B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Randy is the manager of a motel.As a condition of his employment, Randy is required to live in a room on the premises so that he would be there in case of emergencies.Randy considered this a fringe benefit, since he would otherwise be required to pay $800 per month rent.The room that Randy occupied normally rented for $70 per night, or $2,100 per month.On the average, 90% of the motel rooms were occupied.As a result of this rent-free use of a room, Randy is required to include in gross income.

A) $0.

B) $800 per month.

C) $2,100 per month.

D) $1,890 $2,100 × .90) .

E) None of these.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jordan performs services for Ryan.Which, if any, of the following factors indicate that Jordan is an independent contractor, rather than an employee?

A) Ryan sets the work schedule.

B) Ryan provides the tools used.

C) Jordan follows a specific set of instructions from Ryan to complete tasks.

D) Jordan is paid based on tasks performed.

E) None of these.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Under the right circumstances, a taxpayer's meals and lodging expense can qualify as a deductible education expense.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

For a person who is in the 35% marginal tax bracket, $1,000 of tax-exempt income is equivalent to $1,350 of income that is subject to tax.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When using the automatic mileage method, which, if any, of the following expenses also can be claimed?

A) Engine tune-up.

B) Parking.

C) Interest on automobile loan.

D) MACRS depreciation.

E) None of these.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The work-related expenses of an independent contractor are treated as itemized deductions.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Under the simplified method, the maximum office in the home deduction allowed is the greater of $1,500 or the office square feet × $5.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

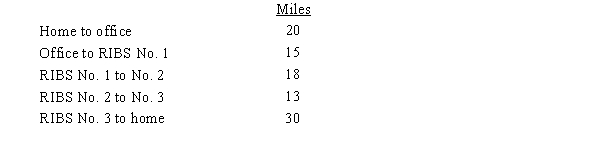

Corey is the city sales manager for "RIBS," a national fast food franchise.Every working day, Corey drives his car as follows:  Corey renders an adequate accounting to his employer.As a result, Corey's reimburseable mileage is:

Corey renders an adequate accounting to his employer.As a result, Corey's reimburseable mileage is:

A) 0 miles.

B) 50 miles.

C) 66 miles.

D) 76 miles.

E) None of these.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The First Chance Casino has gambling facilities, a bar, a restaurant, and a hotel.All employees are allowed to obtain food from the restaurant at no charge during working hours.In the case of the employees who operate the gambling facilities, bar, and restaurant, 60% of all of Casino's employees, the meals are provided for the convenience of the Casino.However, the hotel workers demanded equal treatment and therefore were also allowed to eat in the restaurant at no charge while they are at work.Which of the following is correct?

A) All the employees are required to include the value of the meals in their gross income.

B) Only the restaurant employees may exclude the value of their meals from gross income.

C) Only the employees who work in gambling, the bar, and the restaurant may exclude the meals from gross income.

D) All of the employees may exclude the value of the meals from gross income.

E) None of these.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

By itself, credit card receipts will not constitute adequate substantiation for travel expenses.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Fran is a CPA who has a small tax practice in addition to working as the controller for a local manufacturing business.Fran runs her tax practice out of a 150 square foot office in her home where she meets clients and works on their tax returns and researches their tax issues.She meets the exclusive use test for this space.The gross income from her tax practice amounts to $7,500 for the year.Business expenses amount to $1,000.Based on square footage, $4,000 of Fran's mortgage interest and real estate taxes are allocable to the home office.The allocable portion of maintenance, utilities, and depreciation is $4,500.Assuming no other expenses related to the business were incurred, what amount of the maintenance, utilities, and depreciation is deductible by Fran?

A) $0.

B) $2,500.

C) $3,500.

D) $4,500.

E) None of the above.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

One indicator of independent contractor rather than employee) status is when the individual performing the services is paid based on time spent rather than on tasks performed).

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

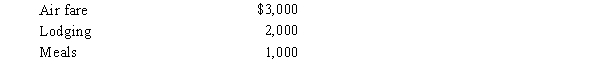

During the year, Walt self-employed) travels from Seattle to Tokyo Japan) on business.His time was spent as follows: 2 days travel one day each way), 2 days business, and 2 days personal.His expenses for the trip were as follows meals and lodging reflect only the business portion):  Presuming no reimbursement, Walt's deductible expenses are:

A)$3,500.

B)$4,500.

C)$5,500.

D)$6,000.

E)None of these.

Presuming no reimbursement, Walt's deductible expenses are:

A)$3,500.

B)$4,500.

C)$5,500.

D)$6,000.

E)None of these.

Correct Answer

verified

Correct Answer

verified

True/False

Nicole's employer pays her $150 per month towards the cost of parking near a railway station where Nicole catches the train to work.The employer also pays the cost of the rail pass, $75 per month.Nicole can exclude both of these payments from her gross income.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

For self-employed taxpayers, travel expenses are deductions for AGI.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A worker may prefer to be classified as an employee rather than an independent contractor) for which of the following reasons:

A) To claim unreimbursed work-related expenses as a deduction for AGI.

B) To avoid the self-employment tax.

C) To avoid the overall limitation 50%) on unreimbursed business entertainment expenses.

D) To avoid the limitations on unreimbursed work-related expenses.

E) None of these.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

For tax year 2018, Taylor used the simplified method of determining her office in the home deduction.For 2019, Taylor must continue to use the simplified method and cannot switch to the regular actual expense) method.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jenna Parker owns and manages her single member LLC which provides a wide variety of financial services to her clients.She is married and will file a joint tax return with her spouse, Paul.Her LLC reports $300,000 of net income, W-2 wages of $120,000, and assets with an unadjusted basis of $75,000.Their taxable income before the QBI deduction is $285.000 this is also their modified taxable income) .What is their QBI deduction for 2018?

A) $-0-.

B) $57,000.

C) $60,000.

D) $70,000.

E) None of the above.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Essay

Sue has unreimbursed expenses.

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 131

Related Exams