A) $2

B) $3

C) $4

D) $5

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

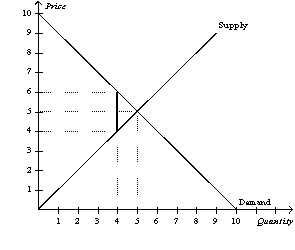

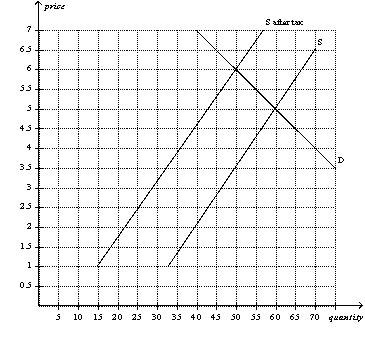

Figure 6-27  -Refer to Figure 6-27. If the government places a $2 tax in the market, the seller receives $6.

-Refer to Figure 6-27. If the government places a $2 tax in the market, the seller receives $6.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the government imposes a 20-cent tax on the sellers of artificially-sweetened beverages. The tax would shift

A) demand, raising both the equilibrium price and quantity in the market for artificially-sweetened beverages.

B) demand, lowering the equilibrium price and raising the equilibrium quantity in the market for artificially-sweetened beverages.

C) supply, raising the equilibrium price and lowering the equilibrium quantity in the market for artificially-sweetened beverages.

D) supply, lowering the equilibrium price and raising the equilibrium quantity in the market for artificially-sweetened beverages.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct concerning the burden of a tax imposed on take-out food?

A) Buyers bear the entire burden of the tax.

B) Sellers bear the entire burden of the tax.

C) Buyers and sellers share the burden of the tax.

D) We have to know whether it is the buyers or the sellers that are required to pay the tax to the government in order to make this determination.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

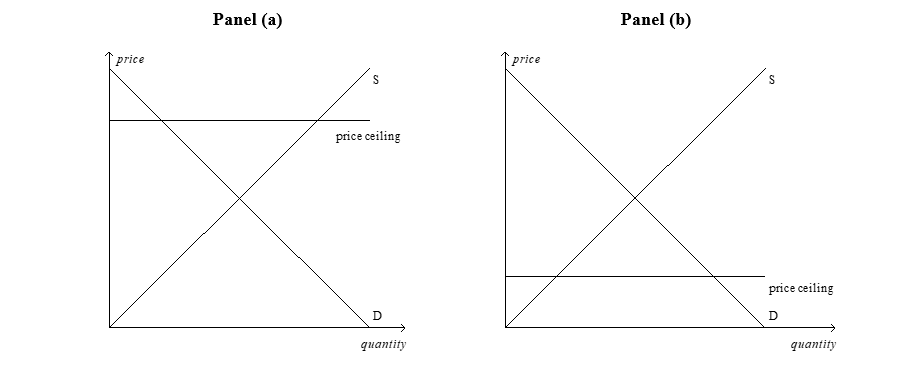

Figure 6-1

-Refer to Figure 6-1. The price ceiling shown in panel (a)

-Refer to Figure 6-1. The price ceiling shown in panel (a)

A) is not binding.

B) creates a surplus.

C) creates a shortage.

D) Both a) and b) are correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

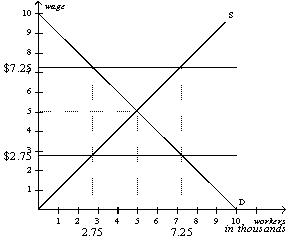

A minimum wage that is set above a market's equilibrium wage will result in an excess

A) demand for labor, that is, unemployment.

B) demand for labor, that is, a shortage of workers.

C) supply of labor, that is, unemployment.

D) supply of labor, that is, a shortage of workers.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

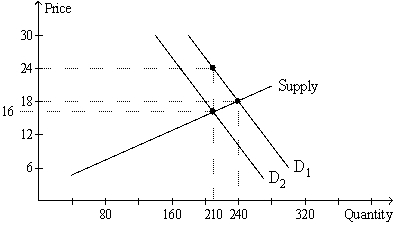

Figure 6-20  -Refer to Figure 6-20. Which of the following statements is correct?

