A) always help those they are designed to help.

B) never help those they are designed to help.

C) often hurt those they are designed to help.

D) always hurt those they are designed to help.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a result of rent control?

A) fewer new apartments offered for rent

B) less maintenance provided by landlords

C) bribery

D) higher quality housing

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The price paid by buyers in a market will decrease if the government

A) imposes a binding price floor in that market.

B) increases a binding price ceiling in that market.

C) increases a tax on the good sold in that market.

D) decreases a binding price floor in that market.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 6-9  -Refer to Figure 6-9. At which price would a price floor be nonbinding?

-Refer to Figure 6-9. At which price would a price floor be nonbinding?

A) $8

B) $7

C) $6

D) $9

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As rationing mechanisms, prices

A) and long lines are efficient.

B) are efficient, but long lines are inefficient.

C) are inefficient, but long lines are efficient.

D) and long lines are inefficient.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

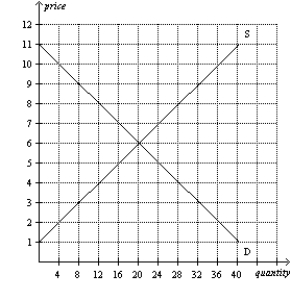

Figure 6-7  -Refer to Figure 6-7. Which of the following price controls would cause a shortage of 20 units of the good?

-Refer to Figure 6-7. Which of the following price controls would cause a shortage of 20 units of the good?

A) a price ceiling set at $6

B) a price ceiling set at $5

C) a price floor set at $9

D) a price floor set at $8

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the government imposes a 50-cent tax on the sellers of packets of chewing gum. The tax would

A) shift the supply curve upward by less than 50 cents.

B) raise the equilibrium price by 50 cents.

C) create a 50-cent tax burden each for buyers and sellers.

D) discourage market activity.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose there is currently a tax of $50 per ticket on airline tickets. Buyers of airline tickets are required to pay the tax to the government. If the tax is reduced from $50 per ticket to $30 per ticket, then the

A) demand curve will shift upward by $20, and the effective price received by sellers will increase by $20.

B) demand curve will shift upward by $20, and the effective price received by sellers will increase by less than $20.

C) supply curve will shift downward by $20, and the price paid by buyers will decrease by $20.

D) supply curve will shift downward by $20, and the price paid by buyers will decrease by less than $20.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a competitive market free of government regulation,

A) price adjusts until quantity demanded is greater than quantity supplied.

B) price adjusts until quantity demanded is less than quantity supplied.

C) price adjusts until quantity demanded equals quantity supplied.

D) supply adjusts to meet demand at every price.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A $0.10 tax levied on the sellers of chocolate bars will cause the

A) supply curve for chocolate bars to shift down by $0.10.

B) supply curve for chocolate bars to shift up by $0.10.

C) demand curve for chocolate bars to shift down by $0.10.

D) demand curve for chocolate bars to shift up by $0.10.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following causes the price paid by buyers to be different than the price received by sellers?

A) a binding price floor

B) a binding price ceiling

C) a tax on the good

D) All of the above are correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

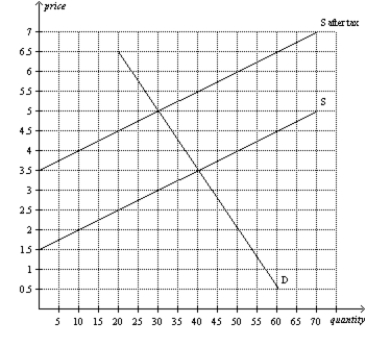

Figure 6-22  -Refer to Figure 6-22. Buyers pay how much of the tax per unit?

-Refer to Figure 6-22. Buyers pay how much of the tax per unit?

A) $0.50.

B) $1.50.

C) $3.00.

D) $5.00.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When policymakers set prices by legal decree, they

A) are usually following the advice of mainstream economists.

B) improve the organization of economic activity.

C) obscure the signals that normally guide the allocation of society's resources.

