B) False

Correct Answer

verified

Correct Answer

verified

True/False

Many people consider lump-sum taxes to be unfair to low-income taxpayers.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a government simplified its tax system the likeliest result would be

A) a decrease in consumer surplus.

B) a decrease in producer surplus.

C) a decrease in deadweight loss.

D) a decrease in tax revenues.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not an administrative burden of our tax system?

A) government resources used to enforce tax laws

B) keeping tax records throughout the year

C) paying the taxes owed

D) time spent in April filling out forms

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In which of the following tax systems do taxes increase as income increases?

A) both proportional and progressive

B) proportional but not progressive

C) progressive but not proportional

D) neither proportional nor progressive

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Deadweight losses represent the

A) inefficiency that taxes create.

B) shift in benefit from producers to consumers.

C) part of consumer and producer surplus that is now revenue to the government.

D) increase in revenue to the government.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

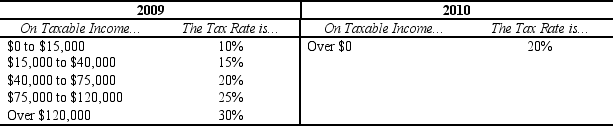

Table 12-10

The following table shows the marginal tax rates for unmarried individuals for two years.

-Refer to Table 12-10.For an individual who earned $80,000 of taxable income in 2009,what was the individual's average tax rate in 2009?

-Refer to Table 12-10.For an individual who earned $80,000 of taxable income in 2009,what was the individual's average tax rate in 2009?

A) 12.7%

B) 15.0%

C) 16.1%

D) 16.9%

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Country A's tax system is more efficient than Country B's tax system if

A) Country A collects less tax revenue than Country B,and the cost to taxpayers is the same in both countries.

B) Country A collects more tax revenue than Country B,even though the cost to taxpayers is greater in Country A than in Country B.

C) the same amount of revenue is raised in both countries,but the cost to taxpayers is smaller in Country A than in Country B.

D) the same amount of revenue is raised in both countries,but the taxes are collected in a shorter amount of time in Country A than in Country B.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Corporate profits are

A) included in payroll taxes.

B) exempt from taxes.

C) taxed twice,once as profit and once as dividends.

D) taxed to pay for Medicare.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Vertical equity refers to a tax system in which individuals with similar incomes pay similar taxes.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Lump-sum taxes are equitable but not efficient.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A country is using a proportional tax when

A) its marginal tax rate equals its average tax rate.

B) its marginal tax rate is less than its average tax rate.

C) its marginal tax rate is greater than its average tax rate.

D) it uses a lump-sum tax.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

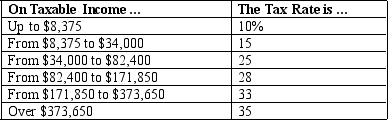

Table 12-1

-Refer to Table 12-1.If Betina has $170,000 in taxable income,her average tax rate is

-Refer to Table 12-1.If Betina has $170,000 in taxable income,her average tax rate is

A) 23.8%.

B) 24.3%.

C) 25.9%.

D) 28.0%.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

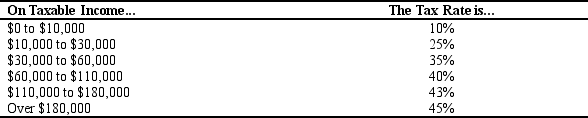

Table 12-9

The table below shows the marginal tax rates for an unmarried taxpayer for various levels of taxable income.

-Refer to Table 12-9.For this tax schedule,what is the average tax rate for an individual with $280,000 in taxable income?

-Refer to Table 12-9.For this tax schedule,what is the average tax rate for an individual with $280,000 in taxable income?

A) 39.9%

B) 40.2%

C) 42.7%

D) 44.8%

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the government levies a tax on a corporation,

A) all the burden of the tax ultimately falls on the corporation's owners.

B) the corporation is more like a tax collector than a taxpayer.

C) output must increase to compensate for reduced profits.

D) less deadweight loss will occur since corporations are entities and not people who respond to incentives.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Many health economists believe that President Obama's 2010 healthcare reform bill and other measures proposed by policymakers to reduce the growth of healthcare costs will have only a limited impact because

A) providing universal coverage is very expensive.

B) the main source of higher costs is medical advances which extend and improve lives.

C) lawsuits do not create a costly burden on the healthcare system.

D) encouraging competition does not usually result in lower costs.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) Both tax avoidance and tax evasion are legal.

B) Both tax avoidance and tax evasion are illegal.

C) Tax avoidance is legal,whereas tax evasion is illegal.

D) Tax avoidance is illegal,whereas tax evasion is legal.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

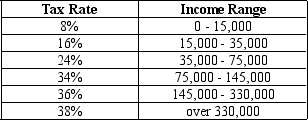

Table 12-2

Consider the tax rates shown in the table below.

-Refer to Table 12-2.If Noah has taxable income of $43,000,his average tax rate is

-Refer to Table 12-2.If Noah has taxable income of $43,000,his average tax rate is

A) 14.7%.

B) 16.3%.

C) 20.8%.

D) 24.0%.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Deadweight losses arise because a tax causes some individuals to change their behavior.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In addition to tax payments,the two other primary costs that a tax system inevitably imposes on taxpayers are

A) deadweight losses and administrative burdens.

B) deadweight losses and frustration with the political system.

C) administrative burdens and tax-preparation costs.

D) administrative burdens and the risk of punishment for failure to comply with tax laws.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 361 - 380 of 499

Related Exams