Correct Answer

verified

Correct Answer

verified

Multiple Choice

A family's ability to buy goods and services depends largely on its

A) permanent income, which is its normal, or average, income.

B) permanent income, which is the lowest annual income the family has received over a 10-year period.

C) transitory income, which is the measure of income used by the government to analyze the distribution of income and the poverty rate.

D) transitory income, which is its money income plus any in-kind transfers it receives.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A common criticism of welfare programs is that they

A) create self-reliant individuals.

B) encourage strong family values.

C) encourage illegitimate births.

D) have increasing benefits over time, in real terms.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The marketplace allocates resources

A) fairly.

B) efficiently.

C) to those desiring them least.

D) both efficiently and equitably.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Diminishing marginal utility suggests that

A) more is always preferred to less.

B) the well-being of society is maximized when the distribution of income is equal.

C) the poor are less efficient at spending money than the rich.

D) the poor receive more satisfaction from the last dollar spent than the rich.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the U.S. government determines that the cost of feeding an urban family of four is $7,500 per year, then the official poverty line for a family of that type is

A) $7,500.

B) $15,000.

C) $22,500.

D) $30,000.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Raising total utility is the prime objective of which political philosophy?

A) utilitarianism

B) liberalism

C) libertarianism

D) None of the above is correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Even though the average income in the United States has continued to grow, the poverty rate has increased to over 20% since the early 1970s.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

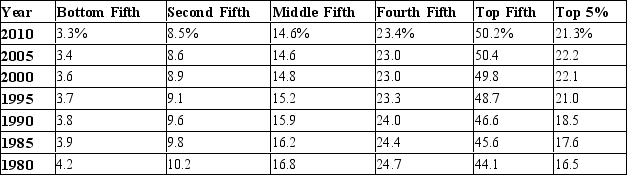

Table 20-14

Income Inequality in the United States

The values in the table reflect the percentages of pre-tax-and transfer income.

Source: US Census Bureau

-Refer to Table 20-14. In 2010, what percentage of total income in the US did the bottom 20% of families have?

Source: US Census Bureau

-Refer to Table 20-14. In 2010, what percentage of total income in the US did the bottom 20% of families have?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which group (or groups) would be the most upset by wide variation in the income distribution?

A) utilitarians

B) utilitarians and liberals

C) libertarians

D) liberals and libertarians

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A disadvantage associated with an Earned Income Tax Credit (EITC) program to reduce poverty is that it

A) encourages illegitimate births because single women with children receive higher payments.

B) rewards laziness because it provides payments to those with low incomes regardless of their work effort.

C) does not help the poor who are unemployed.

D) creates unemployment by increasing the wage paid to unskilled workers above the equilibrium wage.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

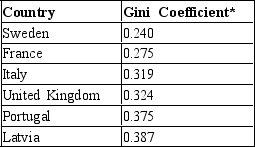

Table 20-10

*A Gini coefficient is a commonly used measure of income inequality, with values between 0 and 1 (0 corresponds to perfect equality whereby everyone has exactly the same income, and 1 corresponds to perfect inequality where one person has all the income, while everyone else has zero income) .

Source: The World Bank

-Refer to Table 20-10. Which country has the most equal income distribution?

*A Gini coefficient is a commonly used measure of income inequality, with values between 0 and 1 (0 corresponds to perfect equality whereby everyone has exactly the same income, and 1 corresponds to perfect inequality where one person has all the income, while everyone else has zero income) .

Source: The World Bank

-Refer to Table 20-10. Which country has the most equal income distribution?

A) Latvia

B) Italy

C) France

D) Sweden

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 20-4 Suppose the government implemented a negative income tax and used the following formula to compute a family's tax liability: Taxes owed = (1/5 of income) - $15,000 -Refer to Scenario 20-4. Below what level of income would families start to receive a subsidy from this negative income tax?

A) $5,000

B) $15,000

C) $50,000

D) $75,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the government redistributes income to achieve greater equality, it

A) distorts incentives.

B) improves efficiency.

C) focuses on middle income brackets.

D) relies on foreign aid to help balance the budget.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Libertarianism identifies a redistribution of income role for government when

A) the utility of the worst-off could be improved.

B) the income distribution is altered by illegal means (e.g. theft) .

C) the total utility for society can be improved through redistribution of income.

D) a "veil of ignorance" would result in a recommendation of redistribution of income.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to utilitarians, the ultimate objective of public actions should be to

A) ensure the poor can afford an adequate diet.

B) distribute income uniformly.

C) maximize the sum of individual utility.

D) prevent all people from experiencing diminishing marginal utility.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) A disadvantage of a minimum-wage law is that it may benefit unskilled workers who are not low-income workers.

B) A disadvantage of a negative income tax program is that a poor person who chooses not to work many hours would receive a cash benefit.

C) A disadvantage of an Earned Income Tax Credit (EITC) is that a person who is unable to work due to a disability does not benefit from the program.

D) All of the above are correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Utilitarians believe

A) that the government should choose just policies as evaluated by an impartial observer behind a "veil of ignorance."

B) in the assumption of diminishing marginal utility.

C) that everyone in society should have equal utility.

D) that the government should not redistribute income.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The distribution of income for Danville is as follows: Number of Families Income

500 less than $15,000

600 between $15,000 and $20,000

1,000 between $20,000 and $25,000

700 between $25,000 and $30,000

500 over $30,000

500 less than $15,000

600 between $15,000 and $20,000

1,000 between $20,000 and $25,000

700 between $25,000 and $30,000

500 over $30,000

If the poverty rate in Danville is 33.3 percent, what is the poverty line in Danville?

If the poverty rate in Danville is 33.3 percent, what is the poverty line in Danville?

A) $15,000.

B) $20,000.

C) $25,000.

D) $30,000.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Table 20-11

Poverty Thresholds in 2011, by Size of Family and Number of Related Children Under 18 Years [Dollars]

![Table 20-11 Poverty Thresholds in 2011, by Size of Family and Number of Related Children Under 18 Years [Dollars] -Refer to Table 20-11. What is the poverty line for a 75-year-old individual? A) $10,788 B) $11,702 C) $13,596 D) $15,446](https://d2lvgg3v3hfg70.cloudfront.net/TB2186/11ea6dab_72b2_639b_9009_93fd430aa189_TB2186_00_TB2186_00_TB2186_00_TB2186_00_TB2186_00_TB2186_00.jpg) -Refer to Table 20-11. What is the poverty line for a 75-year-old individual?

-Refer to Table 20-11. What is the poverty line for a 75-year-old individual?

A) $10,788

B) $11,702

C) $13,596

D) $15,446

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 361 - 380 of 457

Related Exams