A) Q3 - Q2.

B) Q5 - Q4.

C) P3a - P3b.

D) P4a - P4b.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is not correct?

A) A patent is a way for the government to encourage the production of a good with technology spillovers.

B) A tax is a way for the government to reduce the production of a good with a negative externality.

C) A tax that accurately reflects social costs produces the socially optimal outcome.

D) Government policies cannot improve upon private market outcomes.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Why can't private individuals always internalize an externality without the help of government?

A) Legal restrictions prevent side payments between individuals.

B) Transactions costs may be too high.

C) Side payments between individuals are inefficient.

D) Side payments between individuals are insufficient.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

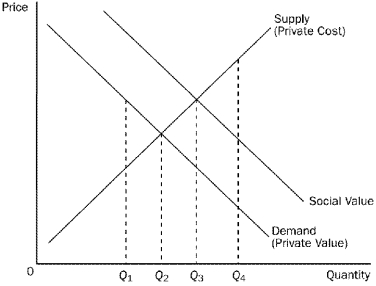

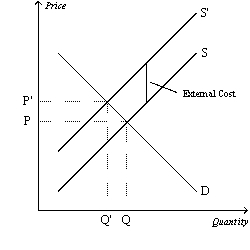

Figure 10-7  -Refer to Figure 10-7.To internalize the externality in this market,the government should

-Refer to Figure 10-7.To internalize the externality in this market,the government should

A) impose a tax on this product.

B) provide a subsidy for this product.

C) forbid production.

D) produce the product itself.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 10-1  -Refer to Figure 10-1.This graph represents the tobacco industry.The industry creates

-Refer to Figure 10-1.This graph represents the tobacco industry.The industry creates

A) positive externalities.

B) negative externalities.

C) no externalities.

D) no equilibrium in the market.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Markets sometimes fail to allocate resources efficiently.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Government intervention in the economy with the goal of promoting technology-producing industries is known as patent policy.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Externalities tend to cause markets to be

A) inefficient.

B) unequal.

C) unnecessary.

D) overwhelmed.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Coase theorem states that

A) taxes are an efficient way for governments to remedy negative externalities.

B) subsidies are an efficient way for governments to remedy positive externalities.

C) industrial policies encourage technology spillovers.

D) in the absence of transaction costs,private parties can solve the problem of externalities on their own.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

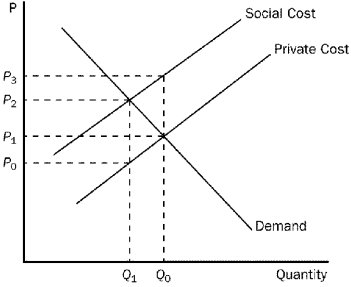

Figure 10-5  -Refer to Figure 10-5.Which price and quantity combination represents the social optimum?

-Refer to Figure 10-5.Which price and quantity combination represents the social optimum?

A) P0 and Q1.

B) P2 and Q1.

C) P1 and Q0.

D) P2 and Q0.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a problem that keeps people from privately solving externality problems?

A) Each party involved holds out for a better deal.

B) The externality is large.

C) Only problems with a sufficiently large number of parties can be solved.

D) There is a lack of government intervention.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A command-and-control policy is another term for a

A) pollution permit.

B) government regulation.

C) corrective tax.

D) Both a and b are correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

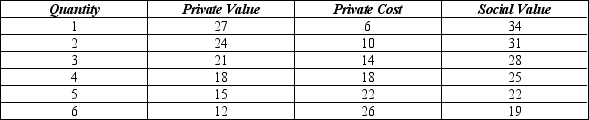

Table 10-2

The following table shows the private value,private cost,and social value for a market with a positive externality.

-Refer to Table 10-2.What is the equilibrium quantity of output in this market?

-Refer to Table 10-2.What is the equilibrium quantity of output in this market?

A) 3 units

B) 4 units

C) 5 units

D) 6 units

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If it is illegal for a biochemical manufacturer to release its waste into a nearby stream,then this is an example of

A) a market-based policy.

B) a command-and-control policy.

C) tradable pollution permits.

D) transaction costs.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is an example of a positive externality?

A) A college student buys a new car when she graduates.

B) The mayor of a small town plants flowers in the city park.

C) Local high school teachers have pizza delivered every Friday for lunch.

D) An avid fisherman buys new fishing gear for his next fishing trip.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

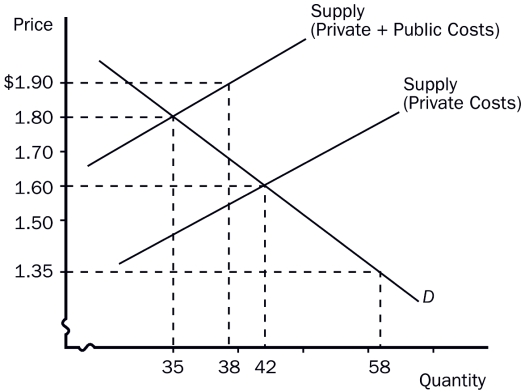

Figure 10-6  -Refer to Figure 10-6.How large would a corrective tax need to be to move this market from the equilibrium outcome to the socially-optimal outcome?

-Refer to Figure 10-6.How large would a corrective tax need to be to move this market from the equilibrium outcome to the socially-optimal outcome?

A) An amount equal to P' minus P.

B) An amount equal to P'.

C) An amount equal to P.

D) An amount equal to the external cost.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that a negative externality is created by the production of good X.Which of the following statements is correct?

A) The social cost of producing good X includes the private cost plus the cost to bystanders of the externality.

B) The increased social cost can be graphed as a decrease in demand.

C) The market equilibrium quantity will be the socially optimal quantity as long as the government does not interfere.

D) Both a and b are correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that electricity producers create a negative externality equal to $5 per unit.Further suppose that the government gives a $5 per-unit subsidy to producers.What is the relationship between the equilibrium quantity and the socially optimal quantity of electricity to be produced?

A) They are equal.

B) The equilibrium quantity is greater than the socially optimal quantity.

C) The equilibrium quantity is less than the socially optimal quantity.

D) There is not enough information to answer the question.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The social cost of pollution includes the private costs of the producers plus the costs to those bystanders adversely affected by the pollution.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Negative externalities lead markets to produce

A) greater than efficient output levels and positive externalities lead markets to produce smaller than efficient output levels.

B) smaller than efficient output levels and positive externalities lead markets to produce greater than efficient output levels.

C) greater than efficient output levels and positive externalities lead markets to produce efficient output levels.

D) efficient output levels and positive externalities lead markets to produce greater than efficient output levels.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 281 - 300 of 352

Related Exams