between upside and downside risk.

D) While the variance and the standard deviation both measure the variability of the returns,the variance is easier to interpret because it is in the same units as the returns themselves.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

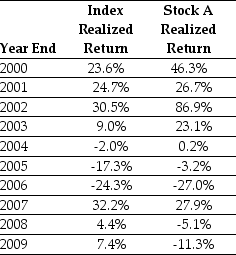

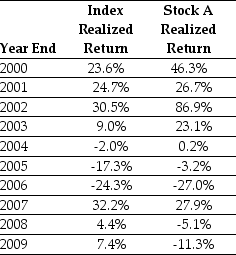

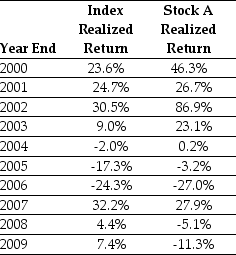

Use the table for the question(s) below.

Consider the following realized annual returns:

-The average annual return on Stock A from 2000 to 2009 is closest to:

-The average annual return on Stock A from 2000 to 2009 is closest to:

A) 29.9%

B) 16.40%

C) 18.2%

D) 18.7%

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

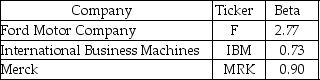

Use the following information to answer the question(s) below.

-If the risk-free rate is 5% and the expected return of investing in Merck is 11.3%,then the expected return on the market must be:

-If the risk-free rate is 5% and the expected return of investing in Merck is 11.3%,then the expected return on the market must be:

A) 8.0%

B) 10.0%

C) 10.4%

D) 12.0%

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following investments offered the lowest overall return over the past eighty years?

A) Small stocks

B) Treasury Bills

C) S&P 500

D) Corporate bonds

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

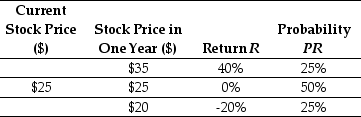

Use the table for the question(s) below.

Consider the following probability distribution of returns for Alpha Corporation:

-The variance of the return on Alpha Corporation is closest to:

-The variance of the return on Alpha Corporation is closest to:

A) 5.00%

B) 4.75%

C) 3.625%

D) 3.75%

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The risk-free rate is closest to:

A) 0%

B) 4%

C) 8%

D) 16%

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that you want to use the 10 year historical average return on the Index to forecast the expected future return on the Index.The standard error of your estimate of the expected return is closest to:

A) 19.4%

B) 3.8%

C) 6.2%

D) 1.95%

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

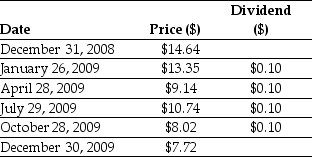

Use the table for the question(s) below.

Consider the following Price and Dividend data for General Electric Company:

-Assume that you purchased Ford Motor Company stock at the closing price on December 31,2008 and sold it at the closing price on December 30,2009.Your realized annual return for the year 2009 is closest to:

-Assume that you purchased Ford Motor Company stock at the closing price on December 31,2008 and sold it at the closing price on December 30,2009.Your realized annual return for the year 2009 is closest to:

A) -45.1%

B) -44.5%

C) -48.5%

D) -47.3%

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The standard deviation of the return on Alpha Corporation is closest to:

A) 22.4%

B) 19.0%

C) 21.8%

D) 19.4%

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the table for the question(s) below.

Consider the following realized annual returns:

-The average annual return on the Index from 2000 to 2009 is closest to:

-The average annual return on the Index from 2000 to 2009 is closest to:

A) 7.10%

B) 4.00%

C) 9.75%

D) 8.75%

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is FALSE?

A) Because diversification improves with the number of stocks held in a portfolio an efficient portfolio should be a large portfolio containing many different stocks.

B) The beta of a security is the sensitivity of the security's return to the return of the overall market.

C) An efficient portfolio cannot be diversified further,that is there is no way to reduce the risk of the portfolio without lowering its expected return.

D) We call a portfolio that contains only unsystematic risk an efficient portfolio.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is FALSE?

A) The expected return is the return that actually occurs over a particular time period.

B) If you hold the stock beyond the date of the first dividend,then to compute you return you must specify how you invest any dividends you receive in the interim.

C) The average annual return of an investment during some historical period is simply the average of the realized returns for each year.

D) The realized return is the total return we earn from dividends and capital gains,expressed as a percentage of the initial stock price.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is FALSE?

A) The Capital Asset Pricing Model is the most important method for estimating the cost of capital that is used in practice.

B) Because the risk that determines expected returns is unsystematic risk,which is measured by beta,the cost of capital for an investment is the expected return available on securities with the same beta.

C) A common assumption is that the project has the same risk as the firm.

D) To determine a project's cost of capital we need to estimate its beta.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that Luther's beta is 0.9.If the market risk premium is 8% and the risk-free interest rate is 4%,then then expected return for Luther stock is?

A) 7.6%

B) 11.6%

C) 11.2%

D) 12.9%

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the table for the question(s) below.

Consider the following realized annual returns:

-The variance of the returns on the Index from 2000 to 2009 is closest to:

-The variance of the returns on the Index from 2000 to 2009 is closest to:

A) .0450

B) .3400

C) .1935

D) .0375

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Common risk is also called:

A) diversifiable risk.

B) correlated risk.

C) uncorrelated risk.

D) independent risk.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is FALSE?

A) Fluctuations of a stock's returns that are due to firm-specific news are common risks.

B) The volatility in a large portfolio will decline until only the systematic risk remains.

C) When we combine many stocks in a large portfolio,the firm-specific risks for each stock will average out and be diversified.

D) The risk premium of a security is determined by its systematic risk and does not depend on its diversifiable risk.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is FALSE?

A) Beta measures the sensitivity of a security to market wide risk factors.

B) Volatility measures total risk,while beta measures only systematic risk.

C) The beta is the expected percentage change in the excess return of the market portfolio for a 1% change in the excess return of a security.

D) Utilities tend to be stable and highly regulated,and thus are insensitive to fluctuations in the overall market.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 103

Related Exams