-Refer to Figure 6-20. Which of the following statements is correct?

A) The amount of the tax per unit is $6.

B) The tax leaves the size of the market unchanged.

C) The tax is levied on buyers of the good, rather than on sellers.

D) All of the above are correct.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 6-20  -Refer to Figure 6-20. What is the amount of the tax per unit?

-Refer to Figure 6-20. What is the amount of the tax per unit?

A) $8

B) $6

C) $4

D) $2

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the government passes a law requiring sellers of mopeds to send $200 to the government for every moped they sell, then

A) the supply curve for mopeds shifts downward by $200.

B) sellers of mopeds receive $200 less per mopeds than they were receiving before the tax.

C) buyers of mopeds are unaffected by the tax.

D) None of the above is correct.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

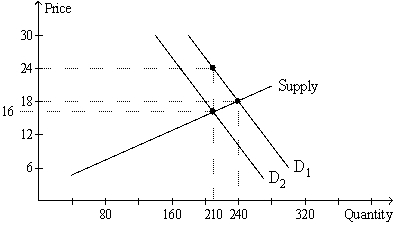

Figure 6-18  -Refer to Figure 6-18. Suppose the same supply and demand curves apply, and a tax of the same amount per unit as shown here is imposed. Now, however, the buyers of the good, rather than the sellers, are required to pay the tax to the government. After the buyers pay the tax, relative to the case depicted in the figure, the burden on buyers will be

-Refer to Figure 6-18. Suppose the same supply and demand curves apply, and a tax of the same amount per unit as shown here is imposed. Now, however, the buyers of the good, rather than the sellers, are required to pay the tax to the government. After the buyers pay the tax, relative to the case depicted in the figure, the burden on buyers will be

A) larger, and the burden on sellers will be smaller.

B) smaller, and the burden on sellers will be larger.

C) the same, and the burden on sellers will be the same.

D) The relative burdens in the two cases cannot be determined without further information.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would not interfere with market equilibria?

A) a minimum wage

B) a rent control

C) a non-binding price floor

D) a binding price ceiling

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A binding price floor causes quantity supplied to be less than quantity demanded.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 6-13  -Refer to Figure 6-13. In this market, a minimum wage of $2.75 creates a labor

-Refer to Figure 6-13. In this market, a minimum wage of $2.75 creates a labor

A) shortage of 2,250 workers.

B) shortage of 4,500 workers.

C) surplus of 2,250 workers.

D) neither a labor shortage nor surplus.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The minimum wage is an example of a

A) price ceiling.

B) price floor.

C) wage subsidy.

D) tax.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A legal minimum on the price at which a good can be sold is called a price

A) subsidy.

B) floor.

C) support.

D) ceiling.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

A tax on golf clubs will cause buyers of golf clubs to pay a higher price, sellers of golf clubs to receive a lower price, and fewer golf clubs to be sold.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You have responsibility for economic policy in the country of Freedonia. Recently, the neighboring country of Sylvania has cut off all exports of oranges to Freedonia. Harpo, who is one of your advisors, suggests that you should impose a binding price ceiling in order to avoid a shortage of oranges. Chico, another one of your advisors, argues that without a binding price floor, a shortage will certainly develop. Zeppo, a third advisor, says that the best way to avoid a shortage of oranges is to take no action at all. Which of your three advisors is most likely to have studied economics?

A) Harpo

B) Chico

C) Zeppo

D) Apparently, all three advisors have studied economics, but their views on positive economics are different.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If the demand curve is very inelastic and the supply curve is very elastic in a market, then the sellers will bear a greater burden of a tax imposed on the market, even if the tax is imposed on the buyers.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The incidence of a tax falls more heavily on

A) consumers than producers if demand is more inelastic than supply.

B) producers than consumers if supply is more inelastic than demand.

C) consumers than producers if supply is more elastic than demand.

D) All of the above are correct.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be the most likely result of a binding price ceiling imposed on the market for rental cars?

A) frequent rental programs such as "Rent nine times and the tenth rental is free!"

B) enhanced maintenance programs to promote the high quality of the cars

C) free gasoline given to people as an incentive to a rent a car

D) slow replacement of old rental cars with newer ones

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 556

Related Exams