A) $.50.

B) $1.50.

C) $1.00.

D) $2.00.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a household has $40,000 in taxable income and its tax liability is $10,000,the household's average tax rate is

A) 10 percent.

B) 25 percent.

C) 40 percent.

D) 50 percent

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

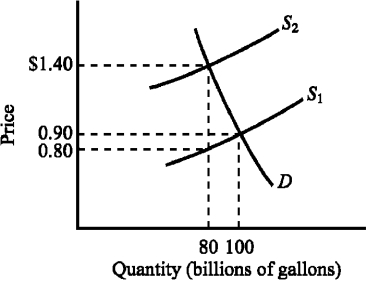

Use the figure below to answer the following question(s) .

Figure 4-7

-Refer to Figure 4-7.The supply curve S₁ and the demand curve D indicate initial conditions in the market for gasoline.A $.60-per-gallon excise tax on gasoline is levied.How much revenue does the $.60-per-gallon tax generate for the government?

-Refer to Figure 4-7.The supply curve S₁ and the demand curve D indicate initial conditions in the market for gasoline.A $.60-per-gallon excise tax on gasoline is levied.How much revenue does the $.60-per-gallon tax generate for the government?

A) $40 billion

B) $48 billion

C) $50 billion

D) $60 billion

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Both price floors and price ceilings,when effective,lead to

A) shortages.

B) surpluses.

C) an increase in the quantity traded.

D) a reduction in the quantity traded.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

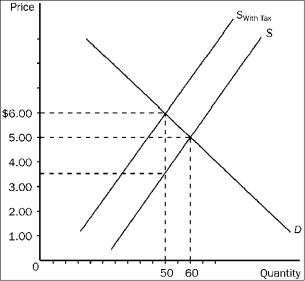

Figure 4-22

-Refer to Figure 4-22.Sellers pay how much of the tax per unit?

-Refer to Figure 4-22.Sellers pay how much of the tax per unit?

A) $1.00.

B) $1.50.

C) $2.50.

D) $3.00.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax is levied on products A and B,both of which have the same price elasticity of supply.The demand for A is more inelastic than is the demand for B.Other things constant,how will this affect the incidence of an excise tax on these products?

A) Producers will bear a smaller share (and consumers a larger share) of the tax burden on A than B.

B) Consumers will bear a smaller share (and producers a larger share) of the tax burden on A than B.

C) The deadweight loss (or excess burden) will be larger for good A than B.

D) All of the above are true.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the federal government placed a 50 cent per pack excise tax on cigarette manufacturers,and if as a result,the price to consumers of a pack of cigarettes went up by 40 cents,the

A) actual burden of this tax falls mostly on consumers.

B) actual burden of this tax falls mostly on manufacturers.

C) actual burden of the tax would be shared equally by producers and consumers.

D) tax would clearly be a progressive tax.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During the Prohibition period (when the production and sale of alcohol was illegal) ,

A) the quality of alcohol sold became less reliable.

B) the murder rate increased.

C) gangsters dominated the alcohol trade.

D) all of the above occurred.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

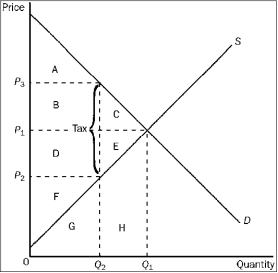

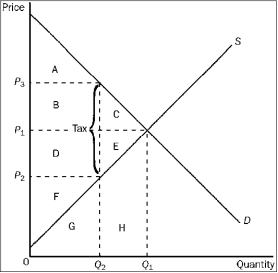

Figure 4-25

-Refer to Figure 4-25.The tax causes a reduction in producer surplus that is represented by area

-Refer to Figure 4-25.The tax causes a reduction in producer surplus that is represented by area

A) A.

B) B + C.

C) D + E.

D) F.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A payment the government makes to either the buyer or seller,usually on a per-unit basis,when a good or service is purchased or sold is called a

A) black market.

B) interest rate.

C) subsidy.

D) tax.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax for which the average tax rate rises with income is defined as a

A) regressive tax.

B) proportional tax.

C) neutral tax.

D) progressive tax.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 4-25

-Refer to Figure 4-25.The price that sellers receive after the tax is imposed is

-Refer to Figure 4-25.The price that sellers receive after the tax is imposed is

A) P₁.

B) P₂.

C) P₃.

D) impossible to determine from the figure.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

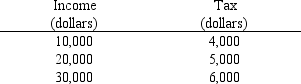

Use the table below to choose the correct answer.

For the income range illustrated,the tax shown here is

For the income range illustrated,the tax shown here is

A) regressive.

B) proportional.

C) progressive.

D) progressive up to $20,000 but regressive beyond that.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The deadweight loss (or excess burden) resulting from levying a tax on an economic activity is the

A) tax revenue raised by the government as the result of the tax.

B) loss of potential gains from trade from activities forgone because of the tax.

C) increase in the price of an activity as the result of the tax levied on it.

D) marginal benefits derived from the expansion in government activities made possible by the increase in tax revenues.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A regressive tax

A) taxes individuals with higher incomes at a higher rate than individuals with lower incomes.

B) takes a similar percentage of income at all income levels.

C) takes a higher percentage of the income of those with lower incomes than for those with higher incomes.

D) taxes savings at a higher rate than consumption.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The revenue generated by the tax illustrated in Figure 4-6 is given by the area

A) ACLH.

B) BEKM.

C) ACFG.

D) 0AGJ.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The benefit of a subsidy will go primarily to sellers when the

A) demand for the product is highly inelastic and supply is relatively elastic.

B) demand for the product is highly elastic and the supply is relatively inelastic.

C) subsidy is legally (statutorily) granted to the seller of the product.

D) subsidy is legally (statutorily) granted to the buyer of the product.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax for which the average tax rate decreases with income is defined as a

A) regressive tax.

B) proportional tax.

C) neutral tax.

D) progressive tax.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a $300 subsidy is legally (statutorily) granted to the buyers of computers and as a result the selling price of computers rises by $200,the actual benefit of the subsidy

A) goes completely to the buyers of computers.

B) goes completely to the sellers of computers.

C) is $100 to computer buyers and $200 to computer sellers.

D) is $200 to computer buyers and $100 to computer sellers.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An income tax is defined as regressive if

A) the tax liability of those with higher incomes exceeds the tax liability of those with low incomes.

B) the tax liability of those with higher incomes is less than the tax liability of those with low incomes.

C) those with higher incomes pay a higher percentage of their incomes in taxes than those with low incomes.

D) those with higher incomes pay a lower percentage of their incomes in taxes than those with low incomes.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 161 - 180 of 331

Related Exams