A) $7,500

B) $52,500

C) $62,500

D) $77,500

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Short Answer

Who said "The inherent vice of capitalism is the unequal sharing of blessings. The inherent virtue of socialism is the equal sharing of miseries"?

Correct Answer

verified

Correct Answer

verified

Short Answer

What is the term for a measure of happiness or satisfaction a person receives from his or her circumstances?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A society consists of three individuals: Larry, Margaret, and Nina. In terms of income and utility, Larry is currently best-off, Margaret ranks in the middle, and Nina is worst-off. Which of the following statements is correct?

A) Utilitarianism suggests that government policies should strive to maximize the sum of all three individuals' utility.

B) Liberalism suggests that government policies should strive to maximize the sum of Larry's utility and Nina's utility.

C) Libertarianism suggests that government policies should strive to make Nina better off at the cost of Larry and Margaret.

D) Utilitarianism suggests that the government policies should strive to make Nina better off than Margaret.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which political philosophy focuses on the process of determining the distribution of income rather than on the outcome?

A) utilitarianism

B) liberalism

C) libertarianism

D) welfarism

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Economists study poverty and income inequality to answer which of the following questions?

A) What are people's wages?

B) How does labor-force experience affect wages?

C) How much inequality is there in society?

D) How do people adjust their behavior due to taxation?

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A disadvantage associated with in-kind transfers to reduce poverty is that they

A) alter peoples' incentives, whereas a negative income tax does not alter peoples' incentives.

B) do not allow poor families to make purchases based on their preferences.

C) can only be distributed by the federal government.

D) cannot restrict the group of recipients and some middle-class families may benefit from them.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

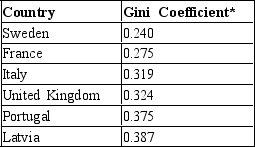

Table 20-10

*A Gini coefficient is a commonly used measure of income inequality, with values between 0 and 1 (0 corresponds to perfect equality whereby everyone has exactly the same income, and 1 corresponds to perfect inequality where one person has all the income, while everyone else has zero income) .

Source: The World Bank

-Refer to Table 20-10. Which country has the most unequal income distribution?

*A Gini coefficient is a commonly used measure of income inequality, with values between 0 and 1 (0 corresponds to perfect equality whereby everyone has exactly the same income, and 1 corresponds to perfect inequality where one person has all the income, while everyone else has zero income) .

Source: The World Bank

-Refer to Table 20-10. Which country has the most unequal income distribution?

A) Latvia

B) Italy

C) France

D) Sweden

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In-kind transfers

A) are cash payments given to the poor from the government.

B) are available to citizens of all income levels, but usually only sought by the poor.

C) are non-monetary items given to the poor.

D) include food stamps, but not housing vouchers or medical services.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Short Answer

Which philosopher claimed that the government should aim to maximize the well-being of the worst-off person in society?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2011, the poverty line for a family of four in the U.S. was

A) $60,974.

B) $23,021.

C) $20,988.

D) $17,642.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Anti-poverty programs

A) encourage saving among recipient groups.

B) impose a very low marginal tax rate on income.

C) are only made available to those with no other source of income.

D) may discourage the poor from escaping poverty on their own.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following lists correctly ranks countries from most equal to least equal distribution of income?

A) Nigeria, India, Mexico, Germany

B) Brazil, United States, India, Japan

C) United States, Ethiopia, Japan, South Africa

D) Japan, India, United States, Brazil

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The percentage of families with incomes below the poverty line

A) is defined as the 10 percent of U.S.households with the lowest incomes.

B) is known as the poverty rate.

C) is known as the unemployment rate.

D) rises as the general income level rises.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

U.S. income data over the last 75 years suggests that the distribution of income

A) has gradually become more equal over the entire time period.

B) has gradually become less equal over the entire time period.

C) gradually became less equal until about 1970, then became more equal from 1970 to 2011.

D) gradually became more equal until about 1970, then became less equal from 1970 to 2011.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the government used the following formula to compute a family's tax liability: Taxes owed = 28% of income - $8,000. How much would a family that earned $20,000 owe?

A) -$8,000

B) -$2,400

C) $0

D) $2,400

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Pietro is 40 years old and is laid off from his job at the paper plant and borrows from his savings for 8 months until he finds a new job. Pietro's

A) transitory income likely exceeds his permanent income for that year.

B) borrowing is representative of a normal economic life cycle.

C) permanent income is largely unaffected by this one time change to his income.

D) economic mobility during this year is highly unusual, as US workers tend to stay in a particular income class.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the value of in-kind transfers are taken into account, the number of families living in poverty in the United States would

A) increase by about 1 percent.

B) decrease by about 1 percent.

C) decrease by about 5 percent.

D) decrease by about 10 percent.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

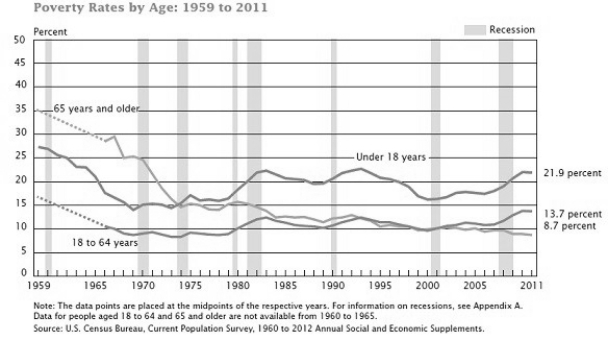

Multiple Choice

Figure 20-3  -Refer to Figure 20-3. In 2011, the percent of adults between ages 18 and 64 in poverty is

-Refer to Figure 20-3. In 2011, the percent of adults between ages 18 and 64 in poverty is

A) higher than both the percentage of children under age 18 and the percentage of elderly aged 65 and over in poverty.

B) higher than the percentage of children under age 18 but is lower than the percentage of elderly aged 65 and over in poverty.

C) is lower than the percentage of children under age 18 but is higher than the percentage of elderly aged 65 and over in poverty.

D) is lower than the percentage of children under age 18 and is equal to the percentage of elderly aged 65 and over in poverty.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Income mobility studies suggest that poverty

A) cannot be alleviated by privately sponsored anti-poverty programs.

B) cannot be alleviated by government sponsored anti-poverty programs.

C) is a long-term problem for a relatively large number of families.

D) is not a long-term problem for most families.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 457

Related Exams