B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct regarding the imposition of a tax on gasoline?

A) The incidence of the tax depends upon whether the buyers or the sellers are required to remit tax payments to the government.

B) The incidence of the tax depends upon the price elasticities of demand and supply.

C) The amount of tax revenue raised by the tax depends upon whether the buyers or the sellers are required to remit tax payments to the government.

D) The amount of tax revenue raised by the tax does not depend upon the amount of the tax per unit.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The deadweight loss from a 3 pound tax will be largest in a market with

A) inelastic supply and elastic demand.

B) inelastic supply and inelastic demand.

C) elastic supply and elastic demand.

D) elastic supply and inelastic demand.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

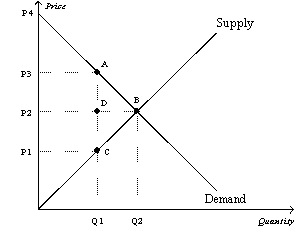

Figure 8-3

The vertical distance between points A and C represents a tax in the market.  -Refer to Figure 8-3.The price that buyers effectively pay after the tax is imposed is

-Refer to Figure 8-3.The price that buyers effectively pay after the tax is imposed is

A) P1.

B) P2.

C) P3.

D) P4.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The decrease in total surplus that results from a market distortion,such as a tax,is called a

A) wedge loss.

B) revenue loss.

C) deadweight loss.

D) consumer surplus loss.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

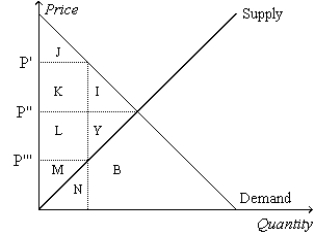

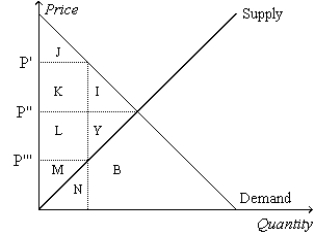

Figure 8-1  -Refer to Figure 8-1.Suppose the government imposes a tax of P' - P'''.The producer surplus before the tax is measured by the area

-Refer to Figure 8-1.Suppose the government imposes a tax of P' - P'''.The producer surplus before the tax is measured by the area

A) I+J+K.

B) I+Y.

C) L+M+Y.

D) M.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 8-10  -Refer to Figure 8-10.Suppose the government imposes a tax that reduces the quantity sold in the market after the tax to Q2.With the tax,the consumer surplus is

-Refer to Figure 8-10.Suppose the government imposes a tax that reduces the quantity sold in the market after the tax to Q2.With the tax,the consumer surplus is

A) (P0-P2) x Q2.

B) x (P0-P2) x Q2.

C) (P0-P5) x Q5.

D) x (P0-P5) x Q5.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a tax is placed on the buyers of a product,a result is that buyers effectively pay

A) less than before the tax,and sellers effectively receive less than before the tax.

B) less than before the tax,and sellers effectively receive more than before the tax.

C) more than before the tax,and sellers effectively receive less than before the tax.

D) more than before the tax,and sellers effectively receive more than before the tax.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

A tax raises the price received by sellers and lowers the price paid by buyers.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The benefit to buyers of participating in a market is measured by

A) the price elasticity of demand.

B) consumer surplus.

C) the maximum amount that buyers are willing to pay for the good.

D) the equilibrium price.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that for good X the supply curve for a good is a typical,upward-sloping straight line,and the demand curve is a typical downward-sloping straight line.If the good is taxed,and the tax is doubled,the

A) base of the triangle that represents the deadweight loss quadruples.

B) height of the triangle that represents the deadweight loss doubles.

C) deadweight loss of the tax doubles.

D) All of the above are correct.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The view held by Arthur Laffer and Ronald Reagan that cuts in tax rates would encourage people to increase the quantity of labor they supplied became known as

A) California economics.

B) welfare economics.

C) supply-side economics.

D) elasticity economics.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 8-10  -Refer to Figure 8-10.Suppose the government imposes a tax that reduces the quantity sold in the market after the tax to Q2.The size of the tax is

-Refer to Figure 8-10.Suppose the government imposes a tax that reduces the quantity sold in the market after the tax to Q2.The size of the tax is

A) P0-P2.

B) P2-P8.

C) P2-P5.

D) P5-P8.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Essay

Using demand and supply diagrams,show the difference in deadweight loss between (a)a market with inelastic demand and supply and (b)a market with elastic demand and supply.

Correct Answer

verified

11ea7a3f_c07e_6aa6_81a2_c526f4b6bea0_TB4793_00

Correct Answer

verified

Multiple Choice

Figure 8-1  -Refer to Figure 8-1.Suppose the government imposes a tax of P' - P'''.The tax revenue is measured by the area

-Refer to Figure 8-1.Suppose the government imposes a tax of P' - P'''.The tax revenue is measured by the area

A) K+L.

B) I+Y.

C) J+K+L+M.

D) I+J+K+L+M+Y.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

When a tax is imposed on sellers,consumer surplus and producer surplus both decrease.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The higher a country's tax rates,the more likely that country will be

A) at the top of the Laffer curve.

B) on the positively sloped part of the Laffer curve.

C) on the negatively sloped part of the Laffer curve.

D) experiencing small deadweight losses.

F) A) and D)

Correct Answer

verified

C

Correct Answer

verified

Essay

John has been in the habit of mowing Carl's lawn each week for 20 dinar.John's opportunity cost is 15 dinar,and Carl would be willing to pay 25 dinar to have his lawn mowed.What is the maximum tax the government can impose on lawn mowing without discouraging John and Carl from continuing their mutually beneficial arrangement?

Correct Answer

verified

If the tax is less than 10 dinar,there will exist a price at which both John and Carl will still benefit from the lawn-mowing arrangement.If the tax is 10 dinar,a price can be set which will leave John and Carl neither better off nor worse off from the lawn-mowing arrangement.If the tax is greater than 10 dinar,all possible prices will leave at least one of the parties worse off from the lawn-mowing arrangement.

Correct Answer

verified

True/False

Economists disagree on whether labor taxes have a small or large deadweight loss.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

When a tax is imposed on buyers,consumer surplus and producer surplus both decrease.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 69

Related Exams