B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bruce, who is single, had the following items for the current year: ∙ Salary of $80,000. ∙ Gain of $20,000 on the sale of § 1244 stock acquired two years earlier. ∙ Loss of $75,000 on the sale of § 1244 stock acquired three years earlier. ∙ Worthless stock of $15,000.The stock was acquired on February 1 of the prior year and became worthless on January 15 of the current year. Determine Bruce's AGI for the current year.

A) $27,000

B) $38,000

C) $42,000

D) $47,000

E) None of these.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If a business debt previously deducted as partially worthless becomes totally worthless this year, only the amount not previously deducted can be deducted this year.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Currently, a personal casualty loss deduction is allowed only for losses occurring in a Federally declared disaster area.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Alicia was involved in an automobile accident in 2019.Her car was used 60% for business and 40% for personal use.The car had originally cost $40,000.At the time of the accident, the car was worth $20,000 and Alicia had taken $8,000 of depreciation.The car was totally destroyed and Alicia had let her car insurance expire.If her AGI is $50,000 (before considering the loss) , determine her AGI and itemized deduction for the casualty loss.

A) $34,000; $-0-.

B) $50,000; $-0-.

C) $34,000; $4,500.

D) $26,000; $5,700.

E) None of these.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Wayne owns a small apartment building that produces a $45,000 loss during the year.His AGI before considering the rental loss is $85,000.Because Wayne is an active participant with respect to the rental activity, he may deduct the $45,000 loss.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A cash basis taxpayer must include as income the proceeds from the sale of an account receivable to a collection agency.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Oriole Corporation has active income of $45,000 and a passive activity loss of $23,000 in the current year.Under an exception, Oriole can deduct the $23,000 loss if it is a personal service corporation.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The excess business loss rule applies to partnerships and S corporations (rather than partners and shareholders).

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Gray Company, a closely held C corporation, incurs a $50,000 loss on a passive activity during the year.The company has active income of $34,000 and portfolio income of $24,000.If Gray is not a personal service corporation, it may deduct $34,000 of the passive activity loss.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2019, Kipp invested $65,000 for a 30% interest in a partnership conducting a passive activity.The partnership reported losses of $200,000 in 2019 and $100,000 in 2020, Kipp's share being $60,000 in 2019 and $30,000 in 2020.How much of the losses from the partnership can Kipp deduct assuming he owns no other investments and does not participate in the partnership's operations?

A) $0 in 2019; $30,000 in 2020.

B) $60,000 in 2019; $30,000 in 2020.

C) $60,000 in 2019; $5,000 in 2020.

D) $60,000 in 2019; $0 in 2020.

E) None of these.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If an account receivable written off during a prior year is subsequently collected during the current year, the amount collected must be included in the gross income of the current year to the extent it created a tax benefit in the prior year.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Carol made a gift to Tim of a passive activity (adjusted basis of $50,000, suspended losses of $20,000, and a fair market value of $80,000) .No gift tax resulted from the transfer.

A) Tim's adjusted basis is $80,000, and he can deduct the $20,000 of suspended losses in the future.

B) Tim's adjusted basis is $80,000.

C) Tim's adjusted basis is $50,000, and the suspended losses are lost.

D) Tim's adjusted basis is $50,000, and he can deduct the $20,000 of suspended losses in the future.

E) None of these applies here.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Paula owns four separate activities.She elects not to group them together as a single activity under the "appropriate economic unit" standard.Paula participates for 130 hours in Activity A, 115 hours in Activity B, 260 hours in Activity C, and 100 hours in Activity D.She has one employee, who works 125 hours in Activity D.Which of the following statements is correct?

A) Activities A, B, C, and D are all significant participation activities.

B) Paula is a material participant with respect to Activities A, B, C, and D.

C) Paula is not a material participant with respect to Activities A, B, C, and D.

D) Losses from all of the activities can be used to offset Paula's active income.

E) None of these is correct.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Tomas participates for 300 hours in Activity A and 250 hours in Activity B, both of which are nonrental businesses. Both activities are active.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If the amount of the insurance recovery for a theft of business property is greater than the asset's fair market value (FMV) but less than its adjusted basis, a gain is recognized.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Peggy is in the business of factoring accounts receivable.Last year, she purchased a $30,000 account receivable for $25,000.This year, the account was settled for $25,000.How much loss can Peggy deduct and in which year?

A) $5,000 for the current year.

B) $5,000 for the prior year and $5,000 for the current year.

C) $5,000 for the prior year.

D) $10,000 for the current year.

E) None of these.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

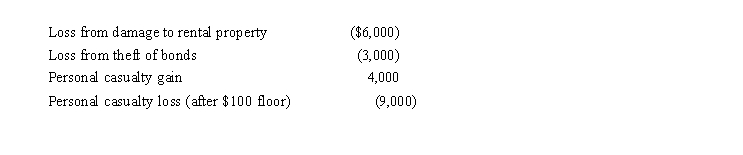

In 2019, Morley, a single taxpayer, had an AGI of $30,000 before considering the following items:  The personal casualties occurred in a Federally declared disaster area.Determine the amount of Morley's itemized deduction from the losses.

The personal casualties occurred in a Federally declared disaster area.Determine the amount of Morley's itemized deduction from the losses.

A) $0

B) $2,900

C) $5,120

D) $5,600

E) None of these.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2019, Grant's personal residence was completely destroyed by fire.He was insured for 100% of his actual loss, and he received the insurance settlement.Grant had adjusted gross income before considering the casualty item of $30,000.Pertinent data with respect to the residence follows:  What is Grant's allowable casualty loss deduction?

What is Grant's allowable casualty loss deduction?

A) $0

B) $6,500

C) $6,900

D) $10,000

E) $80,000

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Jennifer gave her interest in a passive activity (fair market value of $75,000 and basis of $60,000) to Harrison. Associated with the interest is a suspended passive activity loss of $8,000.Upon making the gift, the suspended passive activity loss is not deductible to Jennifer, but it will benefit Harrison.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 147

Related Exams