A) 20 percent

B) 15 percent

C) 12 percent

D) 10 percent

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

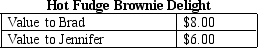

Table 12-4

-Refer to Table 12-4.Suppose that the government imposes a $2 tax on delights,causing the price to increase from $5.00 to $7.00.Deadweight loss arises because

-Refer to Table 12-4.Suppose that the government imposes a $2 tax on delights,causing the price to increase from $5.00 to $7.00.Deadweight loss arises because

A) Jennifer will pay more tax as a percentage of her value of delights than Brad.

B) Brad must pay the $2.00 tax from his consumer surplus.

C) Brad will have to pay a higher price for delights.

D) Jennifer will leave the market.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

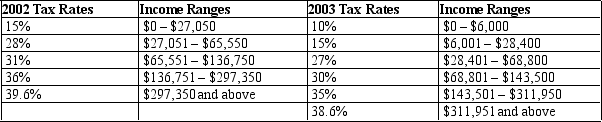

Table 12-12

United States Income Tax Rates for a Single Individual,2002 and 2003.

-Refer to Table 12-12.Charles is a single person whose taxable income is $35,000 a year.What happened to his average tax rate between 2002 and 2003?

-Refer to Table 12-12.Charles is a single person whose taxable income is $35,000 a year.What happened to his average tax rate between 2002 and 2003?

A) It increased.

B) It decreased.

C) It did not change.

D) We do not have enough information to answer this question.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

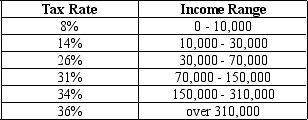

Table 12-2

Consider the tax rates shown in the table below.

-Refer to Table 12-2.If John has taxable income of $72,000,his tax liability is

-Refer to Table 12-2.If John has taxable income of $72,000,his tax liability is

A) $13,720.

B) $14,620.

C) $22,320.

D) $23,470.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In order to construct a more complete picture of the economic burden of government across income classes,economists usually

A) include tax payments as well as transfer payments received.

B) focus only on the tax payments of wealthy tax payers.

C) limit their analysis to taxes based on the ability-to-pay principle.

D) focus their analysis on issues of tax efficiency.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The U.S.federal government spends its revenues in a number of ways.Rank the following spending categories from largest to smallest.

A) Social Security,national defense,income security,net interest

B) Health care,national defense,net interest,income security

C) Social Security,health care,national defense,Medicare

D) National defense,Social Security,net interest,income security

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

In the United States,all families pay the same proportion of their income in taxes.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The marginal tax rate for a lump-sum tax

A) is always positive.

B) is always negative.

C) is zero.

D) can take on any value but must be greater than the average tax rate.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Incentives to work and save are reduced when

A) income taxes are higher.

B) consumption taxes replace income taxes.

C) corrective taxes are implemented.

D) All of the above are correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For state and local governments,education accounts for approximately what percentage of spending?

A) 25 percent

B) 34 percent

C) 50 percent

D) 75 percent

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

When the total surplus lost as a result of a tax is less than the amount of tax revenue collected by the government there is a deadweight loss.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Like spending on Social Security,the share of federal government spending on Medicare has risen substantially over time.This is most likely a result of

A) a rising population of poor in the economy.

B) the elderly population growing more rapidly than the overall population.

C) an immigration policy that promotes an influx of migrant farm workers.

D) All of the above are important factors.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which type of tax is used to finance the Social Security program in the United States?

A) Consumption tax

B) Income tax

C) Payroll tax

D) Property tax

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The government's health plan for the elderly is called

A) Medicaid.

B) Medicare.

C) Social Security.

D) TANF.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

With a lump-sum tax,

A) the average tax rate for high income taxpayers will be the same as the average tax rate for low income taxpayers.

B) the average tax rate for high income taxpayers will be lower than the average tax rate for low income taxpayers.

C) the average tax rate for high income taxpayers will be higher than the average tax rate for high income taxpayers.

D) Any of the above could be true under a regressive tax system.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Lump-sum taxes are equitable but not efficient.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In many cases,tax loopholes are designed by Congress to

A) give special treatment to specific types of behavior.

B) reduce the overall administrative burden of the tax system.

C) raise revenues for special projects.

D) All of the above are correct.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As the economy's income has grown,the government has

A) grown at about the same pace.

B) grown at a faster pace.

C) grown at a slower pace.

D) shrunk.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A value-added tax or VAT is a tax on

A) retail purchases only.

B) wholesale purchases only.

C) pollution.

D) all stages of production of a good.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The most efficient tax possible is a

A) marginal income tax.

B) lump-sum tax.

C) consumption tax.

D) corporate profit tax.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 201 - 220 of 397

Related Exams