B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under the Swan Company's cafeteria plan, all full-time employees are allowed to select any combination of the benefits below, but the total received by the employee cannot exceed $8,000 a year. I.Group medical and hospitalization insurance for the employee, $3,600 a year. II) Group medical and hospitalization insurance for the employee's spouse and children, $1,200 a year. III) Child-care payments, actual cost but not more than $4,800 a year. IV) Cash required to bring the total of benefits and cash to $8,000. Which of the following statements is true?

A) Sam, a full-time employee, selects choices II and III and $2,000 cash.His gross income must include the $2,000.

B) Paul, a full-time employee, elects to receive $8,000 cash because his wife's employer provided these same insurance benefits for him.Paul is not required to include the $8,000 in gross income.

C) Sue, a full-time employee, elects to receive choices I, II and $3,200 for III.Sue is required to include $3,200 in gross income.

D) All of these.

E) None of these.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which, if any, of the following factors is not a characteristic of independent contractor status?

A) Work-related expenses are reported on Form 2106.

B) Receipt of a Form 1099 reporting payments received.

C) Workplace fringe benefits are not available.

D) Services are performed for more than one party.

E) None of these.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following expenses, if any, qualify as deductible?

A) Contributions to a Coverdell Education Savings Account CESA) .

B) Contributions to a qualified tuition program § 529 plan) .

C) Job hunting expense of FBI agent who applies for the job of city manager of Beaumont TX) .

D) Contribution to a traditional IRA.

E) None of these.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Sarah's employer pays the hospitalization insurance premiums for a policy that covers all employees and retired former employees.After Sarah retires, the hospital insurance premiums paid for her by her employer can be excluded from her gross income.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A taxpayer who claims the standard deduction may be able to claim an office in the home deduction.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Allowing for the overall limitation 50% reduction for meals) , which of the following trips, if any, will qualify for the travel expense deduction?

A) Dr.Jones, a self-employed general dentist, attends a two-day seminar on developing a dental practice.

B) Dr.Brown, a self-employed surgeon, attends a two-day seminar on financial planning.

C) Paul, a romance language high school teacher, spends summer break in France, Portugal, and Spain improving his language skills.

D) Myrna went on a two-week vacation in Boston.While there, she visited her employer's home office to have lunch with former co-workers.

E) All of these.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

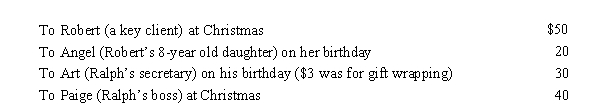

Ralph made the following business gifts during the year.  Presuming proper substantiation, Ralph's deduction is:

Presuming proper substantiation, Ralph's deduction is:

A) $0.

B) $53.

C) $73.

D) $78.

E) $98.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

A deduction for parking and other traffic violations incurred during business use of the automobile is allowed under the actual cost method but not the automatic mileage method.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

Sue does not file a Schedule SE with her Form 1040.

Correct Answer

verified

Correct Answer

verified

True/False

Fresh Bakery often has unsold donuts at the end of the day.The bakery allows employees to take the leftovers home.The employees are not required to recognize gross income because the bakery does not incur any additional cost.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 121 - 131 of 131

Related Exams