A) The system minimizes deadweight loss.

B) The system raises the same amount of revenue at a lower cost.

C) The system minimizes administrative burdens.

D) All of the above are correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

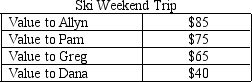

Table 12-3

-Refer to Table 12-3.Assume that the price of a weekend ski pass is $38 and that the price reflects the actual unit cost of providing a weekend of skiing.Suppose the government imposes a tax of $15 on skiing,which raises the price of a weekend ski pass to $53.The deadweight loss associated with the tax is

-Refer to Table 12-3.Assume that the price of a weekend ski pass is $38 and that the price reflects the actual unit cost of providing a weekend of skiing.Suppose the government imposes a tax of $15 on skiing,which raises the price of a weekend ski pass to $53.The deadweight loss associated with the tax is

A) $2.

B) $37.

C) $52.

D) $97.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If a tax system is designed so that individuals with similar incomes pay similar taxes,the system achieves horizontal equity.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

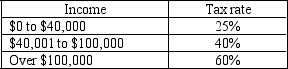

Table 12-6

-Refer to Table 12-6.What is the average tax rate for a person who makes $130,000?

-Refer to Table 12-6.What is the average tax rate for a person who makes $130,000?

A) 30%

B) 40%

C) 50%

D) 60%

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

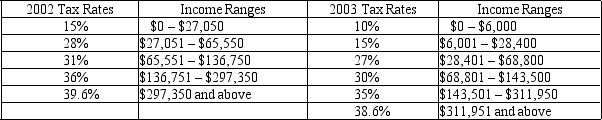

Table 12-2

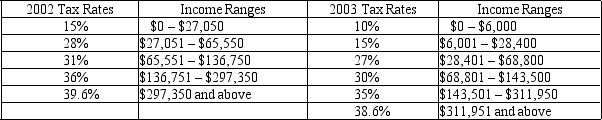

United States Income Tax Rates for a Single Individual, 2002 and 2003.

-Refer to Table 12-2.Costa is a single person whose taxable income is $50,000 a year.What is his average tax rate in 2002?

-Refer to Table 12-2.Costa is a single person whose taxable income is $50,000 a year.What is his average tax rate in 2002?

A) 19.6%

B) 20.5%

C) 21%

D) 28%

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about state income taxes is correct?

A) Some states do not tax income at all.

B) If states tax income, they must follow federal guidelines for designing the tax structure.

C) States are not allowed to have a higher marginal tax rate than the federal marginal tax rate.

D) All of the above are correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

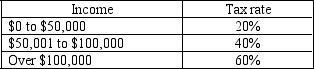

Table 12-7

-Refer to Table 12-7.What is the marginal tax rate for a person who makes $60,000?

-Refer to Table 12-7.What is the marginal tax rate for a person who makes $60,000?

A) 20%

B) 23%

C) 40%

D) 45%

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Part of the deadweight loss from taxing labor earnings is that people

A) will work more.

B) will be reluctant to hire accountants to file their tax returns.

C) with low tax liabilities will universally be worse off than under some other tax policy.

D) will work less.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

One characteristic of an efficient tax system is that it minimizes the costs associated with revenue collection.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

State and local governments

A) use a mix of taxes and fees to generate revenue.

B) are required by federal mandate to levy income taxes.

C) are required to tax property at a standard rate set by the federal government.

D) cannot impose state excise taxes on products that are taxed by the federal government.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If transfer payments are included when evaluating tax burdens,then the average tax rate of the poorest quintile of taxpayers would be approximately

A) negative 30 percent.

B) negative 10 percent.

C) positive 1 percent.

D) positive 8 percent.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Many people consider lump-sum taxes to be unfair to low-income taxpayers.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Table 12-2

United States Income Tax Rates for a Single Individual, 2002 and 2003.

-Refer to Table 12-2.Surbhi is a single person whose taxable income is $150,000 a year.What is her total tax due in 2002?

-Refer to Table 12-2.Surbhi is a single person whose taxable income is $150,000 a year.What is her total tax due in 2002?

A) $22,072

B) $41,679.50

C) $43,789.75

D) $54,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Taxes create deadweight loss when they

A) distort behavior.

B) cause the price of the product to increase.

C) don't raise sufficient government revenue.

D) cannot be computed easily.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) National defense and Medicare are the two largest spending categories for the federal government.

B) Welfare programs and highways are the two largest spending categories for state and local governments.

C) Sales taxes and property taxes are the two most important revenue sources for state and local governments.

D) Corporate income taxes are the largest source of revenue for the federal government.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

If Mary earns $80,000 in taxable income and pays $40,000 in taxes,her marginal tax rate is 50 percent.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2004,total spending per person by the federal government amounted to

A) $4,750.

B) $5,000.

C) $6,400.

D) $7,800.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which type of tax is used to finance the Social Security program in the United States?

A) consumption tax

B) income tax

C) payroll tax

D) property tax

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

State and local governments

A) are funded entirely by their own tax base.

B) receive the majority of their tax revenues from corporate income tax.

C) are generally not responsible for collecting sales taxes.

D) receive some of their funds from the federal government.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a poor family has three children in public school and a rich family has two children in private school,the benefits principle would suggest that

A) the poor family should pay more in taxes to pay for public education than the rich family.

B) the rich family should pay more in taxes to pay for public education than the poor family.

C) the benefits of private school exceed those of public school.

D) public schools should be financed by property taxes.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 181 - 200 of 328

Related Exams