A) A tax levied on buyers will never be partially paid by sellers.

B) Who actually pays a tax depends on the price elasticities of supply and demand.

C) Government can decide who actually pays a tax.

D) A tax levied on sellers always will be passed on completely to buyers.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a free,competitive market,what is the rationing mechanism?

A) seller bias

B) buyer bias

C) government law

D) price

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a binding price ceiling is imposed on a market to benefit buyers,

A) no buyers actually benefit.

B) some buyers benefit,but no buyers are harmed.

C) some buyers benefit,and some buyers are harmed.

D) all buyers benefit.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is correct? A tax burden

A) falls more heavily on the side of the market that is more elastic.

B) falls more heavily on the side of the market that is less elastic.

C) falls more heavily on the side of the market that is closest to unit elastic.

D) is distributed independently of the relative elasticities of supply and demand.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

A price ceiling set below the equilibrium price causes quantity demanded to exceed quantity supplied.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under rent control,bribery is a mechanism to

A) bring the total price of an apartment (including the bribe) closer to the equilibrium price.

B) allocate housing to the poorest individuals in the market.

C) force the total price of an apartment (including the bribe) to be less than the market price.

D) allocate housing to the most deserving tenants.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Since half of the FICA tax is paid by firms and the other half is paid by workers,the burden of the tax must fall equally on firms and workers.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be the least likely result of a binding price ceiling imposed on the market for rental cars?

A) an accumulation of dirt in the interior of rental cars

B) poor engine maintenance in rental cars

C) free gasoline given to people as an incentive to a rent a car

D) slow replacement of old rental cars with newer ones

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

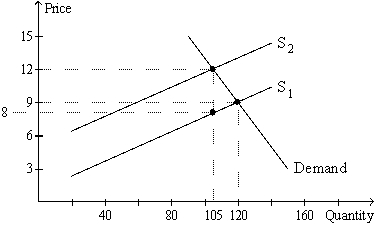

Figure 6-17  -Refer to Figure 6-17.What is the amount of the tax per unit?

-Refer to Figure 6-17.What is the amount of the tax per unit?

A) $1

B) $2

C) $3

D) $4

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

To say that a price ceiling is binding is to say that the price ceiling

A) results in a surplus.

B) is set above the equilibrium price.

C) causes quantity demanded to exceed quantity supplied.

D) All of the above are correct.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume the demand for cigarettes is relatively inelastic,and the supply of cigarettes is relatively elastic.When cigarettes are taxed,we would expect

A) most of the burden of the tax to fall on sellers of cigarettes,regardless of whether buyers or sellers of cigarettes are required to pay the tax to the government.

B) most of the burden of the tax to fall on buyers of cigarettes,regardless of whether buyers or sellers of cigarettes are required to pay the tax to the government.

C) the distribution of the tax burden between buyers and sellers of cigarettes to depend on whether buyers or sellers of cigarettes are required to pay the tax to the government.

D) a large percentage of smokers to quit smoking in response to the tax.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

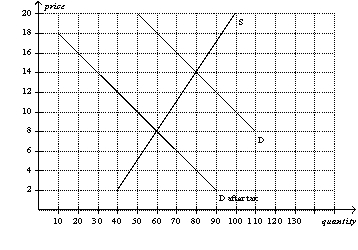

Figure 6-23  -Refer to Figure 6-23.The price paid by buyers after the tax is imposed is

-Refer to Figure 6-23.The price paid by buyers after the tax is imposed is

A) $8.

B) $10.

C) $14.

D) $18.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The goal of rent control is to help the poor by making housing more affordable.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Minimum-wage laws dictate the

A) average price employers must pay for labor.

B) highest price employers may pay for labor.

C) lowest price employers may pay for labor.

D) the highest and lowest prices employers may pay for labor.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

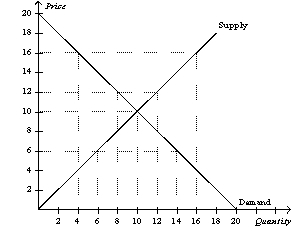

Figure 6-4  -Refer to Figure 6-4.A government-imposed price of $6 in this market is an example of a

-Refer to Figure 6-4.A government-imposed price of $6 in this market is an example of a

A) binding price ceiling that creates a shortage.

B) non-binding price ceiling that creates a shortage.

C) binding price floor that creates a surplus.

D) non-binding price floor that creates a surplus.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Minimum-wage laws dictate the lowest wage that firms may pay workers.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the government removes a $1 tax on sellers of gasoline and imposes the same $1 tax on buyers of gasoline,then the price paid by buyers will

A) increase,and the price received by sellers will increase.

B) increase,and the price received by sellers will not change.

C) not change,and the price received by sellers will increase.

D) not change,and the price received by sellers will not change.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A surplus results when a

A) nonbinding price floor is imposed on a market.

B) nonbinding price floor is removed from a market.

C) binding price floor is imposed on a market.

D) binding price floor is removed from a market.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 6-4  -Refer to Figure 6-4.A government-imposed price of $16 in this market could be an example of a (i) binding price ceiling.

(ii) non-binding price ceiling.

(iii) binding price floor.

(iv)

Non-binding price floor.

-Refer to Figure 6-4.A government-imposed price of $16 in this market could be an example of a (i) binding price ceiling.

(ii) non-binding price ceiling.

(iii) binding price floor.

(iv)

Non-binding price floor.

A) (i) only

B) (ii) only

C) (i) and (iv) only

D) (ii) and (iii) only

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

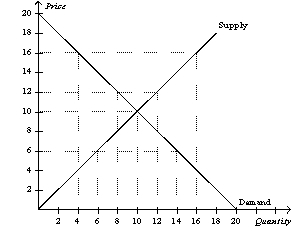

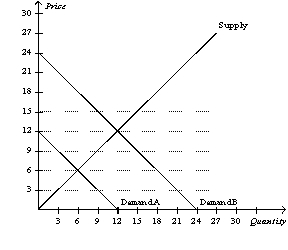

Figure 6-11  -Refer to Figure 6-11.Which of the following statements is not correct?

-Refer to Figure 6-11.Which of the following statements is not correct?

A) A government-imposed price of $9 would be a binding price floor if market demand is Demand A and a binding price ceiling if market demand is Demand B.

B) A government-imposed price of $15 would be a binding price ceiling if market demand is either Demand A or Demand B.

C) A government-imposed price of $3 would be a binding price ceiling if market demand is either Demand A or Demand B.

D) A government-imposed price of $12 would be a binding price floor if market demand is Demand A and a non-binding price ceiling if market demand is Demand B.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 301 - 320 of 553

Related Exams