A) $30,500

B) $580,200

C) $600,000

D) $660,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Percentage depletion enables the taxpayer to recover more than the cost of an asset in the form of tax deductions.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Pat purchased a used five-year class asset on March 15, 2019, for $60,000.He did not elect § 179 expensing. Determine the cost recovery deduction for 2019 for earnings and profits purposes.

A) $2,000

B) $3,000

C) $6,000

D) $12,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a required test for the deduction of a business expense?

A) Ordinary

B) Necessary

C) Reasonable

D) All of these

E) None of these

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

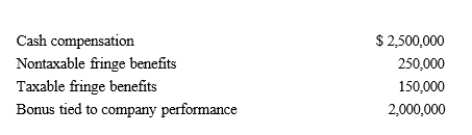

Wanda is the Chief Executive Officer of Pink corporation, a publicly traded, calendar year C corporation.For the current year, Wanda's compensation package consists of:  How much of Wanda's compensation is deductible by Pink Corporation?

How much of Wanda's compensation is deductible by Pink Corporation?

A) $1,000,000.

B) $1,250,000.

C) $3,250,000.

D) $4,900,000.

E) None of these.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Assets that do not have a determinable useful life are not eligible for cost recovery under MACRS.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a taxpayer operates an illegal business, no deductions are permitted.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Under MACRS, if the mid-quarter convention is applicable, all property sold is treated as being sold at the mid-point of the quarter in which it is placed in service.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The key date for calculating cost recovery is the date the asset is placed in service.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The cost recovery period for three-year class property is four years.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

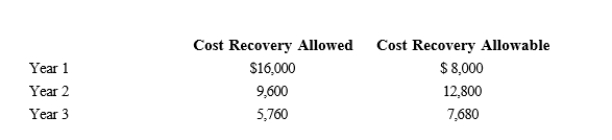

Tara purchased a machine for $40,000 to be used in her business.The cost recovery allowed and allowable for the three years the machine was used are computed as follows.

If Tara sells the machine after three years for $15,000, how much gain should she recognize?

If Tara sells the machine after three years for $15,000, how much gain should she recognize?

A) $3,480

B) $6,360

C) $9,240

D) $11,480

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Purchased goodwill must be capitalized but can be amortized over a 60-month period.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Terry and Jim are both involved in operating illegal businesses.Terry operates a gambling business and Jim operates a drug-running business.Both businesses have gross revenues of $500,000.The businesses incur the following expenses.  Which of the following statements is correct?

Which of the following statements is correct?

A) Neither Terry nor Jim can deduct any of these items in calculating the business profit.

B) Terry should report profit from his business of $250,000.

C) Jim should report profit from his business of $500,000.

D) Jim should report profit from his business of $250,000.

E) None of these.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On June 1, 2019, Red Corporation purchased an existing business.With respect to the acquired assets of the business, Red allocated $300,000 of the purchase price to a patent.The patent will expire in 20 years.Determine the total amount that Red may amortize for 2019 for the patent.

A) $0

B) $1,667

C) $11,667

D) $35,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Cost depletion is determined by multiplying the depletion cost per unit by the number of units sold.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Goodwill associated with the acquisition of a business cannot be amortized.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The amount of the addition to the reserve for bad debts for an accrual method taxpayer is allowed as a deduction for tax purposes but is not allowed for a cash method taxpayer.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The Code does not specifically define what constitutes a trade or business.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The § 179 limit for a sports utility vehicle with a GVW of 7,000 pounds will not apply if the sports utility vehicle is used as a taxi.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The amortization period for $58,000 of startup expenses is 180 months.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 143

Related Exams