Correct Answer

verified

Correct Answer

verified

Multiple Choice

Nebraska Inc. issues 3,000 shares of common stock for $45,000. The stock has a stated value of $10 per share. The journal entry to record the stock issuance would include a credit to Common Stock for

A) $30,000

B) $45,000

C) $15,000

D) $3,000

F) A) and C)

Correct Answer

verified

A

Correct Answer

verified

Essay

Prepare entries to record the following: (a)Issued 1,000 shares of $10 par common stock at $56.(b)Issued 1,400 shares of $10 par common stock in exchange for equipment with a fair market price of $21,000.(c)Purchased 100 shares of treasury stock at $25.(d)Sold the 100 shares of treasury stock purchased in (c) at $30.

Correct Answer

verified

Correct Answer

verified

True/False

When common stock is issued in exchange for land, the land should be recorded in the accounts at the par value of the stock issued.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

Alma Corp. issues 1,000 shares of $10 par common stock at $14 per share. Journalize the transaction.

Correct Answer

verified

Correct Answer

verified

True/False

The cost of treasury stock is deducted from total paid-in capital and retained earnings in determining total stockholders' equity.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A corporation is a separate entity for accounting purposes but not for legal purposes.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not true of a corporation?

A) It may enter into binding legal contracts in its own name.

B) It may sue and be sued.

C) The acts of its owners bind the corporation.

D) It may buy, own, and sell property.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The cumulative effect of the declaration and payment of a cash dividend on a company's financial statements is to

A) decrease total liabilities and stockholders' equity

B) increase total expenses and total liabilities

C) increase total assets and stockholders' equity

D) decrease total assets and stockholders' equity

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stockholders' equity

A) is usually equal to cash on hand

B) includes paid-in capital and liabilities

C) includes retained earnings and paid-in capital

D) is shown on the income statement

F) C) and D)

Correct Answer

verified

C

Correct Answer

verified

True/False

A large public corporation normally uses registrars and transfer agents to maintain records of the stockholders.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

Match the following stockholders' equity concepts to the appropriate term (a-h). -Account used when shares are issued for an amount greater than par value A)cash dividend B)date of record C)Stock Dividends Distributable D)date of declaration E)treasury stock F)preferred stock G)date of payment H)Paid-In Capital in Excess of Par

Correct Answer

verified

Correct Answer

verified

True/False

For accounting purposes, stated value is treated the same way as par value.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

On February 1, Marine Company reacquired 7,500 shares of its common stock at $30 per share. On March 15, Marine sold 4,500 of the reacquired shares at $34 per share. On June 2, Marine sold the remaining shares at $28 per share. Journalize the transaction of February 1, March 15, and June 2.

Correct Answer

verified

Correct Answer

verified

True/False

A restriction/appropriation of retained earnings establishes cash assets that are set aside for a specific purpose.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

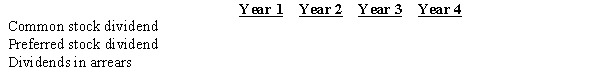

On January 1, Year 1, a company had the following transactions:

- Issued 10,000 shares of $2.00 par common stock for $12.00 per share.- Issued 3,000 shares of $50 par, 6% cumulative preferred stock for $70 per share.- Purchased 1,000 shares of previously issued common stock for $15.00 per share.- No other shares of stock were issued or outstanding.

The company had the following dividend information available:

Year 1 - No dividend paid

Year 2 - Paid a $2,000 total dividend

Year 3 - Paid a $20,000 total dividend

Year 4 - Paid a $25,000 total dividend

Using the following format, fill in the correct values for each year:

Correct Answer

verified

Correct Answer

verified

Short Answer

Match each of the following stockholders' equity concepts to the most appropriate term (a-h). -The dollar amount assigned to each share of stock A)authorized shares B)issued shares C)outstanding shares D)par value E)common stock F)preferred stock G)Paid-In Capital in Excess of Par H)transfer agent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The liability for a dividend is recorded on which of the following dates?

A) the date of record

B) the date of payment

C) the last day of the fiscal year

D) the date of declaration

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The two main sources of stockholders' equity are

A) investments by stockholders and net income retained in the business

B) investments by stockholders and dividends paid

C) net income retained in the business and dividends paid

D) investments by stockholders and purchases of assets

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sabas Company has 20,000 shares of $100 par, 2% cumulative preferred stock and 100,000 shares of $50 par common stock. The following amounts were distributed as dividends: Year 1: $10,000 Year 2: 45,000 Year 3: 90,000 Determine the dividends per share for preferred and common stock for the third year.

A) $4.50 and $0.25

B) $3.25 and $0.25

C) $4.50 and $0.90

D) $2.00 and $0.25

F) B) and C)

Correct Answer

verified

B

Correct Answer

verified

Showing 1 - 20 of 221

Related Exams