A) $0.

B) $4,000.

C) $6,000.

D) ($2,000) .

E) None of the above.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

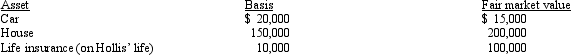

Henrietta and Hollis have been married for 10 years when Hollis dies in a sky-diving accident.Their assets are summarized below.  Henrietta and Hollis reside in Wisconsin, a community property state.All of the assets were acquired with community funds and pass to Henrietta.Her basis for each of the assets becomes:

Car House Cash from life insurance proceeds

Henrietta and Hollis reside in Wisconsin, a community property state.All of the assets were acquired with community funds and pass to Henrietta.Her basis for each of the assets becomes:

Car House Cash from life insurance proceeds

A) $20,000 $150,000 $ 10,000

B) $17,500 $175,000 $ 10,000

C) $17,500 $175,000 $100,000

D) $15,000 $200,000 $100,000

E) None of the above.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Gains and losses on nontaxable exchanges are deferred because the tax law recognizes that nontaxable exchanges result in a change in the substance but not the form of the taxpayer's relative economic position.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2008, Harold purchased a classic car that he planned to restore for $12,000.However, Harold is too busy to work on the car and he gives it to his daughter Julia in 2012.At this time, the fair market value of the car has declined to $10,000.Harold paid no gift tax on the transaction.Julia completes some of the restoration herself with out-of-pocket costs of $5,000.She later sells the car for $30,000.What is Julia's recognized gain or loss on the sale of the car?

A) $0.

B) $13,000.

C) $15,000.

D) $18,000.

E) None of the above.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sandra's automobile, which is used exclusively in her trade or business, was damaged in an accident.The adjusted basis prior to the accident was $11,000.The fair market value before the accident was $10,000 and the fair market value after the accident is $6,000.Insurance proceeds of $3,200 are received.What is Sandra's adjusted basis for the automobile after the casualty?

A) $0.

B) $7,000.

C) $7,800.

D) $10,200.

E) None of the above.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The basis of personal use property converted to business use is:

A) Always the lower of its adjusted basis or fair market value on the date of conversion.

B) Always its adjusted basis on the date of conversion.

C) Always its fair market value on the date of conversion.

D) Always the higher of its adjusted basis or fair market value on the date of conversion.

E) None of the above.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Eva exchanges a pick-up truck that she has held for personal use plus $19,000 for a new pick-up truck which she will use exclusively in her sole proprietorship business.This exchange qualifies for nontaxable exchange treatment.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A condemned office building owned and used in the business by a taxpayer can be replaced by land and qualify for nonrecognition treatment.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A taxpayer who sells his or her principal residence at a realized loss can elect to recognize the loss even if a qualified residence is acquired during the statutory time period.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A realized gain whose recognition is postponed results in the temporary recovery of more than the taxpayer's cost or other basis.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Vanessa's personal residence was condemned, and she received a condemnation award of $475,000.Vanessa had owned and occupied the residence for 15 years.The adjusted basis in the residence at the time of condemnation was $200,000.Vanessa used part of the condemnation proceeds to purchase a new residence for $210,000.What is Vanessa's recognized gain or loss and her basis in the new residence?

A) $0; $185,000.

B) $0; $210,000.

C) $15,000; $200,000.

D) $25,000; $210,000.

E) None of the above.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is incorrect for a § 1033 involuntary conversion?

A) An election can be made to postpone gain on a § 1033 involuntary conversion only if the proceeds received are reinvested in qualifying property no later than two years after the date of the involuntary conversion.

B) The postponement of realized gain in a § 1033 involuntary conversion is elective.

C) The functional use test is satisfied if a business warehouse is replaced with another business warehouse.

D) The taxpayer use test is satisfied if a shopping mall rented to tenants is replaced with an office building to be rented to tenants.

E) All of the above are correct.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The holding period for property acquired by gift is automatically long term.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kevin purchased 5,000 shares of Purple Corporation stock at $10 per share.Two years later, he receives a 5% common stock dividend.At that time, the common stock of Purple Corporation had a fair market value of $12.50 per share.What is the basis of the Purple Corporation stock, the per share basis, and gain recognized upon receipt of the common stock dividend?

A) $50,000 basis in stock, $10 basis per share for the original stock and $0 basis per share for the dividend shares, $0 recognized gain.

B) $50,000 basis in stock, $9.52 basis per share, $0 recognized gain.

C) $53,125 basis in stock, $10 basis per share for the original stock and $12.50 basis per share for the dividend shares, $3,125 recognized gain.

D) $53,125 basis in stock, $10.12 basis per share, $3,125 recognized gain.

E) None of the above.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sam's office building with an adjusted basis of $750,000 and a fair market value of $900,000 is condemned on November 30, 2012.Sam is a calendar year taxpayer.He receives a condemnation award of $875,000 on March 1, 2013.He builds a new office building at a cost of $845,000 which is completed and paid for on December 31, 2015.What is Sam's recognized gain on receipt of the condemnation award and basis for the new office building assuming his objective is to minimize gain recognition?

A) $0; $720,000.

B) $30,000; $750,000.

C) $30,000; $845,000.

D) $150,000; $750,000.

E) None of the above.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The taxpayer can elect to have the exclusion of gain under § 121 (sale of principal residence) not apply.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Shari exchanges an office building in New Orleans (adjusted basis of $700,000) for an apartment building in Baton Rouge (fair market value of $900,000).In addition, she receives $100,000 of cash.Shari's recognized gain is $100,000 and her basis for the apartment building is $800,000 ($700,000 adjusted basis + $100,000 recognized gain).

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Cassie purchases a sole proprietorship for $145,000.The fair market value of the tangible assets is $110,000 and the agreed to value of goodwill is $10,000.Assuming there are no other intangible assets, Cassie's basis for the tangible assets is $132,917 ($110,000 + $22,917) and her basis for the goodwill is $12,083 ($10,000 + $2,083).

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Realized gain or loss is measured by the difference between the amount realized from the sale or other disposition of property and the property's adjusted basis at the date of disposition.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Under the taxpayer-use test for a § 1033 involuntary conversion, the taxpayer has less flexibility in qualifying replacement property than under the functional-use test.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 200

Related Exams