D) are demonstrating a willingness to sacrifice fairness for the sake of a gain in efficiency.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Studies by economists have found that a 10 percent increase in the minimum wage decreases teenage employment 10 percent.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose there is currently a tax of $50 per ticket on airline tickets. Sellers of airline tickets are required to pay the tax to the government. If the tax is reduced from $50 per ticket to $30 per ticket, then the

A) demand curve will shift upward by $20, and the price paid by buyers will decrease by less than $20.

B) demand curve will shift upward by $20, and the price paid by buyers will decrease by $20.

C) supply curve will shift downward by $20, and the effective price received by sellers will increase by less than $20.

D) supply curve will shift downward by $20, and the effective price received by sellers will increase by $20.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

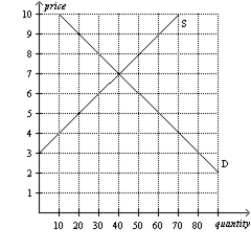

Multiple Choice

Figure 6-8  -Refer to Figure 6-8. When a certain price control is imposed on this market, the resulting quantity of the good that is actually bought and sold is such that buyers are willing and able to pay a maximum of P1 dollars per unit for that quantity and sellers are willing and able to accept a minimum of P2 dollars per unit for that quantity. If P1 - P2 = $3, then the price control is

-Refer to Figure 6-8. When a certain price control is imposed on this market, the resulting quantity of the good that is actually bought and sold is such that buyers are willing and able to pay a maximum of P1 dollars per unit for that quantity and sellers are willing and able to accept a minimum of P2 dollars per unit for that quantity. If P1 - P2 = $3, then the price control is

A) a price ceiling of $2.00.

B) a price ceiling of $5.00.

C) a price floor of $5.00.

D) either a price ceiling of $2.00 or a price floor of $5.00.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose sellers of perfume are required to send $1.00 to the government for every bottle of perfume they sell. Further, suppose this tax causes the price paid by buyers of perfume to rise by $0.60 per bottle. Which of the following statements is correct?

A) The effective price received by sellers is $0.40 per bottle less than it was before the tax.

B) Sixty percent of the burden of the tax falls on sellers.

C) This tax causes the demand curve for perfume to shift downward by $1.00 at each quantity of perfume.

D) All of the above are correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

A tax on buyers decreases demand.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is correct?

A) Rent control and the minimum wage are both examples of price ceilings.

B) Rent control is an example of a price ceiling, and the minimum wage is an example of a price floor.

C) Rent control is an example of a price floor, and the minimum wage is an example of a price ceiling.

D) Rent control and the minimum wage are both examples of price floors.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

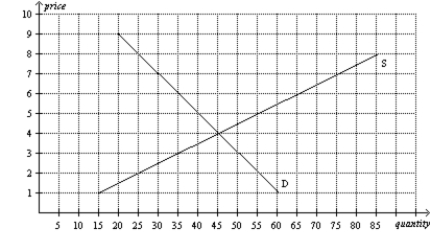

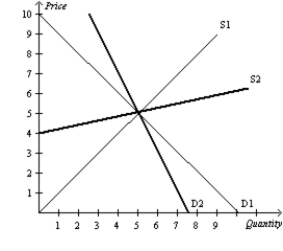

Figure 6-29

Suppose the government imposes a $2 on this market.  -Refer to Figure 6-29. Suppose D1 represents the demand curve for gasoline in both the short run and long run, S1 represents the supply curve for gasoline in the short run, and S2 represents the supply curve for gasoline in the long run. After the imposition of the $2,

-Refer to Figure 6-29. Suppose D1 represents the demand curve for gasoline in both the short run and long run, S1 represents the supply curve for gasoline in the short run, and S2 represents the supply curve for gasoline in the long run. After the imposition of the $2,

A) buyers bear a higher burden of the tax in the short run than in the long run.

B) sellers bear a higher burden of the tax in the short run than in the long run.

C) buyers and sellers bear an equal burden of the tax in both the short run and long run.

D) buyers and sellers bear an equal burden of the tax in the short run, but buyers bear a higher burden of the tax in the long run.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 644

Related Exams