A) The private value of the 280th unit of output is $10.

B) The social value of the 280th unit of output is $28.

C) The external benefit of the 280th unit of output is $18.

D) All of the above are correct.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sally's cat causes Mike to sneeze.Sally values her cat's companionship at $300 per year.The cost to Mike of tissues and her allergy medication is $350 per year.Based on the Coase theorem,

A) Sally should pay Mike $400 so that she may keep her cat.

B) Sally should pay Mike $350 for tissues and allergy medication.

C) Mike should pay Sally $325 to give away her cat.

D) Mike should move.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is the most effective way to internalize a technology spillover?

A) taxes

B) patents

C) government regulations

D) free markets

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

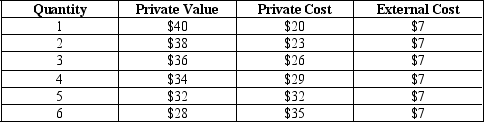

Table 10-4

-Refer to Table 10-4.Take into account private and external costs and assume the quantity of output is always a whole number (that is,fractional units of output are not possible) .The maximum total surplus that can be achieved in this market is

-Refer to Table 10-4.Take into account private and external costs and assume the quantity of output is always a whole number (that is,fractional units of output are not possible) .The maximum total surplus that can be achieved in this market is

A) $19.

B) $21.

C) $24.

D) $28.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

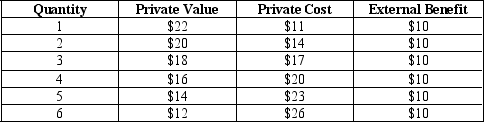

Table 10-3

-Refer to Table 10-3.What amount of subsidy per unit of output would move the market from the equilibrium level of output to the socially optimal level of output?

-Refer to Table 10-3.What amount of subsidy per unit of output would move the market from the equilibrium level of output to the socially optimal level of output?

A) $2

B) $3

C) $5

D) $10

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The Coase theorem asserts that private economic actors can solve the problem of externalities among themselves,without government intervention,regardless of whether those actors incur significant costs in reaching and enforcing an agreement.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is an example of a positive externality?

A) air pollution

B) a person littering in a public park

C) a nice garden in front of your neighbor's house

D) the pollution of a stream

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Markets sometimes fail to allocate resources efficiently.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

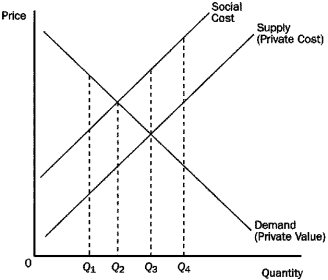

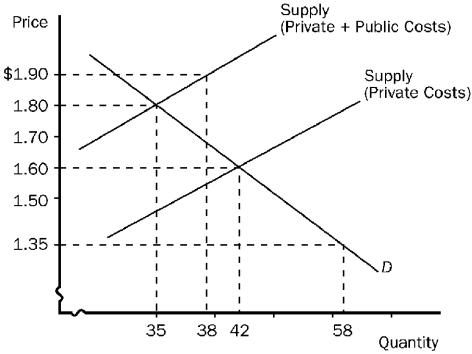

Figure 10-4  -Refer to Figure 10-4.At Q3

-Refer to Figure 10-4.At Q3

A) the marginal consumer values this product less than the social cost of producing it.

B) every consumer values this product less than the social cost of producing it.

C) the cost to society is equal to the value to society.

D) the marginal consumer values this product more than the private cost.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

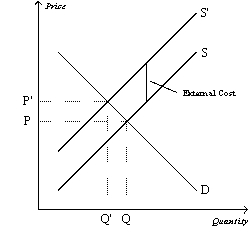

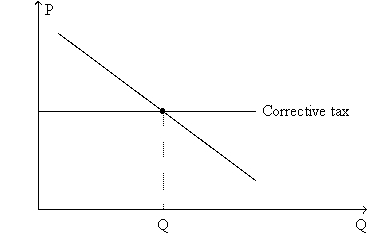

Figure 10-17  -Refer to Figure 10-17.How large would a corrective tax need to be to move this market from the equilibrium outcome to the socially-optimal outcome?

-Refer to Figure 10-17.How large would a corrective tax need to be to move this market from the equilibrium outcome to the socially-optimal outcome?

A) An amount equal to P' minus P.

B) An amount equal to P'.

C) An amount equal to P.

D) An amount equal to the external cost.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Honey producers provide a positive externality to orchards because

A) the honey producers get more honey.

B) the orchard owner frequently gets stung by the honey producer's bees.

C) the orchard owner does not have to purchase bees to pollinate his flowers.

D) the honey producers have to rent access to the orchard grounds.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When he was a candidate for president,Barack Obama proposed which of the following as a means of combating climate change?

A) a "cap and trade" system in which the government would give away permits to emit carbon

B) a "cap and trade" system in which the government would auction permits to emit carbon

C) a tax on carbon emissions

D) a government mandate to switch from gasoline-powered vehicles to vehicles powered by natural gas

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A paper plant produces water pollution during the production process.If the government forces the plant to internalize the negative externality,then the

A) supply curve for paper would shift to the right.

B) supply curve for paper would shift to the left.

C) demand curve for paper would shift to the right.

D) demand curve for paper would shift to the left.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 10-1  -Refer to Figure 10-1.This graph represents the tobacco industry.Without any government intervention,the equilibrium price and quantity are

-Refer to Figure 10-1.This graph represents the tobacco industry.Without any government intervention,the equilibrium price and quantity are

A) $1.90 and 38 units,respectively.

B) $1.80 and 35 units,respectively.

C) $1.60 and 42 units,respectively.

D) $1.35 and 58 units,respectively.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If an aluminum manufacturer does not bear the entire cost of the smoke it emits,it will

A) emit a lower level of smoke than is socially efficient.

B) emit a higher level of smoke than is socially efficient.

C) emit an acceptable level of smoke.

D) not emit any smoke in an attempt to avoid paying the entire cost.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a difference between corrective taxes and tradable pollution permits?

A) Corrective taxes are a market-based solution while tradable pollution permits are a command-and-control policy.

B) With a corrective tax the government sets the price of pollution;with tradable pollution permits,demand and supply set the price of pollution.

C) With corrective taxes firms pay for pollution;with tradable pollution permits firms do not.

D) Corrective taxes internalize the pollution externality while tradable pollution permits do not.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A negative externality

A) is an adverse impact on a bystander.

B) causes the product in a market to be under-produced.

C) is an adverse impact on market participants.

D) is present in markets where the good or service does not have any impact on bystanders.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When negative externalities are present in a market,

A) producers will be affected but consumers will not.

B) producers will supply too much of the product.

C) demand will be too high.

D) the market will still maximize total benefits.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If education produces positive externalities,we would expect

A) the government to tax education.

B) the government to subsidize education.

C) people to realize the benefits,which would increase the demand for education.

D) colleges to relax admission requirements.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 10-18.The graph represents a corrective tax to reduce pollution.On the axes,Q denotes the quantity of pollution and P represents the price of pollution.  -Refer to Figure 10-18.The tax depicted on the graph

-Refer to Figure 10-18.The tax depicted on the graph

A) gives polluting firms an incentive to develop cleaner technologies.

B) is viewed by most economists as less effective than a command-and-control policy as a means of reducing pollution.

C) has the effect of moving the allocation of resources further from the social optimum than it would be in the absence of the tax.

D) All of the above are correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 281 - 300 of 473

Related Exams