B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

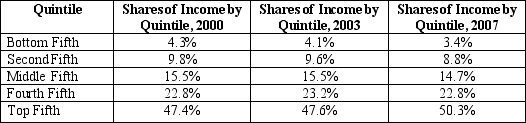

Table 20-4

Source: U.S. Bureau of Census

-Refer to Table 20-4.In 2007,the bottom 60% of families have

Source: U.S. Bureau of Census

-Refer to Table 20-4.In 2007,the bottom 60% of families have

A) only 12% of total income in the U.S.

B) only 27% of total income in the U.S.

C) 50% of total income in the U.S.

D) 73% of total income in the U.S.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Smith family owns an apple orchard in Illinois.The Jones family owns an apple orchard in Wisconsin.A late frost destroys half of the Smith family's harvest for one year.For the Smith family,their

A) transitory income for the year of the frost likely exceeds their permanent income.

B) permanent income likely exceeds their transitory income for the year of the frost.

C) permanent income will be more affected by the frost than their transitory income.

D) Both a and c are correct.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the Ten Principles of Economics do governments run into when they redistribute income to achieve greater equality?

A) Trade can make everyone better off.

B) The cost of something is what you give up to get it.

C) People face trade-offs.

D) Markets are usually a good way to organize economic activity.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the United States approximately 80 percent of millionaires did not inherit their wealth.This illustrates the

A) amount of transitory income in the United States.

B) effectiveness of government anti-poverty programs in the United States.

C) great economic mobility in the United States.

D) level of permanent income in the United States.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 20-2 Suppose the government implemented a negative income tax and used the following formula to compute a family's tax liability: Taxes owed = (1/4 of income) - $20,000 -Refer to Scenario 20-2.A family earning $90,000 before taxes would have how much after-tax income?

A) $12,500

B) $17,500

C) $87,500

D) $92,500

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

"The government should choose policies deemed to be just,as evaluated by an impartial observer behind a 'veil of ignorance.'" This statement is most closely associated with which political philosophy?

A) liberalism

B) utilitarianism

C) libertarianism

D) welfarism

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

John Rawls,who developed the way of thinking called liberalism,argued that government policies should be aimed at maximizing the sum of utility of everyone in society.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not an example of in-kind transfers?

A) food stamps

B) Medicaid

C) the Earned Income Tax Credit

D) housing vouchers

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Utilitarianism is

A) a liberal religion that focuses on individual rights.

B) a political philosophy that believes the government should choose policies deemed to be just by an impartial observer.

C) a political philosophy that believes the government should not redistribute income.

D) a political philosophy that believes the government should choose policies to maximize the total utility of society.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2008,the poverty rate in the United States was 13.2 percent.This means that 13.2 percent

A) of the population had a total family income that fell below the poverty line.

B) of the population had a total family income that was above the poverty line.

C) of the population had a total family income below $10,000.

D) of the population had a total family income above $50,000.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The poverty rate is based on a family's

A) income, in-kind transfers, and other government aid.

B) income and in-kind transfers.

C) in-kind transfers only.

D) income only.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not correct?

A) Critics argue that minimum-wage laws hurt the very people they are intended to help.

B) Minimum-wage laws may increase unemployment among the groups of workers affected by the minimum wage.

C) If the demand for unskilled labor is relatively inelastic, the higher wage will produce more unemployment than if the demand for unskilled labor is relatively elastic.

D) Minimum-wage laws may benefit teenagers from middle-class families, so the policy is not a precise way to help the poor.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The poverty line is

A) established by the federal government.

B) approximately equivalent to three times the cost of providing an adequate diet.

C) an absolute level of income below which a family is deemed to be in poverty.

D) All of the above are correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The study by economists Cox and Alm found that the 2006 pre-tax income of the richest fifth of U.S.households is

A) 5 times the pre-tax income of the poorest fifth.

B) 10 times the pre-tax income of the poorest fifth.

C) 15 times the pre-tax income of the poorest fifth.

D) 20 times the pre-tax income of the poorest fifth.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not correct?

A) Poverty is long-term problem for relatively few families.

B) Measurements of income inequality usually do not include in-kind transfers.

C) Measurements of income inequality use lifetime incomes rather than annual incomes.

D) Measurements of income inequality would be more meaningful if they reflected permanent rather than current income.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following will not occur when government policies are enacted to make the distribution of income more equitable?

A) People will alter their behaviors.

B) Incentives will be distorted.

C) Total utility will likely remain constant.

D) The allocation of resources will be less efficient .

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Liberals believe

A) that the government should choose just policies as evaluated by an impartial observer behind a "veil of ignorance."

B) in the assumption of diminishing marginal utility.

C) that everyone in society should have equal utility.

D) that the government should not redistribute income.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

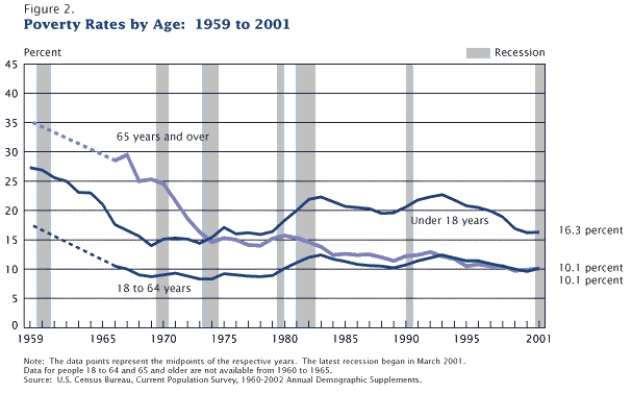

Figure 20-4

Poverty Rates by Age

-Refer to Figure 20-4.From 1969 to 2001,the percent of elderly aged 64 and over in poverty has

-Refer to Figure 20-4.From 1969 to 2001,the percent of elderly aged 64 and over in poverty has

A) declined, while the percentage of children under age 18 in poverty has also declined.

B) declined, while the percentage of children under age 18 in poverty has increased.

C) increased, while the percentage of children under age 18 in poverty has declined.

D) increased, while the percentage of children under age 18 in poverty has also increased.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The United States has more income inequality than Brazil and South Africa.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 241 - 260 of 374

Related Exams