A) have no effect on its stock price.

B) raise the price of the stock.

C) lower the price of the stock.

D) change the price of the stock in a random direction.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In answering which of the following questions would you find it necessary to calculate a present value?

A) Should Jane put $1,000 today into a 5-year certificate of deposit that pays 4 percent annual interest?

B) Should ABC Corporation buy a factory today for $2 million, knowing that the factory will yield the corporation $3 million after 5 years?

C) If Jill puts $5,000 today into a bank account that pays 3 percent interest, then how much will she have in the account after 2 years?

D) You would find it necessary to calculate a present value in order to answer all of these questions.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Studies find that mutual fund managers who do well in one year are likely to do well the next year.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a source of market risk?

A) Holding stocks in many companies carries the risk of a reduced average return.

B) Real GDP varies over time and sales and profits move with real GDP.

C) When a paper producer has declining sales, it is likely that so will other paper producers.

D) If stockholders become aggravated with the way a CEO runs a company, the price of that company's stock might fall in the stock market.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Using the rule of 70, about how much would $100 be worth after 50 years if the interest rate were 7 percent?

A) $400

B) $800

C) $1,600

D) $3,200

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Increasing the number of corporations whose stocks are in your portfolio reduces market risk.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following actions best illustrates adverse selection?

A) A person adds risky stock to his portfolio.

B) A person who has narrowly avoided many accidents applies for automobile insurance.

C) A person is unwilling to buy a stock when she believes its price has an equal chance of rising or falling $10.

D) A person purchases homeowners insurance and then checks his smoke detector batteries less frequently.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Some people claim that stocks follow a random walk. What does this mean?

A) The price of stock one day is about what it was on the previous day.

B) Changes in stock prices cannot be predicted from available information.

C) Stock prices are not determined by market fundamentals such as supply and demand.

D) Prices of stocks of different firms in the same industry show no or little tendency to move together.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A judge requires Harry to make a payment to Sally. The judge says that Harry can pay her either $10,000 today or $11,000 two years from today. Of the following interest rates, which is the lowest one at which Harry would be better off paying $11,000 two years from today?

A) 2 percent

B) 3 percent

C) 4 percent

D) 5 percent

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

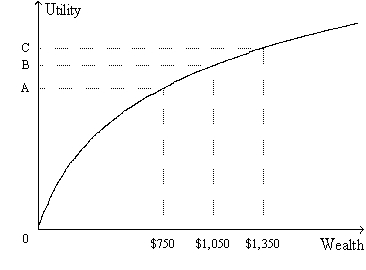

Figure 14-2. The figure shows a utility function for Mary Ann.  -Refer to Figure 14-2. Suppose the vertical distance between the points (0, A) and (0, B) is 5. If her wealth increased from $1,050 to $1,350, then

-Refer to Figure 14-2. Suppose the vertical distance between the points (0, A) and (0, B) is 5. If her wealth increased from $1,050 to $1,350, then

A) Mary Ann's subjective measure of her well-being would increase by less than 5 units.

B) Mary Ann's subjective measure of her well-being would increase by more than 5 units.

C) Mary Ann would change from being a risk-averse person into a person who is not risk averse.

D) Mary Ann would change from being a person who is not risk averse into a risk-averse person.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You have been promised a payment of $400 in the future. In which of the following cases is the present value of this payment the lowest?

A) You receive the payment 4 years from now and the interest rate is 4 percent.

B) You receive the payment 4 years from now and the interest rate is 5 percent.

C) You receive the payment 5 years from now and the interest rate is 4 percent.

D) You receive the payment 5 years from now and the interest rate is 5 percent.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

According to the efficient markets hypothesis, the number of people who think a stock is overvalued exactly balances the number of people who think a stock is undervalued.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

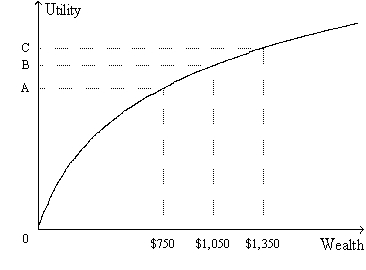

Figure 14-2. The figure shows a utility function for Mary Ann.  -Refer to Figure 14-2. From the appearance of the utility function, we know that

-Refer to Figure 14-2. From the appearance of the utility function, we know that

A) if Mary Ann owns a house, she would not consider buying fire insurance.

B) Mary Ann would prefer to hold a portfolio of stocks with an average return of 8 percent and a standard deviation of 2 percent to a portfolio of stocks with an average return of 8 percent and a standard deviation of 5 percent.

C) Mary Ann would prefer to hold a portfolio of stocks with an average return of 8 percent and a standard deviation of 5 percent to a portfolio of stocks with an average return of 6 percent and a standard deviation of 3 percent.

D) All of the above are correct.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assuming the interest rate is 6 percent, which of the following has the greatest present value?

A) $300 paid in two years

B) $150 paid in one year plus $140 paid in two years

C) $100 paid today plus $100 paid in one year plus $100 paid in two years

D) $285 today

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If you put $250 into an account with a 4 percent interest rate, how many years would you have to wait to have $432.92?

A) 10

B) 14

C) 17

D) 20

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a person is risk averse, then she has

A) diminishing marginal utility of wealth, implying that her utility function gets flatter as wealth increases.

B) diminishing marginal utility of wealth, implying that her utility function gets steeper as wealth increases.

C) increasing marginal utility of wealth, implying that her utility function gets flatter as wealth increases.

D) increasing marginal utility of wealth, implying that her utility function gets steeper as wealth increases.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A bank might make mortgages to people in different regions of the country. By doing so

A) the bank reduces the risk it faces from falling house prices in its region and falling prices in all regions.

B) the bank reduces the risk it faces of falling house prices in its region but not from falling prices in all regions.

C) the bank reduces the risk it faces of falling house prices in all regions, but not the risk it faces from falling house prices in its regions.

D) the bank reduces neither the risk it faces from falling house prices in its region nor falling prices in all regions.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The future value of a deposit in a savings account will be larger

A) the longer a person waits to withdraw the funds.

B) the higher the interest rate is.

C) the larger the initial deposit is.

D) All of the above are correct.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Hector puts $150 into an account when the interest rate is 4 percent. Later he checks his balance and finds he has about $168.73. How long did Hector wait to check his balance?

A) 3 years

B) 3.5 years

C) 4 years

D) 4.5 years

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An increase in the number of corporations in a portfolio from 1 to 10 reduces

A) market risk by more than an increase from 110 to 120.

B) market risk by less than an increase from 110 to 120.

C) firm-specific risk by more than an increase from 110 to 120.

D) firm-specific risk by less than an increase from 110 to 120.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 181 - 200 of 419

Related Exams