A) This reduces risk's standard deviation and firm-specific risk.

B) This reduces risk's standard deviation and market risk.

C) This raises market risk,but lowers firm-specific risk.What happens to overall risk is unclear.

D) This raises firm-specific risk,but lowers market risk.What happens to overall risk is unclear.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the future value of $450 at an interest rate of 9 percent two years from today?

A) $534.65

B) $546.35

C) $565.18

D) $574.13

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Two years ago Lenny put some money into an account.He earned 6 percent interest on this account and now he has about $1,000.About how much did Lenny deposit into his account two years ago?

A) about $860

B) about $870

C) about $880

D) about $890

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following best illustrates diversification?

A) A company that produces many different products decides to produce fewer.

B) After selling stock,corporate management spends funds on projects with greater risks than shareholders had anticipated.

C) Instead of holding only the stocks of companies engaged in the banking business,a person decides to hold stock in a number of different companies producing different goods and services.

D) A person decides to purchase only stocks that have paid high dividends in the past.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Imagine that someone offers you $100 today or $200 in 10 years.You would prefer to take the $100 today if the interest rate is

A) 4 percent.

B) 6 percent.

C) 8 percent.

D) All of the above are correct.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Available evidence indicates that stock prices,even if not exactly a random walk,are very close to a random walk.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The rule of 70 applies to a growing savings account but not to a growing economy.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At which interest rate is the present value of $185.71 three years from today equal to $175 today?

A) 2 percent

B) 4 percent

C) 6 percent

D) 8 percent

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Greg's Tasty Ice Cream is considering building a new ice cream factory that costs $8.3 million.The company accountants believe that,not accounting for interest costs,building the factory will increase profits by $5 million the first year,$4 million the second year and have no value thereafter.Greg's Tasty Ice Cream should build the factory if the interest rate is

A) 3% but not if it is 4%.

B) 4% but not if it is 5%.

C) 5% but not if it is 6%.

D) 6% but not if it is 7%.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following methods of picking stocks is not consistent with fundamental analysis?

A) doing research such as thoroughly reading and analyzing companies' annual reports

B) choosing mutual funds that are managed by individuals with good reputations

C) viewing individual stock prices as unpredictable

D) relying upon the advice of Wall Street analysts

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not correct?

A) There is a greater reduction in risk by increasing the number of stocks in a portfolio from 1 to 10,than by increasing it from 100 to 120 stocks.

B) The historical rate of return on stocks has been about 5 percentage points higher than the historical rate of return on bonds.

C) Stock in an industry that is very sensitive to economic conditions is likely to have a higher average return than stock in an industry that is not so sensitive to economic conditions.

D) If you had information about a corporation that no one else had,you could earn a very high rate of return.This contradicts the efficient market hypothesis.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the present value of a payment of $150 one year from today if the interest rate is 6 percent?

A) $141.11

B) $141.36

C) $141.75

D) None of the above are correct to the nearest cent.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

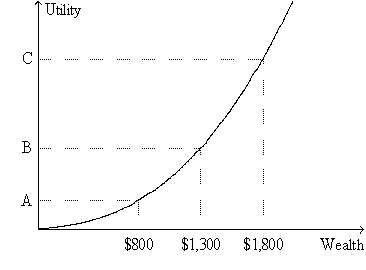

Figure 19-4.The figure shows a utility function for Dexter.  -Refer to Figure 19-4.From the appearance of the utility function,we know that

-Refer to Figure 19-4.From the appearance of the utility function,we know that

A) Dexter is risk averse.

B) Dexter gains more satisfaction when his wealth increases by X dollars than he loses in satisfaction when his wealth decreases by X dollars.

C) the property of decreasing marginal utility applies to Dexter.

D) All of the above are correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the interest rate is 7 percent.Consider four payment options: Option A: $500 today. Option B: $550 one year from today. Option C: $575 two years from today. Option D: $600 three years from today. Which of the payments has the highest present value today?

A) Option A

B) Option B

C) Option C

D) Option D

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are tearing down a building and find $1 in change that someone lost when working on the building 140 years ago.If,instead of being careless with the $1 in change,this person had deposited it into a bank and earned 2 percent interest every year for 140 years,how much would be in the account today according to the rule of 70?

A) $4

B) $8

C) $16

D) $32

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You have been promised a payment of $250,000 in the future.In which case is the present value of this payment highest?

A) You receive the payment 3 years from now and the interest rate is 8 percent.

B) You receive the payment 3 years from now and the interest rate is 6 percent.

C) You receive the payment 2 years from now and the interest rate is 8 percent.

D) You receive the payment 2 years from now and the interest rate is 6 percent.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The efficient markets hypothesis says that beating the market consistently is

A) impossible.Many studies find that beating the market is,at best,extremely difficult.

B) impossible.Many studies find that beating the market is relatively easy.

C) relatively easy.Many studies find that beating the market is,at best,extremely difficult.

D) relatively easy.Many studies find that beating the market is relatively easy.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the rule of 70,if the interest rate is 10 percent,about how long will it take for the value of a savings account to double?

A) about 6.3 years

B) about 7 years

C) about 7.7 years

D) about 10 years

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In general,as a person includes fewer stocks and more bonds in his portfolio,

A) both risk and expected return rise.

B) risk rises but expected return falls.

C) risk falls,but expected return rises.

D) both risk and expected return fall.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

George puts $200 into an account when the interest rate is 8 percent.Later he checks his balance and finds that he has a balance of about $272.10.How many years did he wait to check his balance?

A) 3 years

B) 3.5 years

C) 4 years

D) 4.5 years

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 261 - 280 of 421

Related Exams