A) a legal minimum on the price at which a good can be sold.

B) often imposed when sellers of a good are successful in their attempts to convince the government that the market outcome is unfair without a price floor.

C) a source of inefficiency in a market.

D) All of the above are correct.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A price floor set above the equilibrium price is not binding.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

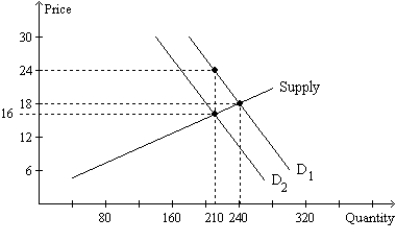

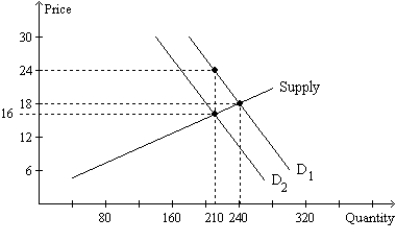

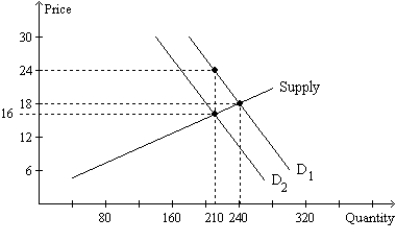

Figure 6-24  -Refer to Figure 6-24. Which of the following statements is correct?

-Refer to Figure 6-24. Which of the following statements is correct?

A) The amount of the tax per unit is $6.

B) The tax leaves the size of the market unchanged.

C) The tax is levied on buyers of the good, rather than on sellers.

D) All of the above are correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The term tax incidence refers to how the burden of a tax is distributed among the various people who make up the economy.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A binding minimum wage tends to

A) cause a labor surplus.

B) cause unemployment.

C) have the greatest impact in the market for teenage labor.

D) All of the above are correct.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the government wants to reduce the burning of fossil fuels, it should impose a tax on

A) buyers of gasoline.

B) sellers of gasoline.

C) either buyers or sellers of gasoline.

D) whichever side of the market is less elastic.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

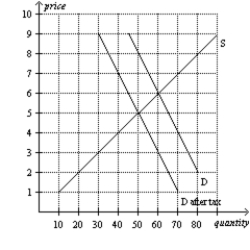

Figure 6-25  -Refer to Figure 6-25. The price that buyers pay after the tax is imposed is

-Refer to Figure 6-25. The price that buyers pay after the tax is imposed is

A) $5.

B) $6.

C) $7.

D) $8.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

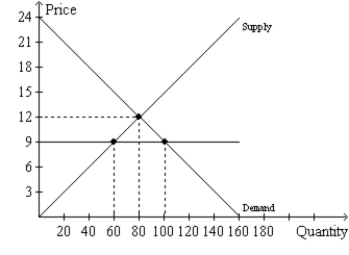

Figure 6-14  -Refer to Figure 6-14. If the horizontal line on the graph represents a price ceiling, then the price ceiling is

-Refer to Figure 6-14. If the horizontal line on the graph represents a price ceiling, then the price ceiling is

A) binding and creates a shortage of 20 units of the good.

B) binding and creates a shortage of 40 units of the good.

C) not binding but creates a shortage of 40 units of the good.

D) not binding, and there will be no surplus or shortage of the good.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Studies of the effects of the minimum wage typically find that a 10 percent increase in the minimum wage depresses teenage employment by about

A) 1 to 3 percent.

B) 5 to 7 percent.

C) 10 percent.

D) None of the above is correct because studies show no decrease in teenage employment.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the government levies a $5 tax per MP3 player on buyers of MP3 players, then the price paid by buyers of MP3 players would likely

A) increase by more than $5.

B) increase by exactly $5.

C) increase by less than $5.

D) decrease.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A binding minimum wage creates a surplus of labor.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

States in the U.S. may mandate minimum wages above the federal level.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is correct?

A) Studies of the effects of the minimum wage typically find that a 10 percent increase in the minimum wage raises the average wage of teenagers by 10 percent.

B) The drop in teenage employment caused by a 10 percent increase in the minimum wage is not significant.

C) The minimum wage is more often binding for teenagers than for other members of the labor force.

D) All firms consistently enforce minimum-wage laws.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 6-24  -Refer to Figure 6-24. The price paid by buyers after the tax is imposed is

-Refer to Figure 6-24. The price paid by buyers after the tax is imposed is

A) $24.

B) $21.

C) $18.

D) $16.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An alternative to rent-control laws that would not reduce the quantity of housing supplied is

A) the payment by government of a fraction of a poor family's rent.

B) higher taxes on rental income earned by landlords.

C) a policy that prevents landlords from evicting tenants.

D) a policy that allows government to confiscate residential property for the purpose of commercial development.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the government levies a $5 tax per ticket on buyers of NFL game tickets, then the price paid by buyers of NFL game tickets would

A) increase by less than $5.

B) increase by exactly $5.

C) increase by more than $5.

D) decrease by an indeterminate amount.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a binding price floor is imposed on a market to benefit sellers,

A) every seller in the market benefits.

B) all buyers and sellers benefit.

C) every seller who wants to sell the good will be able to do so, but only if he appeals to the personal biases of the buyers.

D) some sellers will not be able to sell any amount of the good.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 6-24  -Refer to Figure 6-24. What is the amount of the tax per unit?

-Refer to Figure 6-24. What is the amount of the tax per unit?

A) $8

B) $6

C) $4

D) $2

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the government removes a tax on a good, then the price paid by buyers will

A) increase, and the price received by sellers will increase.

B) increase, and the price received by sellers will decrease.

C) decrease, and the price received by sellers will increase.

D) decrease, and the price received by sellers will decrease.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Economic policies often have effects that their architects did not intend or anticipate.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 201 - 220 of 671

Related Exams