A) in unequal conditions should be treated differently.

B) in equal conditions should pay equal taxes.

C) should pay taxes based on the benefits they receive from the government.

D) should pay a proportional tax rather than a progressive tax.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

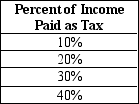

Table 12-15

-Refer to Table 12-15.The tax system is

-Refer to Table 12-15.The tax system is

A) proportional.

B) regressive.

C) progressive.

D) lump sum.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following tax systems is the most fair?

A) proportional taxes

B) regressive taxes

C) progressive taxes

D) There is no objective way to assess fairness among the three systems.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 12-1 Skip places a $20 value on a bottle of wine, and Walt places a $17 value on it. The equilibrium price for a bottle of wine is $15. -Refer to Scenario 12-1.Suppose the government levies a tax of $1 on each bottle of wine,and the equilibrium price of a bottle of wine increases to $16.Because total consumer surplus has

A) fallen by more than the tax revenue, the tax has a deadweight loss.

B) fallen by less than the tax revenue, the tax has no deadweight loss.

C) fallen by exactly the amount of the tax revenue, the tax has no deadweight loss.

D) increased by less than the tax revenue, the tax has a deadweight loss.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax on the wages that a firm pays its workers is called

A) an income tax.

B) an excise tax.

C) a consumption tax.

D) a payroll tax.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 12-3 Suppose that Bob places a value of $10 on a movie ticket and that Lisa places a value of $7 on a movie ticket. In addition, suppose the price of a movie ticket is $5. -Refer to Scenario 12-3.Suppose the government levies a tax of $3 on a movie ticket and that,as a result,the price of a movie ticket increases to $8.What is the deadweight loss from the tax?

A) $0

B) $1

C) $2

D) $3

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) Vertical equity is the idea that taxpayers with similar abilities to pay taxes should pay the same amount.

B) Horizontal equity is the idea that taxes should be levied on a person according to how well that person can shoulder the burden.

C) A regressive tax would mean that high-income tax payers pay a larger fraction of their income in taxes than would low-income taxpayers.

D) A proportional tax would mean that high-income and low-income taxpayers pay the same fraction of income in taxes.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

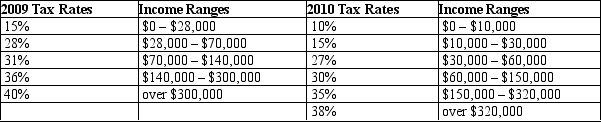

Table 12-12

United States Income Tax Rates for a Single Individual, 2009 and 2010.

-Refer to Table 12-12.Mia is a single person whose taxable income is $100,000 a year.What is her average tax rate in 2010?

-Refer to Table 12-12.Mia is a single person whose taxable income is $100,000 a year.What is her average tax rate in 2010?

A) 24.1%

B) 26.4%

C) 27.8%

D) 30.9%

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Incentives to work and save are reduced when

A) income taxes are higher.

B) consumption taxes replace income taxes.

C) corrective taxes are implemented.

D) All of the above are correct.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Resources devoted to complying with the tax laws are a type of deadweight loss.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

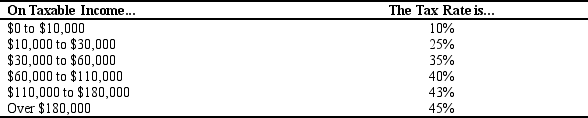

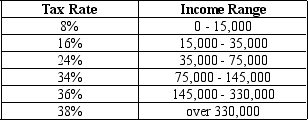

Table 12-9

The table below shows the marginal tax rates for an unmarried taxpayer for various levels of taxable income.

-Refer to Table 12-9.For this tax schedule,what is the marginal tax rate for an individual with $212,000 in taxable income?

-Refer to Table 12-9.For this tax schedule,what is the marginal tax rate for an individual with $212,000 in taxable income?

A) 0%

B) 1%

C) 2%

D) 45%

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2009,social insurance taxes represented approximately what percentage of total receipts for the federal government?

A) 12%

B) 22%

C) 32%

D) 42%

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a way that a corporate tax on the income of U.S.car companies will affect markets?

A) The price of cars will rise.

B) The wages of auto workers will fall.

C) Owners of car companies (stockholders) will receive less profit.

D) Less deadweight loss will occur since corporations are entities and not people who respond to incentives.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

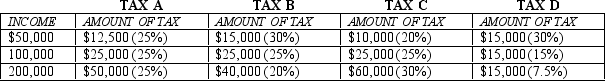

Table 12-14

-Refer to Table 12-14.A progressive tax is illustrated by tax

-Refer to Table 12-14.A progressive tax is illustrated by tax

A) A.

B) B.

C) C.

D) D.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the absence of taxes,Ashley would prefer to purchase a large sport utility vehicle (SUV) .The government has recently decided to place a $10,000 nuisance tax on SUVs.If Ashley decides to purchase a small economy car as a result of the tax,which of the following statements is correct?

A) Other people who choose to purchase SUVs will incur the cost of the deadweight loss of the tax.

B) There are no deadweight losses as long as some people still choose to purchase SUVs.

C) In order to determine the magnitude of the deadweight loss, we must add the revenues from the tax to the loss in Ashley's consumer surplus.

D) Ashley is worse off, and her loss of welfare is part of the deadweight loss of the tax.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A consumption tax is a tax on

A) goods but not on services.

B) the amount of income that people spend.

C) the amount of income that people earn.

D) the amount of income that people save.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Table 12-2

Consider the tax rates shown in the table below.

-Refer to Table 12-2.If Livi has taxable income of $78,000,her marginal tax rate is

-Refer to Table 12-2.If Livi has taxable income of $78,000,her marginal tax rate is

A) 19.3%.

B) 24.0%.

C) 26.8%.

D) 34.0%.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Vertical equity and horizontal equity are associated with

A) the benefits principle of taxation.

B) the ability-to-pay principle of taxation.

C) taxes that have no deadweight losses.

D) falling marginal tax rates.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2009,the federal government spent 5 percent of the budget on net interest.Which of the following statements regarding net interest is correct?

A) If the government pays down its debt, the amount of the budget needed for net interest decreases.

B) If the government accrues more debt, the amount of the budget needed for net interest increases.

C) In 2009, the federal government spent 187 billion dollars to cover interest payments on its loans.

D) All of the above are correct.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Deadweight losses arise because a tax causes some individuals to change their behavior.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 321 - 340 of 478

Related Exams