A) If the taxpayer is not already engaged in the trade or business, the expenses incurred are deductible if the project is abandoned.

B) Expenses may be deducted immediately by a taxpayer engaged in a similar trade or business regardless of whether the business being investigated is acquired.

C) That business must be related to the taxpayer's present business for any expense ever to be deductible.

D) Regardless of whether the taxpayer is already engaged in the trade or business, the expenses must be capitalized and amortized.

E) None of these.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

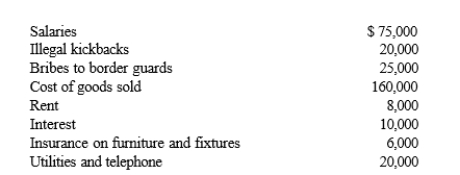

Tom operates an illegal drug-running operation and incurred the following expenses:  Which of the following amounts reduces his taxable income?

Which of the following amounts reduces his taxable income?

A) $119,000.

B) $160,000.

C) $279,000.

D) $324,000.

E) None of these.

G) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Intangible drilling costs are capitalized and recovered through depletion.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Under the alternative depreciation system (ADS), the half-year convention must be used for personalty.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Hans purchased a new passenger automobile on August 17, 2019, for $30,000.During the year, the car was used 40% for business and 60% for personal use.Determine his cost recovery deduction for the car for 2019.

A) $500

B) $1,000

C) $1,200

D) $1,333

F) All of the above

Correct Answer

verified

C

Correct Answer

verified

True/False

The period in which an accrual basis taxpayer can deduct an expense is determined by applying the economic performance and all events tests.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The § 179 deduction can exceed $1,020,000 in 2019 if the taxpayer had a § 179 amount that exceeded the taxable income limitation in the prior year.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On March 1, 2019, Lana leases and places in service a passenger automobile.The lease will run for five years and the payments are $500 per month.During 2019, she uses her car 60% for business and 40% for personal activities.Assuming the dollar amount from the IRS table for auto leases is $70, determine Lana's gross income attributable to the lease.

A) $0

B) $35

C) $59

D) $70

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

On December 20, 2019, the directors of Quail Corporation (an accrual basis, calendar year C corporation) authorized a cash donation of $5,000 to the American Cancer Society, a qualified charity.The payment, which is made on April 6, 2020, may be claimed as a deduction for tax year 2019.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Marge sells land to her adult son, Jason, for its $20,000 appraised value.Her adjusted basis for the land is $25,000. Marge's recognized loss is $5,000, and Jason's adjusted basis for the land is $25,000 ($20,000 cost + $5,000 recognized lossof Marge).

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The portion of a shareholder-employee's salary that is classified as unreasonable has no effect on the amount of the shareholder-employee's gross income but results in an increase in the taxable income of the corporation.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Tan Company acquires a new machine (10-year property) on January 15, 2019, at a cost of $200,000.Tan also acquires another new machine (7-year property) on November 5, 2019, at a cost of $40,000.No election is made to use the straight-line method.The company does not make the § 179 election and elects to not take additional first- year depreciation.Determine the total deductions in calculating taxable income related to the machines for 2019.

A) $24,000

B) $25,716

C) $102,000

D) $132,858

E) None of these.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Maple Company purchases new equipment (7-year MACRS property) on January 10, 2019, at a cost of $430,000. Maple also purchases new machines (5-year MACRS property) on July 19, 2019 at a cost of $290,000.Maple wants to maximize its MACRS deductions; assume no taxable income limitations apply.What is Maple's total MACRS deduction for 2019?

A) $119,447.

B) $560,000.

C) $617,148.

D) $720,000.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Once the more-than-50% business usage test is passed for listed property, it still matters if the business usage for the property drops to 50% or less during the recovery period.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Under the MACRS straight-line election for personalty, only the half-year convention is applicable.

B) False

Correct Answer

verified

False

Correct Answer

verified

True/False

The cost recovery basis for property converted from personal use to business use may be the fair market value of the property at the time of the conversion.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Doug purchased a new factory building on January 15, 1991, for $400,000.On March 1, 2019, the building was sold. Determine the cost recovery deduction for the year of the sale; Doug did not use the MACRS straight-line method.

A) $0

B) $1,587

C) $2,645

D) $12,696

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Research and experimental expenditures do not include the cost of consumer surveys.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

For a new car that is used predominantly in business, the "luxury auto" limit depends on whether the taxpayer takes MACRS or straight-line depreciation.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a "trade or business" expense?

A) Interest on business indebtedness.

B) Property taxes on business property.

C) Parking ticket paid on business auto.

D) Depreciation on business property.

E) All of these are "trade or business" expenses.

G) A) and D)

Correct Answer

verified

C

Correct Answer

verified

Showing 1 - 20 of 143

Related Exams