A) $5.

B) $12.

C) $36.

D) $41.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When government receipts exceed total government spending during a fiscal year,the difference is

A) a budget surplus.

B) a budget deficit.

C) the national debt.

D) automatically refunded.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The government raises revenue through taxation to pay for the services it provides.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sue earns income of $80,000 per year.Her average tax rate is 40 percent.Sue paid $4,500 in taxes on the first $30,000 she earned.What was the marginal tax rate on the rest of her income?

A) 15 percent

B) 32 percent

C) 40 percent

D) 55 percent

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The three largest categories of spending by the Federal government in order from first to third would be

A) Social Security, Medicare, and national defense

B) national defense, net interest, and Social Security

C) Social Security, national defense, and income security

D) income security, Social Security, and national defense

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Over the past 100 years,as the U.S.economy's income has grown,

A) tax rates have decreased, while tax revenues have increased.

B) tax rates have increased, while tax revenues have decreased.

C) both tax rates and tax revenues have increased.

D) both tax rates and tax revenues have decreased.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under a regressive tax system,

A) the marginal tax rate for high income taxpayers is higher than the marginal tax rate for low income taxpayers.

B) the marginal tax rate for high income taxpayers is the same as the marginal tax rate for low income taxpayers.

C) the marginal tax rate for high income taxpayers is lower than the marginal tax rate for low income taxpayers.

D) Any of the above could be true under a regressive tax system.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

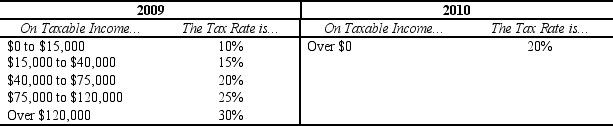

Table 12-10

The following table shows the marginal tax rates for unmarried individuals for two years.

-Refer to Table 12-10.For an individual who earned $80,000 in both years,which of the following statements is true regarding the individual's marginal tax rate?

-Refer to Table 12-10.For an individual who earned $80,000 in both years,which of the following statements is true regarding the individual's marginal tax rate?

A) The marginal tax rate is higher in 2010 than in 2009.

B) The marginal tax rate is the same in 2010 as it was in 2009.

C) The marginal tax rate is lower in 2010 than in 2009.

D) With a proportional tax, as in 2010, it is not possible to determine the individual's marginal tax rate so it is not possible to compare the marginal tax rates in the two years.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

From 1950 to today,government spending on Social Security,Medicare,and Medicaid as a percentage of GDP has

A) decreased from about ten percent to less than one percent.

B) increased from less than one percent to about ten percent.

C) remained constant at less than one percent.

D) remained constant at about ten percent.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Economists play an important role in the complex debates over tax policy by

A) identifying efficiency as the most important goal of tax policy.

B) identifying equity as the most important goal of tax policy.

C) shedding light on the tradeoff between efficiency and equity in tax policy.

D) None of the above is correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One of the most difficult issues associated with trying to structure a tax policy to satisfy horizontal equity is determining

A) whether or not a taxpayer falls within the highest income quintile.

B) the level of transfer payments made to low-income groups.

C) the source of income for taxpayers.

D) what differences are relevant to a family's ability to pay.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Horizontal equity refers to a tax system in which individuals with higher incomes pay more in taxes than individuals with lower incomes.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about a value added tax is not correct?

A) A value added tax is essentially the same as a retail sales tax.

B) A value added tax is a progressive tax.

C) A value added tax would provide a source of revenue to fund a large government.

D) A value added tax is a tax on consumption rather than income.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A person's marginal tax rate equals

A) her tax obligation divided by her average tax rate.

B) the increase in taxes she would pay as a percentage of the rise in her income.

C) her tax obligation divided by her income.

D) the increase in taxes if her average tax rate were to rise by 1%.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The difference between a value-added tax and a flat tax is

A) a value-added tax is progressive, while a flat tax is proportional.

B) a value-added tax is vertically equitable, while a flat tax is horizontally equitable.

C) a value-added tax satisfies the ability-to-pay principle, while a flat tax satisfies the benefits principle.

D) There is essentially no difference between a value-added tax and a flat tax.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

As of 2007,the largest source of receipts for state and local governments was individual income taxes.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Tax evasion is legal,but tax avoidance is illegal.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) Equity is more important than efficiency as a goal of the tax system.

B) Efficiency is more important than equity as a goal of the tax system.

C) Both equity and efficiency are important goals of the tax system.

D) Neither equity nor efficiency is an important goal of the tax system.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The middle quintile of income earners

A) pays 14.2 percent of income as taxes and pays 9.1 percent of all taxes

B) pays 9.1 percent of income as taxes and pays 14.2 percent of all taxes.

C) pays 17.6 percent of income as taxes and pays 16.5 percent of all taxes.

D) pays 16.5 percent of income as taxes and pays 17.6 percent of all taxes.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

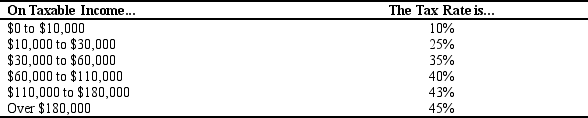

Table 12-9

The table below shows the marginal tax rates for an unmarried taxpayer for various levels of taxable income.

-Refer to Table 12-9.For this tax schedule,what is the marginal tax rate for an individual with taxable income of $49,000?

-Refer to Table 12-9.For this tax schedule,what is the marginal tax rate for an individual with taxable income of $49,000?

A) 0%

B) 10%

C) 25%

D) 35%

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 381 - 400 of 478

Related Exams