A) rise.

B) fall.

C) be unchanged.

D) move in an uncertain direction.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

When a firm wants to borrow directly from the public to finance the purchase of new equipment,it does so by selling shares of stock.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would likely make the interest rate on a bond higher than otherwise?

A) both high credit risk and a long term

B) high credit risk but not a long term

C) a long term but not a high credit risk

D) neither high credit risk nor a long term

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If a share of stock in Dell sells for $70,the retained earnings per share are $5,and the dividend per share is $2,then the price-earnings ratio is 10.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Interest rates fall and investment falls.Which of the following could explain these changes?

A) The government goes from a surplus to a deficit.

B) The government repeals an investment tax credit.

C) The government replaces a consumption tax with an income tax.

D) None of the above is correct.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Eye of Horus incense company has $10 million in cash which it has accumulated from retained earnings.It was planning to use the money to build a new factory.Recently,the rate of interest has increased.The increase in the rate of interest should

A) not influence the decision to build the factory because The Eye of Horus doesn't have to borrow any money.

B) not influence the decision to build the factory because its stockholders are expecting a new factory.

C) make it more likely that The Eye of Horus will build the factory because a higher interest rate will make the factory more valuable.

D) make it less likely that The Eye of Horus will build the factory because the opportunity cost of the $10 million is now higher.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the supply for loanable funds shifts to the left,then the equilibrium interest rate

A) and quantity of loanable funds rise.

B) and quantity of loanable funds fall.

C) rises and the quantity of loanable funds falls.

D) falls and the quantity of loanable funds rises.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2008,CDZ Corporation had total earnings of $500 million and CDZ retained 30 percent of its earnings for future investments.If the price of a share of CDZ stock is $70 and if 80 million shares of its stock were outstanding,then what is the price-earnings ratio?

A) 0.14

B) 11.2

C) 16.0

D) 37.3

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not an important stock exchange in the United States?

A) New York Stock Exchange

B) American Stock Exchange

C) Chicago Mercantile Exchange

D) NASDAQ

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If an economy is closed and if it has no government,then

A) national saving = private saving.

B) total income = consumption + investment.

C) saving = total income - consumption.

D) All of the above are correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

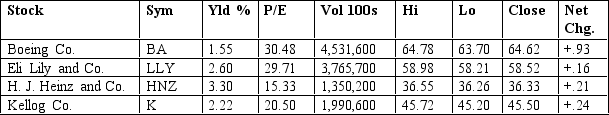

Table 13-2

-Refer to Table 13-2.Which company had the highest dollar dividend?

-Refer to Table 13-2.Which company had the highest dollar dividend?

A) Boeing Co.

B) Eli Lilly and Co.

C) H.J.Heinz and Co.

D) Kellog Co.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Banks and mutual funds are examples of financial markets.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a closed economy,if Y,C,and T remained the same,an increase in G would reduce

A) private saving and public saving.

B) private saving but not public saving.

C) public saving but not private saving.

D) neither private nor public saving.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

World Wide Delivery Service Corporation develops a way to speed up its deliveries and reduce its costs.We would expect that this would

A) raise the demand for existing shares of the stock,causing the price to rise.

B) decrease the demand for existing shares of the stock,causing the price to fall.

C) raise the supply of the existing shares of stock,causing the price to rise.

D) raise the supply of the existing shares of stock,causing the price to fall.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If Congress instituted an investment tax credit

A) it would make buying bonds more desirable,so the demand for loanable funds would shift.

B) it would make buying capital goods more desirable,so the demand for loanable funds would shift.

C) it would make buying bonds more desirable,so the supply of loanable funds would shift.

D) it would make buying capital goods more desirable,so the supply of loanable funds would shift.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the tax revenue of the federal government exceeds spending,then the government necessarily

A) runs a budget deficit.

B) runs a budget surplus.

C) runs a national debt.

D) will increase taxes.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All or part of a firm's profits may be paid out to the firm's stockholders in the form of

A) retained earnings.

B) dividends.

C) interest payments.

D) capital accounts.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You observe a closed economy that has a government deficit and positive investment.Which of the following is correct?

A) Private and public saving are both positive.

B) Private saving is positive;public saving is negative.

C) Private saving is negative;public saving is positive.

D) Both private saving and public saving are negative.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bay City Mining,Inc.has a price of $20 a share,outstanding shares of 2.5 million,retained earnings of $1 million dollars,and a dividend yield of 2 percent.It has a price-earnings ratio of

A) 50,which is high by historical standards.

B) 50,which is low by historical standards.

C) 25,which is high by historical standards.

D) 25,which is low by historical standards.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A perpetuity is

A) a financial intermediary that has existed throughout recorded history.

B) an instrument of equity finance.

C) a stock that pays dividends forever.

D) a bond that pays interest forever.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 281 - 300 of 502

Related Exams