A) 16.4%

B) 19.6%

C) 21.3%

D) 27%

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Social Security is an income support program,designed primarily to maintain the living standards of the poor.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Corporate profits distributed as dividends are

A) tax free.

B) taxed once.

C) taxed twice.

D) taxed three times.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Economist Alan Greenspan discussed the advantages of which kind of tax system,"particularly if one were designing a tax system from scratch"?

A) A progressive tax system

B) A regressive tax system

C) A consumption tax

D) A lump-sum tax

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The U.S.income tax

A) discourages saving.

B) encourages saving.

C) has no effect on saving.

D) will reduce the administrative burden of taxation.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

High marginal income tax rates

A) distort incentives to work.

B) are used to encourage saving behavior.

C) will invariably lead to lower average tax rates.

D) are not associated with deadweight losses.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Approximately what percentage of the U.S.federal government's receipts come from individual income taxes?

A) 8%

B) 15%

C) 45%

D) 67%

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that the government taxes income in the following fashion: 20 percent of the first $50,000,40 percent of the next $50,000,and 60 percent of all income over $100,000.John earns $200,000,and Theresa earns $600,000.Which of the following statements is correct?

A) John's marginal tax rate is higher than Theresa's marginal tax rate.

B) John's average tax rate is higher than his marginal tax rate.

C) Theresa's average tax rate is higher than her marginal tax rate.

D) Theresa's average tax rate is higher than John's average tax rate.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are trying to design a tax system that will simultaneously achieve both of the following goals: 1) two people with the same total income would pay taxes of the same amount,and 2) a high-income person would pay a higher fraction of income in taxes than a low-income person.Which of the following tax systems could achieve both goals?

A) A lump-sum tax

B) A regressive tax

C) A progressive tax

D) A proportional tax

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

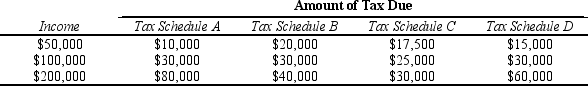

Table 12-14

The following table presents the total tax liability for an unmarried taxpayer under four different tax schedules for the income levels shown.

-Refer to Table 12-14.Which tax schedules are proportional?

-Refer to Table 12-14.Which tax schedules are proportional?

A) Tax Schedule B only

B) Tax Schedule B and Tax Schedule C

C) Tax Schedule D only

D) Tax Schedule A and Tax Schedule B

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

One characteristic of an efficient tax system is that it minimizes the costs associated with revenue collection.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Antipoverty programs funded by taxes on the wealthy are sometimes advocated on the basis of the benefits principle.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

An efficient tax system is one that imposes small deadweight losses and small administrative burdens.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

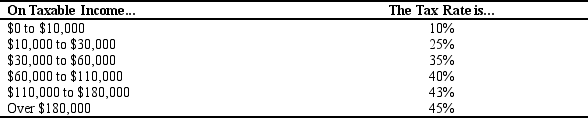

Table 12-9

The table below shows the marginal tax rates for an unmarried taxpayer for various levels of taxable income.

-Refer to Table 12-9.For this tax schedule,what is the marginal tax rate for an individual with taxable income of $49,000?

-Refer to Table 12-9.For this tax schedule,what is the marginal tax rate for an individual with taxable income of $49,000?

A) 0%

B) 10%

C) 25%

D) 35%

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When taxes are imposed on a commodity,

A) there is never a deadweight loss.

B) some consumers alter their consumption by not purchasing the taxed commodity.

C) tax revenue will rise by the amount of the tax multiplied by the before-tax level of consumption.

D) the taxes do not distort incentives.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The deadweight loss of a tax is

A) the reduction in economic welfare of taxpayers that exceeds the revenue raised by the government.

B) the improved efficiency created as people reallocate resources according to the tax incentive rather than the true costs and benefits.

C) the loss in tax revenues.

D) Both a and b are correct.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

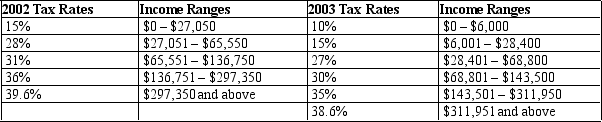

Table 12-12

United States Income Tax Rates for a Single Individual,2002 and 2003.

-Refer to Table 12-12.Charles is a single person whose taxable income is $35,000 a year.What is his marginal tax rate in 2002?

-Refer to Table 12-12.Charles is a single person whose taxable income is $35,000 a year.What is his marginal tax rate in 2002?

A) 15%

B) 28%

C) 31%

D) 36%

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The U.S.federal government collects about one-half of the taxes in our economy.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

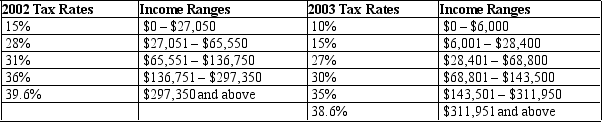

Table 12-16

United States Income Tax Rates for a Single Individual,2002 and 2003.

-Refer to Table 12-16.What type of tax structure did the United States have in 2002 for single individuals?

-Refer to Table 12-16.What type of tax structure did the United States have in 2002 for single individuals?

A) A proportional tax structure

B) A regressive tax structure

C) A progressive tax structure

D) A lump-sum tax structure

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2007,the average American paid approximately how much to the federal government in taxes?

A) $1,900

B) $4,500

C) $6,400

D) $8,500

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 397

Related Exams